Our valued sponsor

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

UK Tories explore scrapping non-dom tax status

- Thread starter pomegranate

- Start date

they should emphasize the "could" word in that phrase.Scrapping the non-dom regime could generate £3.6bn for the government

I won't believe it until I see it... so many better places to live.

I would prefer to give some money to a shithole third world country than paying taxes in uk, the way is going...

I could stand that country 30 years ago... but now it's just so much worse.

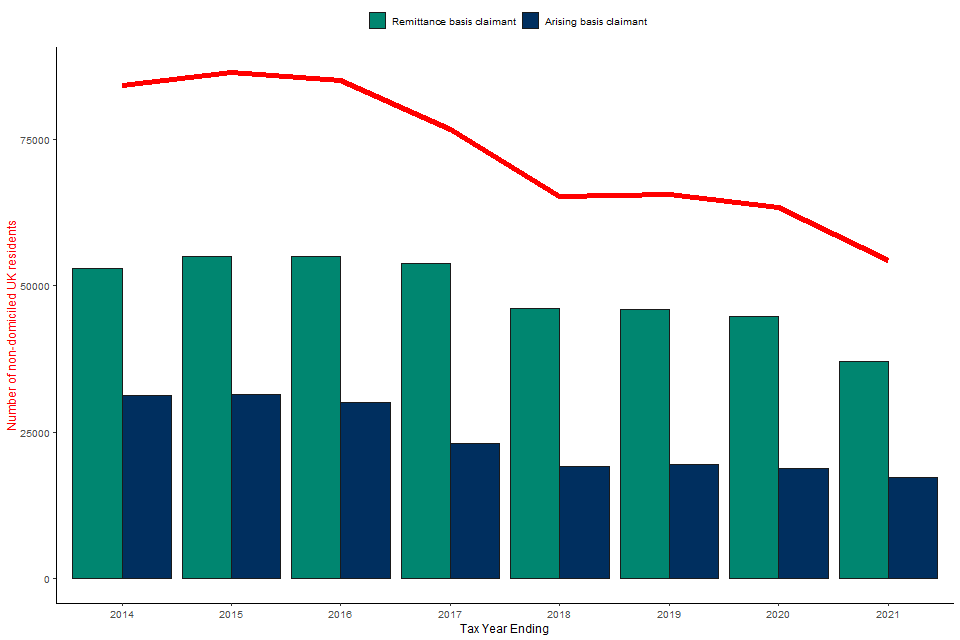

it'll be a non issue for many of them to start a new life chapter in another country...there were 68,800 non-doms in the UK

heck many of those already own houses in monaco, asia, italy, caribbean, spain, switzerland... the relocation is just a formality

They already lost and they understand that. What they are trying is to recuperate some losses and at best lose by a thread.

Ontopic - scrapping non-dom is a terrible idea, but it's the reality we live in. "Eat the rich".

I have many friends in the UK who are not domiciled and for most of them that was the first thing that convinced them to move to the UK in first place. To be fair there are legal ways to optimise your tax burden even without non-dom status, but it was such a boon for those looking to relocate from a third world country to the first.

Ireland and Malta are just not on the same level, Cyprus is boring, tiny, expensive and basically occupied by Russians, Monaco is bonkers price-wise and basically that's it. Italy, Greece or Switzerland for a fixed price tax or UAE/Caribbean/Thai if you're not limited to Europe.

Ontopic - scrapping non-dom is a terrible idea, but it's the reality we live in. "Eat the rich".

I have many friends in the UK who are not domiciled and for most of them that was the first thing that convinced them to move to the UK in first place. To be fair there are legal ways to optimise your tax burden even without non-dom status, but it was such a boon for those looking to relocate from a third world country to the first.

Ireland and Malta are just not on the same level, Cyprus is boring, tiny, expensive and basically occupied by Russians, Monaco is bonkers price-wise and basically that's it. Italy, Greece or Switzerland for a fixed price tax or UAE/Caribbean/Thai if you're not limited to Europe.

