In our last guide, "Binance Guide – Everything You Need to Know Before Signing Up," we looked at the basics of Binance as a top cryptocurrency platform. Now, let's jump into a complete handbook on how you can boost your earnings using different ways on Binance, like copy trading, staking, lending, mining, and more. This guide aims to give you easy and powerful tips to make the most of the many ways you can earn money on Binance passively.

Binance has grown to become the largest cryptocurrency exchange in the world by trading volumes, meaning it outweighs its competition and offers access to hundreds of different digital coins. Users have the opportunity to take home passive income, but they also gain access to professional trading tools.

By the summer of 2025, more than 270 million people used Binance. At the same time, the platform is available in over 180 countries despite some restrictions associated with digital coins in certain jurisdictions. The possibility of buying or selling crypto isn't the main reason behind its popularity, though.

With its user-friendly interface and robust security measures, users can make money on Binance in a variety of ways, with trading being one of the most popular choices out there. Staking, running a savings account, using the referral program, or Binance's proprietary program to earn interest are not to be overlooked either.

With these ideas in mind, this guide will give you all the details you need about using Binance like a pro.

The concept is similar to any other type of investment. Start with whatever you can afford to lose, invest in top currencies like BTC or ETH or perhaps some less-known altcoins, and give them time to gain value and reap the rewards in the long run.

To be successful with this strategy, you need to determine some goals for your investment. Maybe you want more capital, or perhaps you want to preserve your money. Knowing why you want to make a long-term investment will help you make the right decisions.

Now, it’s essential to understand that investing in crypto won’t make you a millionaire overnight. Long-term investments imply holding the money blocked for long periods of time, from months to years. That’s how you gain the real potential of a solid long-term project.

Meanwhile, cryptocurrencies will clearly fluctuate, so there will be times when you'll be at a loss. Checking it on a daily basis is not how long-term investments work.

An active portfolio management strategy is highly recommended too, as investments must be reviewed on a regular basis. Making good decisions requires a lot of research.

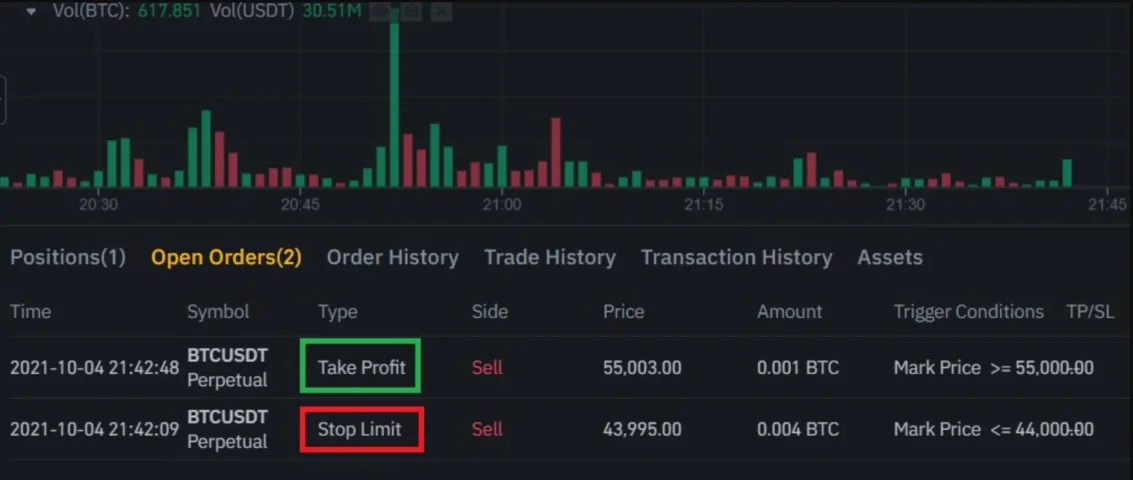

Last but not least, no long-term investment will be complete without risk management strategies. Binance allows setting stop-loss orders, for example. You can also diversify your eggs and spread them over more baskets. Such strategies can protect your investment.

