Our valued sponsor

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wise business is asking for the source of funds when I am applying for a business account

- Thread starter yikai

- Start date

Thanks, but my company is a new company, just registered last month. So I do not have audited accounts.They also give the option for audited accounts etc. If this is an company more than 1 year old you may have that or you may show them a dormant tax report.

Try to explain that to their support. Usually they are very helpsome and will tell you what other documents you can provide. Use their support which is very active and responsive.

That is a good idea, I will contact them. Thank you!Try to explain that to their support. Usually they are very helpsome and will tell you what other documents you can provide. Use their support which is very active and responsive.

They also give the option for audited accounts etc. If this is an company more than 1 year old you may have that or you may show them a dormant tax report.

I fully agree with @clemens that this is the way how this problem may be solved.Try to explain that to their support. Usually they are very helpsome and will tell you what other documents you can provide. Use their support which is very active and responsive.

Nevertheless, I have another advice for you: Consider to avoid Wise and choose another EMI. Quite generally, Wise is really not an optimal solution for most cases (this wording I consider to be really correct). Search here at forums for detailed reasoning and another possibilities.

Thanks for your reply. Wise is a good experience for me, even if they close accounts often, they refund the balance. I am interested in other EMI which is good alternatives to WISE, what are the keywords I should search for in the forum? I am holding China passport, I know some EMI are not friendly and not available to open for Chinese.I fully agree with @clemens that this is the way how this problem may be solved.

Nevertheless, I have another advice for you: Consider to avoid Wise and choose another EMI. Quite generally, Wise is really not an optimal solution for most cases (this wording I consider to be really correct). Search here at forums for detailed reasoning and another possibilities.

Just as a first recommendation, try to check HK EMI's like Currenxie, Statrys, Airwallex /OK, they are Australian but Chinese subjects are onboarded by their HK subsidiary/...I am interested in other EMI which is good alternatives to WISE, what are the keywords I should search for in the forum? I am holding China passport, I know some EMI are not friendly and not available to open for Chinese.

And generally, to be able to give you a well-founded advice, please share

- where is your company incorporated (China, I guess?)

- your current residence country (China, I guess?)

- what is the business of your company

- what currencies you need to operate with

- what are the destinations of future outgoing and incoming payments

- what is the expected monthly and yearly turnover (summarized for all the currencies)

(Sorry for being so inquisitive but you will hear these questions from any bank/EMI nowadays.)

Last edited:

- what is the business of your company--I register a company to apply for business bank accounts. and I do P2P on Binance.Just as a first recommendation, try to check HK EMI's like Currenxie, Statrys, Airwallex /OK, they are Australian but Chinese subjects are onboarded by their HK subsidiary/...

And generally, to be able to give you a well-founded advice, please share

- your current residence country (China, I guess?)--China

- what currencies you need to operate with--I hope to receive and send money in EUR, GBP, USD, AUD, COP...the more currency account I have, more business I can do.

- what are the destinations of future outgoing and incoming payments--I guess many countries, as binance runs globle biz.

- what is the expected monthly and yearly turnover (summarized for all the currencies)--The more the better, idealy 10000usd receiving everyday, but it all depending on if my bank allows me to do so. I dont find any good choice yet, I may try HONGKONG EMI as your recommendation.

(Sorry for being so inquisitive but you will hear these questions from any bank/EMI nowadays.)

I feel I am getting some support here, thank you. My reply is after your questions. Now I am using Wise every day to receive money, I am afraid to receive too much in a day, I guess receiving 1000usd is too much? ! Unless wise will close my personal account. That is why I am applying for business account from wise. I want to receive more and bigger turnover to expand my business. So I am seeking a good solution for payment. and I have to hide from EMI or banks that I am doing P2P business on Binance, cos they dont like. I hope to find a good solution here.

P2P is gonna get you banned on Wise especially when you receive lots of random payments from different banks and people. This may be considered money service that needs a license. Careful not to get involved in a money laundering case..- what is the business of your company--I register a company to apply for business bank accounts. and I do P2P on Binance.

I feel I am getting some support here, thank you. My reply is after your questions. Now I am using Wise every day to receive money, I am afraid to receive too much in a day, I guess receiving 1000usd is too much? ! Unless wise will close my personal account. That is why I am applying for business account from wise. I want to receive more and bigger turnover to expand my business. So I am seeking a good solution for payment. and I have to hide from EMI or banks that I am doing P2P business on Binance, cos they dont like. I hope to find a good solution here.

yes, I agree, what kind of license should I get?P2P is gonna get you banned on Wise especially when you receive lots of random payments from different banks and people. This may be considered money service that needs a license. Careful not to get involved in a money laundering case..

Depends on where your business is based and where do you offer your services. Each country has its own regulations. In UK licenses are issued by the Financial Conduct Authorityyes, I agree, what kind of license should I get?

This is against the acceptable usage policy of Wise. They don't want any business related to crypto, period.- what is the business of your company--I register a company to apply for business bank accounts. and I do P2P on Binance.

If you still try to use them, you will come back here and complain about Wise because of the frozen funds/closed account like many people in the forum.

https://wise.com/acceptable-use-policy

Well, now I understand your situation much better.- what is the business of your company--I register a company to apply for business bank accounts. and I do P2P on Binance.

- what currencies you need to operate with--I hope to receive and send money in EUR, GBP, USD, AUD, COP...the more currency account I have, more business I can do.

