Would this setup be legal?

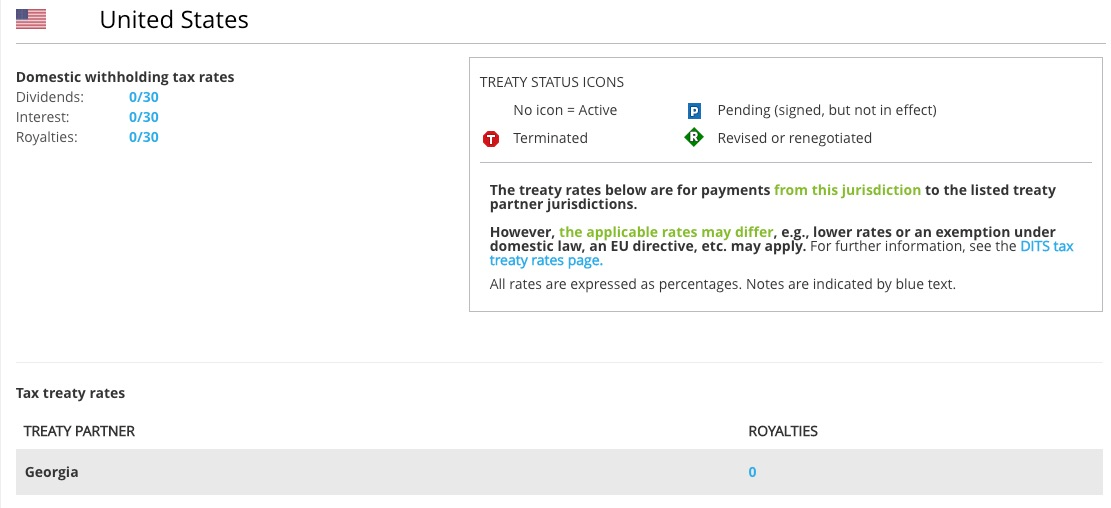

Google Adsense income -> US LLC (no WTH tax as US LLC is run from outside US) -> UAE Company / Personal bank ACC (no corporate income tax/personal income tax), so effectively 0% total taxation.

I am already a UAE resident and have a freezone company in the IFZA freezone.

The revenue generated exceeds 6 figures a month.

Google Adsense income -> US LLC (no WTH tax as US LLC is run from outside US) -> UAE Company / Personal bank ACC (no corporate income tax/personal income tax), so effectively 0% total taxation.

I am already a UAE resident and have a freezone company in the IFZA freezone.

The revenue generated exceeds 6 figures a month.