Binance has designed its proprietary options trading platform, which makes everything simple and straightforward. It’s intuitive, easy to use and understand within minutes only.

Once logged in, go to derivatives in the top menu and find options. You’ll need a new Binance Options account before transferring funds to your wallet, then choose between call and put options. Once you open a position, a new trading panel will pop up as a confirmation before entering a few more details.

Spot trading on Binance kicks in at the market price available when you open a position. On the other hand, futures trading covers contracts with dates and prices agreed later on.

Relying on futures trading will also give you some leverage, meaning you don’t need to invest too much to control large positions.

The leverage is essential at this point. For example, at 125x, even a minor fluctuation can take all the funds in your account. Some traders go for it out of greed. It doesn’t mean it’s a bad idea, but it must be planned accordingly. If you’re new, go for 1x and explore your options from there.

Prior to diving in, it's worth understanding the isolated margin, which covers your trades with separate funds, too. Cross margin shares funds for bigger earnings, but risks are directly proportional.

Here are a few tips and tricks to consider:

Copy trading allows you to replicate someone else's trades. It usually involves new users still trying to learn about trading and trends, as well as experienced traders who know what they're doing and are willing to share their experience.

The idea is fairly simple. It works, but you need someone who can show a proven track record. In other words, don’t just copy anyone, but someone who’s experienced and has actually made money out of it.

While it’s definitely a good idea to share some of your capital in this direction, like for any other investment, don’t put all your eggs into the same basket. You can follow more traders, but you can also keep a small amount for yourself to gain experience.

Even an experienced trader will have losses every now and then, it’s perfectly normal. To become a lead trader, a minimum of $1000 is required, and the criteria for joining copy trading are determined by the lead trader's specified rules. Crucially, the percentage of funds utilized by the lead trader for trading will be mirrored in your copy trading activity automatically.

Copy trading doesn't mean you have to follow the trader and do exactly what they do. Instead, you connect your portfolio to theirs, and the platform automatically follows their trades. Again, it's highly recommended to assess part of your portfolio rather than the full portfolio.

While copy trading may seem simple and straightforward, choosing who to copy is one of the biggest challenges in the process. Like for anything else in life, there are a few things to pay attention to.

Track record:

Double-check the trader's performance, and don't settle for a few days or weeks only. Instead, you should do it over at 90 days. If you can dig deeper than 90 days, do it. History shows performance.

ROI:

When you copy trade on Binance, it's super important to check how much money you're making compared to how much you're putting in, which is called Return on Investment (ROI). Instead of just looking at short-term profits, it's smart to look at how your ROI changes over longer periods like 30 days and 90 days.

By carefully looking at the ROI of a lead trader, you can see if a trader is making money or not. Checking returns over 90 days and 30 days helps you understand how well the trader is doing consistently. If ROI is negative, it's a sign that there might be risks involved, and you might want to think twice before starting to copy that trader.

Copiers:

When it comes to copy trading, there are two main groups involved: copiers and mock copiers. Copiers are investors who replicate the trades of a lead trader, aiming to benefit from their expertise. On the other hand, mock copiers are virtual followers who observe the lead trader's actions without actually executing the trades. If copier slots are full, you can still track the lead trader as a mock copier to understand their trading decisions.

Also, a trader with an impressive amount of copiers and mock copiers is a good sign. It doesn’t mean new traders aren’t good, but they’re just not worth the risk.

Sharpe Ratio:

Calculating the Sharpe Ratio of a lead trader helps determine if the returns they generate are commensurate with the risks taken. A higher Sharpe Ratio indicates better risk-adjusted performance, showcasing the trader's ability to deliver consistent returns while managing risk effectively.

Maximum Drawdown:

When looking for the best lead trader to follow, it's important to check the maximum drawdown percentage. Finding a trader with low drawdown percentages shows they care about managing risks and protecting your money, which is key for a reliable trader.

Now, apart from following more traders who match this criteria, minimizing risks also implies following traders with different strategies.

