You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

USDT: 8-9% at YouHodler/Nexo, Non-EU Exchanges?

- Thread starter DerAufklaerer

- Start date

USDC-DAI on GMX is 13%

USDT APY is 24.7% on NAVI

USDC on Aave is 13% Aave - Open Source Liquidity Protocol

USDT APY is 24.7% on NAVI

USDC on Aave is 13% Aave - Open Source Liquidity Protocol

I wouldn’t trust platforms like nexo for holding crypto, similar companies with the same business model have gone bankrupt, for me it looks like a PONZI.

I’d rather invest it in a good ETF that gives similar returns.

I’d rather invest it in a good ETF that gives similar returns.

i dont use nexo. But to give them credit, they survived the carnage while the loud hype crap like ftx and such went down.I wouldn’t trust platforms like nexo for holding crypto, similar companies with the same business model have gone bankrupt, for me it looks like a PONZI.

I’d rather invest it in a good ETF that gives similar returns.

And where does the yield come from?

In the case of Nexo is mostly corporate loans but they also market make in a few exchanges (and hold TBIlls but to a lesser extend)

In the case of exchanges it mostly comes from using your collateral to lend it to futures traders.

yes but ETF is not cryptoI wouldn’t trust platforms like nexo for holding crypto, similar companies with the same business model have gone bankrupt, for me it looks like a PONZI.

I’d rather invest it in a good ETF that gives similar returns.

I don't know of any foreign institution where you can hold an ETF.

And then there are the taxes

Now i have checked BITFINEX

LENDING

Its automation

Lookes like

7-10 % depending on the term

I have more confidence in them because they have been on the market for so long

Last edited:

In the case of Nexo is mostly corporate loans but they also market make in a few exchanges (and hold TBIlls but to a lesser extend)

In the case of exchanges it mostly comes from using your collateral to lend it to futures traders.

If they collateral on T bills (5.3% currently), the other 10-12% come from other individual/business trading collaterals which is incredibly risky. Looking at Interactive Brokers for instance - the collateral interest rates are pretty high for super safe investments (treasuries), hence how can Nexo manage its risk management with a 10% premium with incredibly riskier crypto assets incl tier 1 (BTC ETH)?

This is the reason I always refrained from investing into saving interests products on crypto exchanges, but I would be glad to be proven otherwise. After all 15% on a stable coin can still be a very nice risk premium over other investments (most junk bonds generally yield less than that today).

USDC-DAI on GMX is 13%

USDT APY is 24.7% on NAVI

USDC on Aave is 13% Aave - Open Source Liquidity Protocol

https://app.gmx.io/#/earn

I'm working out how something like this works

So this is decentralized via my own wallet like Ledger?

https://app.naviprotocol.io/details...a437aaa7d3c74c18e09a95d48aceab08c::coin::COIN

Very high

Base APR:0.61%

Bonus APR:13.26%

The Bonus APR will be airdropped as ARB token

https://app.gmx.io/#/earn

Last edited:

If they collateral on T bills (5.3% currently), the other 10-12% come from other individual/business trading collaterals which is incredibly risky. Looking at Interactive Brokers for instance - the collateral interest rates are pretty high for super safe investments (treasuries), hence how can Nexo manage its risk management with a 10% premium with incredibly riskier crypto assets incl tier 1 (BTC ETH)?

Mostly by market making and hedging holding in futures. See the high funding now?

Thats us paying Nexo's yield (and other platforms)

USDT Flexible Savings

https://www.bybit.com/

<=500USDT Platform Rewards 8.00% + 12.98%

>500USDT12.98%

https://www.bybit.com/

<=500USDT Platform Rewards 8.00% + 12.98%

>500USDT12.98%

Not your keys not your crypto. Did you already forget what happened just a couple of years ago?

No, but when BTC is in a bull market people pay crazy high funding fees to go long BTC with leverage. You can be on the other side of these funding fees by creating a synthetic dollar, i.e. you go short BTC on a platform like bybit or bitmex so you earn the funding fee, and then you separately go long BTC outside the platform (in a cold wallet for example), so you are delta neutral BTC.Not your keys not your crypto. Did you already forget what happened just a couple of years ago?

On the BTCUSD perpetual on Bybit, right now the funding rate is 0.058% every 8 hours, that's 1.00058^(365*3) = 189% on annual basis. That's where the yield comes from!

Lots of platforms just gain this synthetic dollar yield directly via futures or the perpetuals, and then pass on a small part of it to retail.

It's better to create a synthetic dollar yourself. And then you have to post some collateral, but not for the full notional amount, so you take a much smaller counterparty risk than with Nexo or some platform like that. Also the platforms like Bybit that allow you to trade directly are usually a bit more solid.

I have done this in the last few bullmarkets. Havent had a platform rugpull me yet.

I have a Ledger but But I don't know if something like this works with stablecoinsNot your keys not your crypto. Did you already forget what happened just a couple of years ago?