Not quite true. Family, business, local assets, kids at school, social network, local mistresses etc ... make the relocation not that easy for many of them even if they have assets elsewhere. You won't see people rushing out tomorrow just yet....the relocation is just a formality

As often we tend to overestimate the impact in the short-term and underestimate it in the long-term. Ok maybe it will bring £3bn to the UK the first year, but slowly but surely people will leave and more importantly nobody else will come. And this will have a far greater impact than we can imagine. Like Brexit. That's why mid/long term this is like shooting yourself in the foot. And massively!

Also what is scary is the fact that even the Conservatives are contemplating these ideas! It shows you how much they (and other conservative parties in the West) have now embraced the idea of a Big State. They bow to pressures for higher taxes, predominantly to protect their old electorate.

opinionable I agree, there are some different opinions on Stay or go? UK’s non-doms prepare for scrapping of tax statusNot quite true.

cannot share the ft article for copyright issues

the other big issue they mention is inheritance tax that would tax them based on the 40% of their worldwide assets...

(imho where there's a will there's a way... pretty sure there would be a solution for that too)

this should be the LSE study...

https://warwick.ac.uk/fac/soc/economics/research/centres/cage/manage/publications/bn38.2022.pdf

they're estimating how people will respond to such a reform by seeing what happened when the 2017 deemed domicile reform went in full force.

The issue is that the 2017 reform targeted just a small niche of very UK tied people compared to the whole chunk of non-doms...

(people living already 15 years in UK and people born there),

Of course those for sure had/will have more difficulty to move away after such a long time.

But also the stats say another interesting thing... :

These in my opinion could "easily" move away. Know plenty of people that left in that range of time.Most of these unreported income and gains (55%) belong to non-doms who arrived in the UK in the past five years.

This makes the treatment of those who have been in the UK for a relatively short period crucial to the total revenue that could be raised from a reformed policy.

But then the study ends with:

So they're telling me that just 77 people would leave in case of such a drastic reform...Our estimates suggest that abolition of the remittance basis would lead to 0.3% of remittance basis users(77 people) leaving as a result of the reform. After accounting for this limited migration response, including the loss of existing tax paid by non-doms who leave, the additional tax that would be received is £3.23 billion. The net additional revenue to government, after also accounting for the loss of the remittance basis charge receipts, is £ 3.16 billion.

That's where I don't believe a single line of that study after that

in the official stats you can find a big decrease in people after the 2017 tax reform, thousands of them left not just a few... and it was a small cohort:

https://www.gov.uk/government/stati...ntary-on-non-domiciled-taxpayers-in-the-uk--2

And I knew the study smelled BS because I know a few dozen of those exilees... they are real people and they left.

Some back to their country, some to Monaco, some to USA, some to Italy(that had just ratified the 100k flat tax), some to Spain(beckham law). Some to Singapore. Some are in Dubai, some in weird places...

There was a time some guys were flying from monaco (nice) to london with their jets every time it was needed...

And the figure below from HMRC paper tells me I am not wrong.

So imagine what could happen after totally terminating the regime...

Very informative. Thank you for the post!

I am always amazed that the authors of these reports don't see a problem when their conclusion is: "Our estimates suggest that abolition of the remittance basis would lead to 0.3% of remittance basis users(77 people) leaving as a result of the reform."

I am always amazed that the authors of these reports don't see a problem when their conclusion is: "Our estimates suggest that abolition of the remittance basis would lead to 0.3% of remittance basis users(77 people) leaving as a result of the reform."

There was already a parliament vote on whether to scrap non-dom scheme in 2023 brought forward by the Labour party. The conservatives voted overwhelmingly to keep it. So 12 months later and they are exploring scrapping it??? What has changed in meantime? This is the conservatives carrying out a scorched earth policy on their way out of office if they do this.

https://votes.parliament.uk/Votes/Commons/Division/1475

P.S We discussed it in below thread at the time.

https://www.offshorecorptalk.com/th...essful-and-millionaires-flee-uk-anyway.40189/

It's this or sell the Prince of Wales... the UK is broke and they always hollow out or steal via new means.There was already a parliament vote on whether to scrap non-dom scheme in 2023 brought forward by the Labour party. The conservatives voted overwhelmingly to keep it. So 12 months later and they are exploring scrapping it??? What has changed in meantime? This is the conservatives carrying out a scorched earth policy on their way out of office if they do this.

https://votes.parliament.uk/Votes/Commons/Division/1475

P.S We discussed it in below thread at the time.

https://www.offshorecorptalk.com/th...essful-and-millionaires-flee-uk-anyway.40189/

The VAT increase around 2010/12 was meant to be temporary... 12-14 yrs later...