If you'd like to keep an eye on the trades and maybe learn from them, follow a day trader. Obviously, it depends on your timezone, but trades closing on the same day are easier to follow.

Losses will naturally occur every now and then. Pay attention to how the trader acts in such a situation. If they stick to their tested systems, they’re alright. If they panic and do stupid moves, move on.

Staking is another option for making money in Binance. For many users, earning rewards while staking is a safe and secure way to increase your profits. Sure, you won't get rich overnight, but small rewards add up in the long run.

There's a catch, though. You'll practically have to hold onto particular cryptocurrencies.

Just like on any other exchange or platform, staking on Binance works on the same principles. If a digital coin allows staking, you can stake some of your wealth and get a reward in the long run.

The reason behind these rewards is easy to understand. The blockchain puts your coins to work. Such coins use the proof of stake, meaning all transactions are verified more times before being validated. Your coins are used in this process, hence the rewards.

To stake your cryptocurrencies in Binance, go to earn, then find the menu for staking. You’ll find more submenus out there, such as what you can do with the coins you have, as well as your history and rewards overtime.

Binance's official blog offers more guides on staking, and believe it or not, one of them promises rewards of up to $2,000 a month. However, rewards are directly proportional to your capital. To make this kind of money, you'll need to stake an impressive amount of cryptocurrencies.

Binance allows staking more coins, including:

To see full availability, choose the coin you have, assuming it also allows in the process, then request to stake your coin.

Rewards for staking are paid in the digital coin you staked. You can, of course, take your money back before the required time frame expires. However, you may face a fee, not to mention missing out on some rewards.

Apart from using this option to make more money, many users simply do it as an alternative to letting their coins collect dust in their wallets. It's like the interest rate from a bank. You could let money sit in there and do nothing or you can get an interest for it. Why would you ignore such rewards?

Staking also helps with the security and reliability of the blockchain.

Staking comes with some risks as well. For example, you won’t be able to use the coins you stake, so you can’t use them in trading or other activities. From this point of view, it pays off staking a certain percentage of your portfolio.

You can lend out digital coins, just like classic banks lend out fiat currencies. Obviously, there’s some rewards in it in terms of interest. Like other activities involving cryptocurrencies, lending is a type of DeFi, meaning investors lend money to borrowers in exchange of rewards.

To lend crypto in Binance, simply login and go to the finance tab. You'll find access to crypto loans. You can lend money to others, but you can also use the same menu to get a loan yourself, meaning you can access funds without selling your crypto. Your current coins will be used as collateral, though.

Loans can be taken in more coins, including BTC, ETH, and BNB, among others.

Binance allows mining of quite a few different coins, including BTC, BCH, and ETC.

The Binance pool is practically a platform allowing users to combine their resources and mine altogether. The pool has been designed as a solution to those with limited resources. This way, everyone can get involved, regardless of their technological resources.

Cloud mining in Binance, on the other hand, allows users to purchase cloud mining products and get involved in the process. Basically, the process is open to those with no experience or equipment whatsoever as well.

The settlement cycle for rewards usually takes about 24 hours, so rewards are relatively quick.

Bottom line, while only launched in 2017, way after some of its competition, Binance is currently a leading platform in the crypto exchange industry. The trading volume puts Binance way ahead of its competition, yet trading isn’t the only option to increase your profits on the exchange.

Apart from crypto trading, which is a primary option for users, the platform is also used for new tokens to launch, but also as a hub for those interested in staking cryptocurrencies. It offers access to its proprietary debit card as well.

While there are more ways to make money, the above mentioned options are suitable for both new and experienced users.

Binance has grown to become the largest cryptocurrency exchange in the world by trading volumes, meaning it outweighs its competition and offers access to hundreds of different digital coins. Users have the opportunity to take home passive income, but they also gain access to professional trading tools.

By the summer of 2025, more than 270 million people used Binance. At the same time, the platform is available in over 180 countries despite some restrictions associated with digital coins in certain jurisdictions. The possibility of buying or selling crypto isn't the main reason behind its popularity, though.

