You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Withholding tax on dividends in Romania

- Thread starter European

- Start date

Hi all,

Romania has a withholding tax rate of 8% on dividends disbursed by a Romanian legal entity to non-(tax)resident individuals.

If the individual is a ta resident in the EU (not in Romania), can this 8% be claimed back from Romania?

Thanks

https://taxsummaries.pwc.com/romania/corporate/withholding-taxes

@European in Romania you will probably get back nothing but tax credit from ANAF and I don't think they will allow you to claim back the 8%, then after dividends you will most probably be forced to pay healthcare and social security on your dividend income if it's above a minimum income threshold which is very low (unless laws changed recently). You can pay those at the minimum level ifI remember correctly but they still mean a few thousand euros per year.

Thanks @TheCryptoAnt

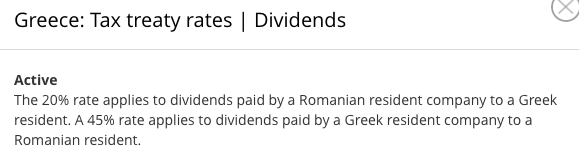

I see that for Greece the rate under the treaty for dividends is 45%. Is that a typo? It's much lower for all other countries

I doubt PWC has a typo in their website, but you can google the agreement itself and check.

It's 20% then, not 45%Not a typo

The PWC webpage talks about distributions by and WHT tax applied to Romanian resident companies (to non-resident entities)

Yeah, it's 20% according to that toolYou should always cross check what PwC says with Deloitte's treaty tool.

I find it to be more precise for the available jurisdictions.

Yeah, it's 20% according to that tool

I know, that's where the screenshot i posted here is coming from

So it is a typo then, in the initial PWC websiteI know, that's where the screenshot i posted here is coming from

Maybe you should post the link to the PWC page, just to be fair.It's 20% then, not 45%

The PWC webpage talks about distributions by and WHT tax applied to Romanian resident companies (to non-resident entities)

@TheCryptoAnt posted it at the beginning of the thread . Here it is againMaybe you should post the link to the PWC page, just to be fair.

https://taxsummaries.pwc.com/romania/corporate/withholding-taxes

This would prevent the WHT tax in Romania, correct?

That's correct but you will have to create substance in Romania AKA hiring at least a director and renting an office to prevent the EU country where you are tax resident to claim that you are managing the RO company from there.

Since you mentioned Greece in your post, Greece could be a good option for an holding (if your RO company doesn't generate > 30% in passive income otherwise it will be considered a CFC) because there will not be any WHT tax in Romania and dividends are taxed only 5% in Greece when distributed to yourself.

Total tax 8%

Not bad at all.

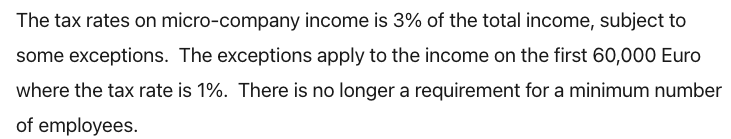

Yes on total turn over, not on profit. Profit tax is 16%. also after a given sum you will also have to pay VAT, add 19% more.Thanks @Marzio

These guys keep changing the rules every year

So the tax is on revenue, not on profit??

Share:

Latest Threads

-

-

-

Need Assistance Opening UK Bank Account or EMI for UK Ltd Company For Non-Resident Directors

- Started by heavyhitter2020

- Replies: 7

-

Does small US LLC company selling B2C to EU customers have to add VAT?

- Started by vgahdmi123

- Replies: 1

-

Thailand approves five-year crypto tax exemption

- Started by Mercury

- Replies: 4