Problem is once they do away with this, it's a slippery road to overseas non-resident taxes...

Problem is once they do away with this, it's a slippery road to overseas non-resident taxes...

This is coming. Yes the UK is on a slippery slope downhill. It has not yet reached terminal velocity as it free falls since the end of the empire although brexit has hastened things. When subjugating and pillaging the earth works no longer and you have to compete with other countries you have what the UK is now i.e a very uncompetitive and unproductive society in decay. One can look at ancient Rome and look at Rome today - another country that pillaged the earth.

I can only tell you that for the UK it will end in war as there is no viable way forward for the country in the modern world. The country is doomed. Northern Ireland will reunify with the Republic of Ireland. Scotland will one day get independence and what you will be left with is a nation of chavs, food banks, US style health care (end of NHS) and poor working class people as the wealthy flee the decay like rats from a sinking ship.

The VAT increase around 2010/12 was meant to be temporary... 12-14 yrs later...

I remember when it was 17.5% I still think its that in my head.

It's this or sell the Prince of Wales... the UK is broke and they always hollow out or steal via new means.

I don't think people realize how fragile the UK financial situation is. Liz Trust exposed that during her chancellors budget. Pension funds almost collapsed and government bonds were selling of so fast that the Bank of England had to step in and buy treasuries to save the gilt market and the government was forced to reverse the budget.

However like any country that committed an injustice like the British did in the name of "King and country" those chickens eventually come home to roost and there is little you can do about it. Karma is a b1tch and the UK will experience it long term sadly.

I personally believe the UK will subjucate itself to openly becoming a vassal state to the United States, the UK, France will be the dominant powers in Western Europe, the UK via it's vassal position (crumbs).I can only tell you that for the UK it will end in war as there is no viable way forward for the country in the modern world.

Germany is destined to collapse, and well chaos there will occur, Italy will have a rise and take Algeria for the energy it needs but will be a vassal of sorts to France.

Sweden/Norway/Finland will combine and become dominant northern powers.

It was this year when the torries opened up elections to non-residents (after so many years you used to loose the right to vote), at that point i realised the days were numbered before they began pilfering non-residents..

Last edited:

UK in recession and lack of growth it must be getting really bad in the UK for the conservatives to look at non-dom abolition again just 12 months after they voted against it or its a stunt. If they think that will raise cash quickly then good luck with that one.

I mean the UK are even thinking for flogging of their aircraft carrier as they can't afford to keep it running. Makes sense now why they are ratcheting up the threat of Russia to justice defence spending increase...lol. They should just put it on ebay now and be done with it.

--- quote start

The ‘cash-strapped’ Royal Navy could be forced to sell the HMS Prince of Wales aircraft carrier, sources have claimed.

Senior figures within the Navy have spoken out after next week’s Budget revealed there won’t be a significant rise in defence spending this year.

In a move dubbed a ‘HS2 moment’ for the Navy, sources fear the HMS Prince of Wales, which cost £3.5 billion to build, could either be mothballed or sold off to a friendly nation at a knockdown price.

The decision could be forced upon commanders as soon as 2028 if defence finances aren’t improved soon.

--- quote end

I mean the UK are even thinking for flogging of their aircraft carrier as they can't afford to keep it running. Makes sense now why they are ratcheting up the threat of Russia to justice defence spending increase...lol. They should just put it on ebay now and be done with it.

Navy might have to sell off £3,500,000,000 HMS Prince of Wales aircraft carrier

https://metro.co.uk/2024/02/29/navy...0-hms-prince-wales-aircraft-carrier-20369541/--- quote start

The ‘cash-strapped’ Royal Navy could be forced to sell the HMS Prince of Wales aircraft carrier, sources have claimed.