With its user-friendly interface and robust security measures, users can make money on Binance in a variety of ways, with trading being one of the most popular choices out there. Staking, running a savings account, using the referral program, or Binance's proprietary program to earn interest are not to be overlooked either.

With these ideas in mind, this guide will give you all the details you need about using Binance like a pro.

Long-Term Investments on Binance

The concept is similar to any other type of investment. Start with whatever you can afford to lose, invest in top currencies like BTC or ETH or perhaps some less-known altcoins, and give them time to gain value and reap the rewards in the long run.

To be successful with this strategy, you need to determine some goals for your investment. Maybe you want more capital, or perhaps you want to preserve your money. Knowing why you want to make a long-term investment will help you make the right decisions.

Now, it’s essential to understand that investing in crypto won’t make you a millionaire overnight. Long-term investments imply holding the money blocked for long periods of time, from months to years. That’s how you gain the real potential of a solid long-term project.

Meanwhile, cryptocurrencies will clearly fluctuate, so there will be times when you'll be at a loss. Checking it on a daily basis is not how long-term investments work.

An active portfolio management strategy is highly recommended too, as investments must be reviewed on a regular basis. Making good decisions requires a lot of research.

Last but not least, no long-term investment will be complete without risk management strategies. Binance allows setting stop-loss orders, for example. You can also diversify your eggs and spread them over more baskets. Such strategies can protect your investment.

What’s the best coin for long-term investments in Binance?

According to the portal itself, 2024 was an excellent year for 5SCAPE, YPRED, ETH, ADA, DOT, SOL and LINK. It doesn't mean other coins didn't perform well, though.Is Binance safe for long-term investments?

The truth is Binance is one of the safest options on the market in terms of long-term investments. Compared to other platforms, it has an insurance fund in place of $1 billion.Trading on Binance

Binance has designed its proprietary options trading platform, which makes everything simple and straightforward. It’s intuitive, easy to use and understand within minutes only.

Once logged in, go to derivatives in the top menu and find options. You’ll need a new Binance Options account before transferring funds to your wallet, then choose between call and put options. Once you open a position, a new trading panel will pop up as a confirmation before entering a few more details.

Spot trading on Binance kicks in at the market price available when you open a position. On the other hand, futures trading covers contracts with dates and prices agreed later on.

Relying on futures trading will also give you some leverage, meaning you don’t need to invest too much to control large positions.

The leverage is essential at this point. For example, at 125x, even a minor fluctuation can take all the funds in your account. Some traders go for it out of greed. It doesn’t mean it’s a bad idea, but it must be planned accordingly. If you’re new, go for 1x and explore your options from there.

Prior to diving in, it's worth understanding the isolated margin, which covers your trades with separate funds, too. Cross margin shares funds for bigger earnings, but risks are directly proportional.

Here are a few tips and tricks to consider:

- Make a plan and stick to it.

- Consider risk management strategies.

- Choose trading pairs you’re familiar with.

- Technical analysis is a must.

- Diversify assets and trading pairs as you become more experienced.

- Keep discipline and control your emotions.

Can I trade with $10 on Binance?

If you’re new to trading, start with such low amounts, the kind of money you can afford to lose. Practice, earn, you win some, you lose some.How good is Binance for trading?

Binance offers an excellent opportunity to new, intermediate, and advanced traders looking for an exchange with numerous features, hundreds of coins, and superior trading tools.Copy Trading on Binance – High Risk, High Reward

Copy trading allows you to replicate someone else's trades. It usually involves new users still trying to learn about trading and trends, as well as experienced traders who know what they're doing and are willing to share their experience.

The idea is fairly simple. It works, but you need someone who can show a proven track record. In other words, don’t just copy anyone, but someone who’s experienced and has actually made money out of it.

While it’s definitely a good idea to share some of your capital in this direction, like for any other investment, don’t put all your eggs into the same basket. You can follow more traders, but you can also keep a small amount for yourself to gain experience.

