I can relocate in almost any country. I run an ecommerce business (6+ figs)

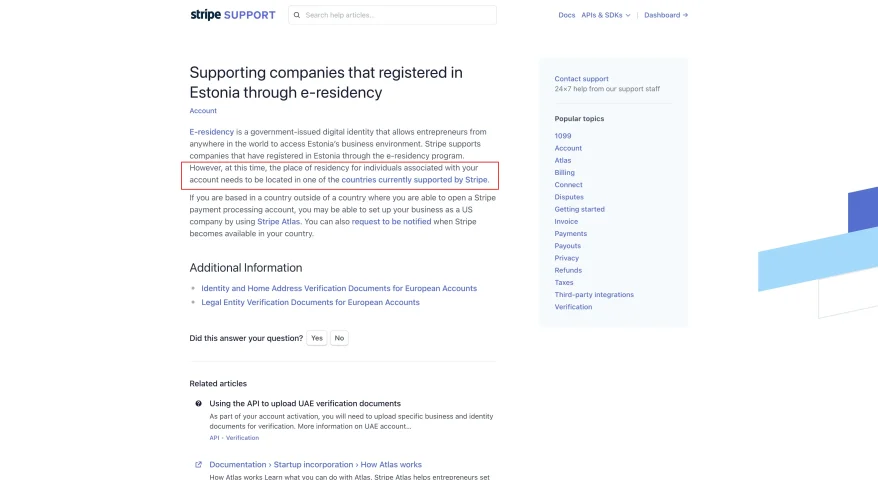

and I would need to incorporate in one of these following countries in order to remain compliant

with Stripe/shopify payments, which one is the best one in terms of saving taxes?

ROMANIA

SWITZERLAND

SINGAPORE

HK

Note that 100% of my income comes from clients outside these countries, that I am not yet a resident of any of these countries

and I have A LOT of monthly transactions to do accounting for (Hong Kong accountants already quoted me 10,000 USD just for book keeping lol).

and I would need to incorporate in one of these following countries in order to remain compliant

with Stripe/shopify payments, which one is the best one in terms of saving taxes?

ROMANIA

SWITZERLAND

SINGAPORE

HK

Note that 100% of my income comes from clients outside these countries, that I am not yet a resident of any of these countries

and I have A LOT of monthly transactions to do accounting for (Hong Kong accountants already quoted me 10,000 USD just for book keeping lol).