Senior figures within the Navy have spoken out after next week’s Budget revealed there won’t be a significant rise in defence spending this year.

In a move dubbed a ‘HS2 moment’ for the Navy, sources fear the HMS Prince of Wales, which cost £3.5 billion to build, could either be mothballed or sold off to a friendly nation at a knockdown price.

The decision could be forced upon commanders as soon as 2028 if defence finances aren’t improved soon.

--- quote end

A pathetic and irrelevant country, so well represented by its head of state and his heirs. It will start to improve when it officially becomes a caliphate.

https://www.telegraph.co.uk/politic...nsidering-85k-levy-to-replace-non-dom-status/

that is their great idea, a bad copy of the italian 100k deal, that will be costing double just because the british feel so superior... without counting the cost of living that is double and the quality of life that is rather crappy.

Even if they go ahead with this idea, I suspect they will tax the remittances like they do for non-doms now, so it will be rather useless

that is their great idea, a bad copy of the italian 100k deal, that will be costing double just because the british feel so superior... without counting the cost of living that is double and the quality of life that is rather crappy.

Even if they go ahead with this idea, I suspect they will tax the remittances like they do for non-doms now, so it will be rather useless

Doesn't matter, the next government will be Labour and they will scrap it whatsoever.

Comrade Sir Starmer doesn't want rich foreigners in the UK, only poor ones that will vote Labour.

Comrade Sir Starmer doesn't want rich foreigners in the UK, only poor ones that will vote Labour.

So this is what was announced today:

Chancellor Jeremy Hunt has abolished non-dom tax as part of his Budget.

From April 2025 new arrivals into the UK will not be required to pay any tax on foreign income and gains in the first four years of their UK residency.

After four years those who continue to live in the UK will pay the same tax as other UK residents.

Hunt said: “We [the government] will put in place transitional arrangements for those benefiting from the current regime. That will include a two year period in which individuals will be encouraged to bring wealth earned overseas so that it can be spent and invested here in the UK.

Chancellor Jeremy Hunt has abolished non-dom tax as part of his Budget.

From April 2025 new arrivals into the UK will not be required to pay any tax on foreign income and gains in the first four years of their UK residency.

After four years those who continue to live in the UK will pay the same tax as other UK residents.

Hunt said: “We [the government] will put in place transitional arrangements for those benefiting from the current regime. That will include a two year period in which individuals will be encouraged to bring wealth earned overseas so that it can be spent and invested here in the UK.

When subjugating and pillaging the earth works no longer and you have to compete with other countries you have what the UK is now i.e a very uncompetitive and unproductive society in decay. One can look at ancient Rome and look at Rome today - another country that pillaged the earth.

I can only tell you that for the UK it will end in war as there is no viable way forward for the country in the modern world. The country is doomed. Northern Ireland will reunify with the Republic of Ireland. Scotland will one day get independence and what you will be left with is a nation of chavs, food banks, US style health care (end of NHS) and poor working class people as the wealthy flee the decay like rats from a sinking ship.

So, one moves to the UK for 4 years and then bails?From April 2025 new arrivals into the UK will not be required to pay any tax on foreign income and gains in the first four years of their UK residency.

After four years those who continue to live in the UK will pay the same tax as other UK residents.

Unless they introduce the exit tax or some other BS.So, one moves to the UK for 4 years and then bails?

Spring Budget 2024: Non-UK domiciled individuals - Policy Summary

https://www.gov.uk/government/publi...4-non-uk-domiciled-individuals-policy-summaryAs you can see the non-dom scheme is gone from 2025 - for those already in UK for more than 4 years. A slightly enhanced scheme for new arrivals will replace it but with a limited time span of 4 years. So there are some caveats in place like non-doms being able to move assets into a trust before April 2025 to avoid IHT and a short term reduced tax rates to soften the landing which is a long term tax trap. But all in all not many people would want to restructure their complex offshore affairs into a trust and lose control of them. And not many would want to pay 40% IHT and high income and gains tax on their wealth. The UK is not that special a place to live to risk your wealth to the UK tax man.