Even an experienced trader will have losses every now and then, it’s perfectly normal. To become a lead trader, a minimum of $1000 is required, and the criteria for joining copy trading are determined by the lead trader's specified rules. Crucially, the percentage of funds utilized by the lead trader for trading will be mirrored in your copy trading activity automatically.

Copy trading doesn't mean you have to follow the trader and do exactly what they do. Instead, you connect your portfolio to theirs, and the platform automatically follows their trades. Again, it's highly recommended to assess part of your portfolio rather than the full portfolio.

While copy trading may seem simple and straightforward, choosing who to copy is one of the biggest challenges in the process. Like for anything else in life, there are a few things to pay attention to.

Track record:

Double-check the trader's performance, and don't settle for a few days or weeks only. Instead, you should do it over at 90 days. If you can dig deeper than 90 days, do it. History shows performance.

ROI:

When you copy trade on Binance, it's super important to check how much money you're making compared to how much you're putting in, which is called Return on Investment (ROI). Instead of just looking at short-term profits, it's smart to look at how your ROI changes over longer periods like 30 days and 90 days.

By carefully looking at the ROI of a lead trader, you can see if a trader is making money or not. Checking returns over 90 days and 30 days helps you understand how well the trader is doing consistently. If ROI is negative, it's a sign that there might be risks involved, and you might want to think twice before starting to copy that trader.

Copiers:

When it comes to copy trading, there are two main groups involved: copiers and mock copiers. Copiers are investors who replicate the trades of a lead trader, aiming to benefit from their expertise. On the other hand, mock copiers are virtual followers who observe the lead trader's actions without actually executing the trades. If copier slots are full, you can still track the lead trader as a mock copier to understand their trading decisions.

Also, a trader with an impressive amount of copiers and mock copiers is a good sign. It doesn’t mean new traders aren’t good, but they’re just not worth the risk.

Sharpe Ratio:

Calculating the Sharpe Ratio of a lead trader helps determine if the returns they generate are commensurate with the risks taken. A higher Sharpe Ratio indicates better risk-adjusted performance, showcasing the trader's ability to deliver consistent returns while managing risk effectively.

Maximum Drawdown:

When looking for the best lead trader to follow, it's important to check the maximum drawdown percentage. Finding a trader with low drawdown percentages shows they care about managing risks and protecting your money, which is key for a reliable trader.

Now, apart from following more traders who match this criteria, minimizing risks also implies following traders with different strategies.

If you'd like to keep an eye on the trades and maybe learn from them, follow a day trader. Obviously, it depends on your timezone, but trades closing on the same day are easier to follow.

Losses will naturally occur every now and then. Pay attention to how the trader acts in such a situation. If they stick to their tested systems, they’re alright. If they panic and do stupid moves, move on.

What’s the downside of copy trading?

Traders won’t share their experience and knowledge for free. This means fees will eat into your profits. In Binance, you’ll pay 10% of your profits. Also, a 10% commission from the trading fees applies.Can you make money with copy trading?

Absolutely. Copy trading allows you to diversify your assets a little, and picking the right traders to copy will add a nice margin to your profits. On the same note, you can also lose with copy trading, so capital is still at risk.Staking in Binance – Low risk, Low reward

Staking is another option for making money in Binance. For many users, earning rewards while staking is a safe and secure way to increase your profits. Sure, you won't get rich overnight, but small rewards add up in the long run.

There's a catch, though. You'll practically have to hold onto particular cryptocurrencies.

Just like on any other exchange or platform, staking on Binance works on the same principles. If a digital coin allows staking, you can stake some of your wealth and get a reward in the long run.

The reason behind these rewards is easy to understand. The blockchain puts your coins to work. Such coins use the proof of stake, meaning all transactions are verified more times before being validated. Your coins are used in this process, hence the rewards.

To stake your cryptocurrencies in Binance, go to earn, then find the menu for staking. You’ll find more submenus out there, such as what you can do with the coins you have, as well as your history and rewards overtime.

Binance's official blog offers more guides on staking, and believe it or not, one of them promises rewards of up to $2,000 a month. However, rewards are directly proportional to your capital. To make this kind of money, you'll need to stake an impressive amount of cryptocurrencies.