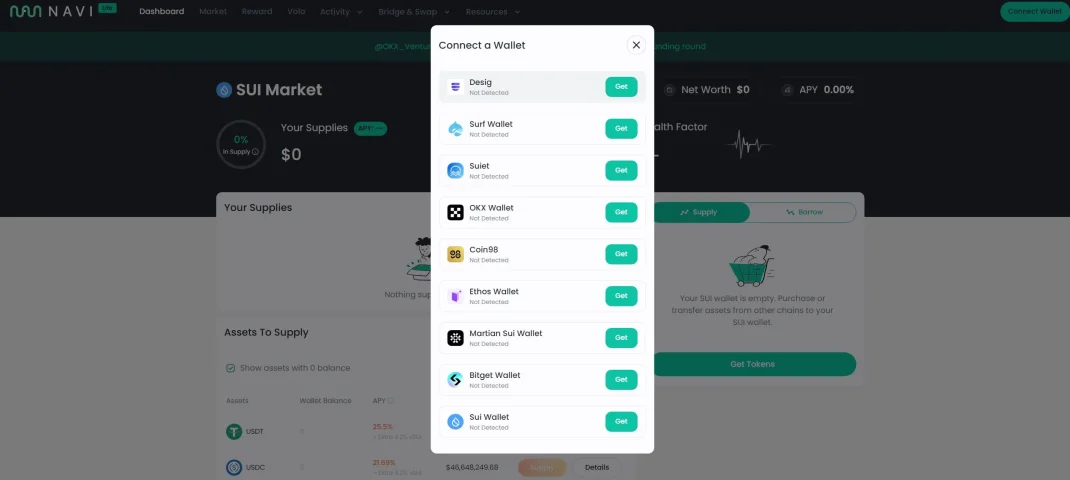

I see many wallets

Its mobile wallets

Attachments

You are right, if you are fine with platform risk, but all this in not suitable for 99% of retail crypto users.No, but when BTC is in a bull market people pay crazy high funding fees to go long BTC with leverage. You can be on the other side of these funding fees by creating a synthetic dollar, i.e. you go short BTC on a platform like bybit or bitmex so you earn the funding fee, and then you separately go long BTC outside the platform (in a cold wallet for example), so you are delta neutral BTC.

On the BTCUSD perpetual on Bybit, right now the funding rate is 0.058% every 8 hours, that's 1.00058^(365*3) = 189% on annual basis. That's where the yield comes from!

Lots of platforms just gain this synthetic dollar yield directly via futures or the perpetuals, and then pass on a small part of it to retail.

It's better to create a synthetic dollar yourself. And then you have to post some collateral, but not for the full notional amount, so you take a much smaller counterparty risk than with Nexo or some platform like that. Also the platforms like Bybit that allow you to trade directly are usually a bit more solid.

I have done this in the last few bullmarkets. Havent had a platform rugpull me yet.

Not sure i would feel comfortable investing more than 10% of my net worth in this. What about you?Mostly by market making and hedging holding in futures. See the high funding now?

Thats us paying Nexo's yield (and other platforms)

I am struggling to understand why this is not capitalized on yet. What I have learnt in finance over the years is that there is no free lunch. I would believe 20% on this (already very nice) but almost tripling your investment every year is crazy.No, but when BTC is in a bull market people pay crazy high funding fees to go long BTC with leverage. You can be on the other side of these funding fees by creating a synthetic dollar, i.e. you go short BTC on a platform like bybit or bitmex so you earn the funding fee, and then you separately go long BTC outside the platform (in a cold wallet for example), so you are delta neutral BTC.

On the BTCUSD perpetual on Bybit, right now the funding rate is 0.058% every 8 hours, that's 1.00058^(365*3) = 189% on annual basis. That's where the yield comes from!

Lots of platforms just gain this synthetic dollar yield directly via futures or the perpetuals, and then pass on a small part of it to retail.

It's better to create a synthetic dollar yourself. And then you have to post some collateral, but not for the full notional amount, so you take a much smaller counterparty risk than with Nexo or some platform like that. Also the platforms like Bybit that allow you to trade directly are usually a bit more solid.

I have done this in the last few bullmarkets. Havent had a platform rugpull me yet.

Last edited:

Bravo for asking the hard-hitting questions!And where does the yield come from?

Thanks for reminding meNot your keys not your crypto. Did you already forget what happened just a couple of years ago?

.... my delusional greed was just about to take over my Ventromedial Prefrontal Cortex on a subject I hadn't fully realized was outside my circle of competence

.... my delusional greed was just about to take over my Ventromedial Prefrontal Cortex on a subject I hadn't fully realized was outside my circle of competence

Note to self: I have to measure thrice and cut once because I am my worst enemy

PS. The value of OCT is immeasurable!

Last edited:

Well, that was the 8 hour perpetual funding fee rate at the time I checked for one single 8 hour period. It spikes up in bull runs, but it doesn't stay at these extremely high levels consistently for long periods of time.Not sure i would feel comfortable investing more than 10% of my net worth in this. What about you?

I am struggling to understand why this is not capitalized on yet. What I have learnt in finance over the years is that there is no free lunch. I would believe 20% on this (already very nice) but almost tripling your investment every year is crazy.

Still, the 2020 - 2021 bull market was fantastic in terms of high (but not crazy high) funding fee rates for a long time. But then the funding rate went negative, meaning shorts pay longs.

Another thing is to take into consideration is how much collateral you deposit to bybit/bitmex or whatever platform you are using - the more you deposit, the more counterparty risk you take, but the smaller the chance of getting stopped out/liquidated out of the short position. I usually do it so Bitcoin has to spike up like 2x - 4x for me to be stopped out.

Last edited:

Not sure i would feel comfortable investing more than 10% of my net worth in this. What about you?

I've got close to a milli w them lol. Not financial advice obvs.

Similar threads

- Replies

- 50

- Views

- 6,847

-

- Sticky

- Replies

- 91

- Views

- 11,264

- Replies

- 44

- Views

- 3,671

- Replies

- 36

- Views

- 4,362

Latest Threads

-

-

Hello World! Time to introduce myself...

- Started by Tradepass

- Replies: 1

-

-

-