- what are the destinations of future outgoing and incoming payments--I guess many countries, as binance runs globle biz.

- what is the expected monthly and yearly turnover (summarized for all the currencies)--The more the better, idealy 10000usd receiving everyday, but it all depending on if my bank allows me to do so. I dont find any good choice yet, I may try HONGKONG EMI as your recommendation.

I feel I am getting some support here, thank you. My reply is after your questions. Now I am using Wise every day to receive money, I am afraid to receive too much in a day, I guess receiving 1000usd is too much? ! Unless wise will close my personal account. That is why I am applying for business account from wise. I want to receive more and bigger turnover to expand my business. So I am seeking a good solution for payment. and I have to hide from EMI or banks that I am doing P2P business on Binance, cos they dont like. I hope to find a good solution here.

And probably I do not have a lot of good news for you.

@turtle is completely right re: Wise. Forget about any usage of Wise (personal or business account) related to crypto P2P operations, unless you really want to be finished. And be advised that you will not able to hide your business in front of any EMI for a reasonably long time, it is really not so difficult to reveal P2P.

Forget also about Currenxie, as it is strongly anti-crypto. I do not know how it is with Airwallex and/or Statrys but I doubt they are P2P-friendly; but you can check.

Having said that, I can assure you that your situation is not unique. Banking for P2P transactions is a well-known problem that was discussed here at OTC several times, IIRC. I do not consider myself being an expert at this field; but if you search here with a keyword P2P, I guess you will learn something...

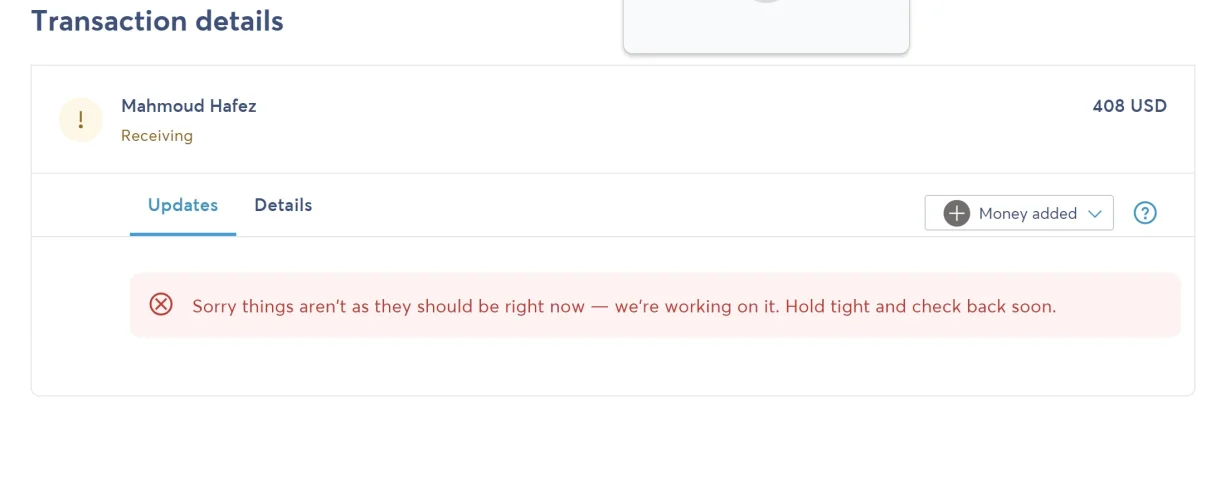

I had the same verification for an account this week:

Upload either an auditeted financial report or your latest Company tax return

I simply just took a screenshot of the companies tax return from the tax authority.

And obviously dont tell Wise that yoo do p2p crypto since crypto is against ToS and they wont open you an account

Upload either an auditeted financial report or your latest Company tax return

I simply just took a screenshot of the companies tax return from the tax authority.

And obviously dont tell Wise that yoo do p2p crypto since crypto is against ToS and they wont open you an account

I dont have it yet, cos this is a very new company, you offered very useful information. Thank you.I had the same verification for an account this week:

Upload either an auditeted financial report or your latest Company tax return

I simply just took a screenshot of the companies tax return from the tax authority.

And obviously dont tell Wise that yoo do p2p crypto since crypto is against ToS and they wont open you an account

Since this is the situation, I will do more research here for p2p trading. I appreciate your help very much!Well, now I understand your situation much better.

And probably I do not have a lot of good news for you.

@turtle is completely right re: Wise. Forget about any usage of Wise (personal or business account) related to crypto P2P operations, unless you really want to be finished. And be advised that you will not able to hide your business in front of any EMI for a reasonably long time, it is really not so difficult to reveal P2P.

Forget also about Currenxie, as it is strongly anti-crypto. I do not know how it is with Airwallex and/or Statrys but I doubt they are P2P-friendly; but you can check.

Having said that, I can assure you that your situation is not unique. Banking for P2P transactions is a well-known problem that was discussed here at OTC several times, IIRC. I do not consider myself being an expert at this field; but if you search here with a keyword P2P, I guess you will learn something...

You are welcome.I appreciate your help very much!

Latest Threads

-

-

Current solutions for SEPA account with US LLC

- Started by disagree

- Replies: 13

-

Is Biden Losing It? 1,600 Get Out of Jai -Free Cards in 14 Days, What’s the Deal?

- Started by cuno

- Replies: 4

-

what happens if you have zero receipt for your expenses?

- Started by libtard

- Replies: 7

-