Binance allows staking more coins, including:

- ETH

- ADA

- BNB

- MATIC

- USDT

- USDC

- BIT

- LUNA

To see full availability, choose the coin you have, assuming it also allows in the process, then request to stake your coin.

Rewards for staking are paid in the digital coin you staked. You can, of course, take your money back before the required time frame expires. However, you may face a fee, not to mention missing out on some rewards.

Apart from using this option to make more money, many users simply do it as an alternative to letting their coins collect dust in their wallets. It's like the interest rate from a bank. You could let money sit in there and do nothing or you can get an interest for it. Why would you ignore such rewards?

Staking also helps with the security and reliability of the blockchain.

Staking comes with some risks as well. For example, you won’t be able to use the coins you stake, so you can’t use them in trading or other activities. From this point of view, it pays off staking a certain percentage of your portfolio.

Why can’t all cryptocurrencies be staked?

Not all cryptocurrencies use the proof of stake technology, which is responsible for staking. Therefore, not all coins can be staked.Can I lose my coins if I stake them?

Follow all the rules in Binance, and you'll be alright. Some proof of stake networks rely on a slashing process as a penalty for validating entities that take improper actions, meaning some of the stake is ruined.Lending in Binance – Low risk, Low reward

You can lend out digital coins, just like classic banks lend out fiat currencies. Obviously, there’s some rewards in it in terms of interest. Like other activities involving cryptocurrencies, lending is a type of DeFi, meaning investors lend money to borrowers in exchange of rewards.

To lend crypto in Binance, simply login and go to the finance tab. You'll find access to crypto loans. You can lend money to others, but you can also use the same menu to get a loan yourself, meaning you can access funds without selling your crypto. Your current coins will be used as collateral, though.

Loans can be taken in more coins, including BTC, ETH, and BNB, among others.

Is crypto lending profitable?

Crypto lending can be profitable, but it depends on how much you’re willing to give. The interest rate is directly proportional with what you’re giving out. To many investors, it’s an excellent opportunity to earn passive income in a safe environment.What’s the interest rate for crypto lending?

How much money you’ll make out of crypto lending depends on the type of loan, as well as the amount of coins and the duration of the loan. Therefore, there are no general rewards, as they vary from one loan to another.Mining in Binance

Binance’s proprietary mining pool allows users to engage into traditional mining opportunities, as well as cloud mining services. Fees vary based on the asset you choose to go for, but they normally go up to 4%, so you’ll have to research your options first.Binance allows mining of quite a few different coins, including BTC, BCH, and ETC.

The Binance pool is practically a platform allowing users to combine their resources and mine altogether. The pool has been designed as a solution to those with limited resources. This way, everyone can get involved, regardless of their technological resources.

Cloud mining in Binance, on the other hand, allows users to purchase cloud mining products and get involved in the process. Basically, the process is open to those with no experience or equipment whatsoever as well.

The settlement cycle for rewards usually takes about 24 hours, so rewards are relatively quick.

How profitable is crypto mining?

Crypto mining can be extremely profitable, especially since Binance makes it accessible without any equipment or experience. It depends on the coins you go for, but for example, if you’re successful at mining a BTC block, you can earn more than 6BTC, which is quite a fortune.How long does it take to mine 1 BTC?

Mining 1 BTC can take around 10 minutes. It doesn’t mean you’ll mine blocks by yourself. More users will get together in the process, meaning rewards will be shared accordingly.Bottom line, while only launched in 2017, way after some of its competition, Binance is currently a leading platform in the crypto exchange industry. The trading volume puts Binance way ahead of its competition, yet trading isn’t the only option to increase your profits on the exchange.

Apart from crypto trading, which is a primary option for users, the platform is also used for new tokens to launch, but also as a hub for those interested in staking cryptocurrencies. It offers access to its proprietary debit card as well.

While there are more ways to make money, the above mentioned options are suitable for both new and experienced users.

Attachments

Last edited: