Some people will take any risk to avoid taxes and other unpleasantness. I prefer not to get into such situations, so I am forced to just think about establishing a company in the Sahara.

I will crawl unarmed through a valley of every dangerous famished wild and poisonous animal in the Universe, except the human animal who is a "public servant"...unless, of course, there are NO witnesses or cameras for the latter one.Some people will take any risk to avoid taxes and other unpleasantness.

Getting banking should be quite simple, also they probably wont bother you too much with KYC about incoming transfers etc. You'll only start to see issues when you need to move your money out of the country, best of luck with that.

This is the easiest thing to do. What is endemic to Morocco that is highly regarded in other countries? Think PhosphatesYes this is the challenge

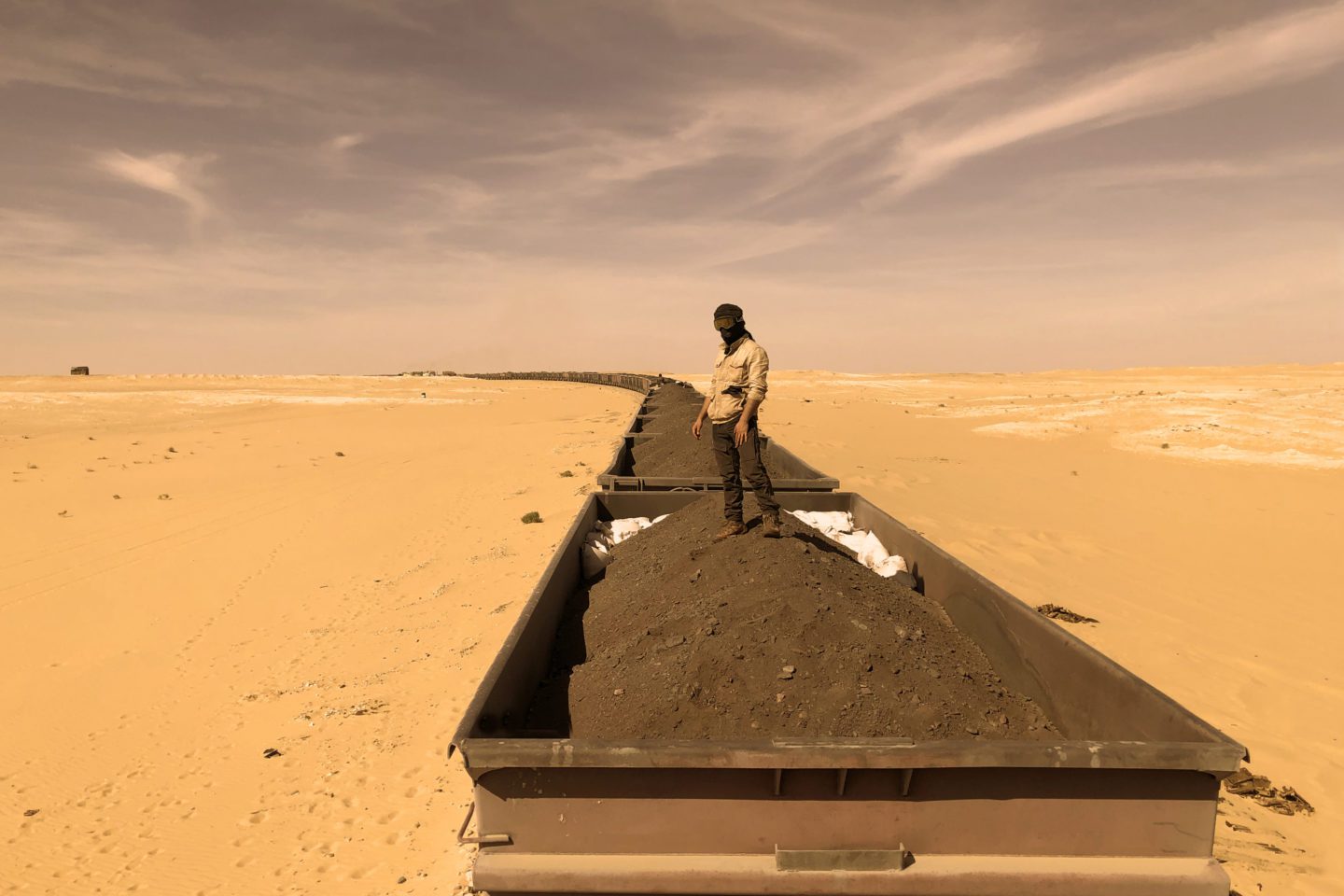

But only if they make a vlog about it and go there on one of these cargo trains that run days through the desert without toilet and water. Can't give the gold account away too easy!The first to open a company there should win a Gold membership - on the condition that he writes a full report on the experience. @Forester @Sols and other mods please approve

I don’t know about cargo trains, but roads and cars exist in Morocco and it doesn’t seem so difficult to reach the southern region. Only if you adventure down to the border you must travel in a convoy.But only if they make a vlog about it and go there on one of these cargo trains that run days through the desert without toilet and water. Can't give the gold account away too easy!

He means the Iron Ore train in Mauritania which runs just south of the border of Western Sahara / Morocco.I don’t know about cargo trains, but roads and cars exist in Morocco and it doesn’t seem so difficult to reach the southern region. Only if you adventure down to the border you must travel in a convoy.

it doesn’t seem so difficult to reach the southern region

stay away from anything EU.I guess one could setup a company in western Sahara, create some substance and spend a lot of time in the Canary islands.

Really, it depends on your angle of view."Western Sahara" is Morocco.

Who will agree to give an account to a Western Sahara company?

To be exact, Moroccans take it so. Hence yes, a Moroccan bank I expect to open an account for a Dakhla company...Almost any Moroccans company (this part of Sahara is Moroccan)

The first to open a company there should win a Gold membership - on the condition that he writes a full report on the experience. @Forester @Sols and other mods please approve

Ok, now it's getting interesting. I think the 0% CIT, 0% VAT is just for companies registered in the Western Sahara part of Morocco though. A foreign company might be treated worse. And Morocco like the rest of north africa has a quite difficult bureaucracy with generally high taxes - but Western Sahara is an interesting exception.I think i just came up with one the greates hacks of 2024 LOL

What about setting up a UK LTD treaty non-resident in Dakhla?

Since UK and Morocco have a DTA you end up having a tax free company with the prestige of a UK company.

I never came up with this idea because i didn't know that Wester Sahara companies are infact Moroccan companies.

I think the 0% CIT, 0% VAT is just for companies registered in the Western Sahara part of Morocco though