If I was a non-dom resident in the UK I would basically exit the UK ASAP before April 2025. The government expects the ultra wealthy under the new system to pay high IHT and income tax on their worldwide income. But one can move to Italy or Greece and just pay a 100k flat tax as a non-dom or simply move to Dubai, Ireland or elsewhere.

---- quote start

Changes to the ‘non dom’ regime

Non-doms are individuals whose permanent home, or domicile, is considered to be outside the UK. The current non-dom regime is a favourable tax regime which allows non-doms who are UK resident to opt to use the remittance basis of taxation. This means that whilst they pay tax on their UK income and gains in the same way as UK domiciles, they pay tax on their foreign income or gains (FIG) only when they are remitted, or brought to, the UK.

This reform removes preferential tax treatment based on domicile status for all new foreign income and gains (FIG) which arise from April 2025. This reform will abolish the remittance basis of taxation for non-doms and replace it with a modernised regime that is simpler and fairer.

For new arrivals, who have a period of 10 years consecutive non-residence, there will be full tax relief for a 4-year period of subsequent UK tax residence on FIG arising during this 4-year period, during which time this money can be brought to the UK without an additional tax charge.

Existing tax residents, who have been tax resident for fewer than 4 tax years and are eligible for the scheme, will also benefit from the relief until the end of their 4th year of tax residence.

This is much simpler and more attractive than our current approach, as these individuals will be able to bring FIG into the UK without attracting any tax charge, encouraging them to spend and invest these funds in the UK.

Non-doms taxed on the remittance basis are eligible for Overseas Workday Relief (OWR) during their first 3 years of UK tax residence. OWR will be retained and simplified under the new system.

Under the new system, regardless of where an individual is domiciled, and after transitional arrangements (see below), anyone who has been tax resident in the UK for more than 4 years will pay UK tax on any newly arising FIG, as is the case for all other UK residents.

This new regime is more generous than countries which have no equivalent scheme, and will be competitive against countries who operate similar systems for new residents.

Liability to inheritance tax (IHT) also depends on domicile status and location of assets. Under the current regime, no inheritance tax is due on non-UK assets of non-doms until they have been UK resident for 15 out of the past 20 tax years. The government will consult on the best way to move IHT to a residence-based regime. To provide certainty to affected taxpayers, the treatment of non-UK assets settled into a trust by a non-UK domiciled settlor prior to April 2025 will not change, so these will not be within the scope of the UK IHT regime. Decisions have not yet been taken on the detailed operation of the new system, and we intend to consult on this in due course.

Transition from the old regime to the new simpler modern system

Given that these reforms represent a significant change for those existing non-doms affected, the government is announcing targeted transitional arrangements for existing non doms. There will be:

- A temporary 50% reduction in the personal foreign income subject to tax in 2025-26 for non-doms who will lose access to the remittance basis on 6 April 2025 and are not eligible for the new 4-year FIG exemption regime.

- Re-basing of capital assets to 5 April 2019 levels for disposals that take place after 6 April 2025 for current non-doms who have claimed the remittance basis. This means that when foreign assets are disposed of, affected individuals can elect to be taxed only on capital gains since that date.

- Non-doms will be able to remit foreign income and gains that arose before 6 April 2025 to the UK at a rate of 12% under a new Temporary Repatriation Facility in the tax years 2025-26 and 2026-27.

- While the government is removing protections on non-resident trusts for all new FIG that arises within them after 6 April 2025, FIG that arose in protected non-resident trusts before 6 April 2025 will not be taxed unless distributions or benefits are paid to UK residents who have been here for more than 4 years.

---- quote end

Similar threads

- Replies

- 2

- Views

- 374

- Replies

- 141

- Views

- 7,449

- Replies

- 14

- Views

- 1,073

- Replies

- 0

- Views

- 141

Latest Threads

-

-

Offshore company (in or out of EU) with EU residency only

- Started by Delta

- Replies: 3

-

Tax optimization and lifestyle in 2025 for 8 figures wealth.

- Started by toums

- Replies: 0

-

-

AML Compliance - Pass once then all clear OR have to pass each time I move the same money?

- Started by fluffypanda

- Replies: 4