According to Ukraine tax code, if you have active private entrepreneur (FOP) you are considered UA tax resident without any other checks where you actually spend time.How. If you do not have for example house in Ukraine and travelling all time, to Europe, Asia, Latam, how you can be tsx resident of Ukraine? If you do not spend most time in the year in Ukraine?

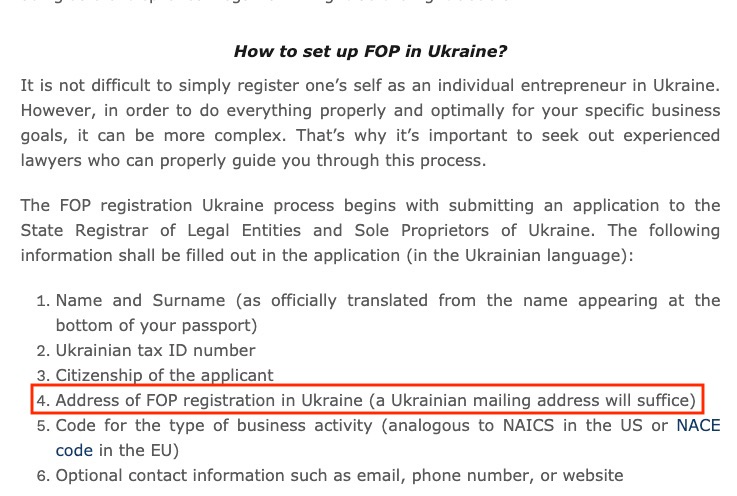

But you still need to have registered address in Ukraine for both FOP entity and personal address, which could be solved by renting one.

Each few years something coming. Last was in 2014-2016 with starting war with russia.have you seen examples of such thing in the Ukraine lately ?

The nearest crisis which will for sure come in a few year period repeat it again with some new banks closures.