Could you please update the thread with your findings if a branch can indeed distribute profits directly to the shareholders?I am currently in the process of double checking that

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Company in Switzerland ?

- Thread starter georgio

- Start date

sorry to ask and if you already mentioned that. Are you located in Switzerland or is it only your holding company?Though it doesn't really makes sense to me and I am currently in the process of double checking that, as I myself looking to restructure my Swiss holdings.

A branch can't distribute profits directly to shareholders, profits first needs to be transferred to the head company and then to the shareholders.a branch can indeed distribute profits directly to the shareholders

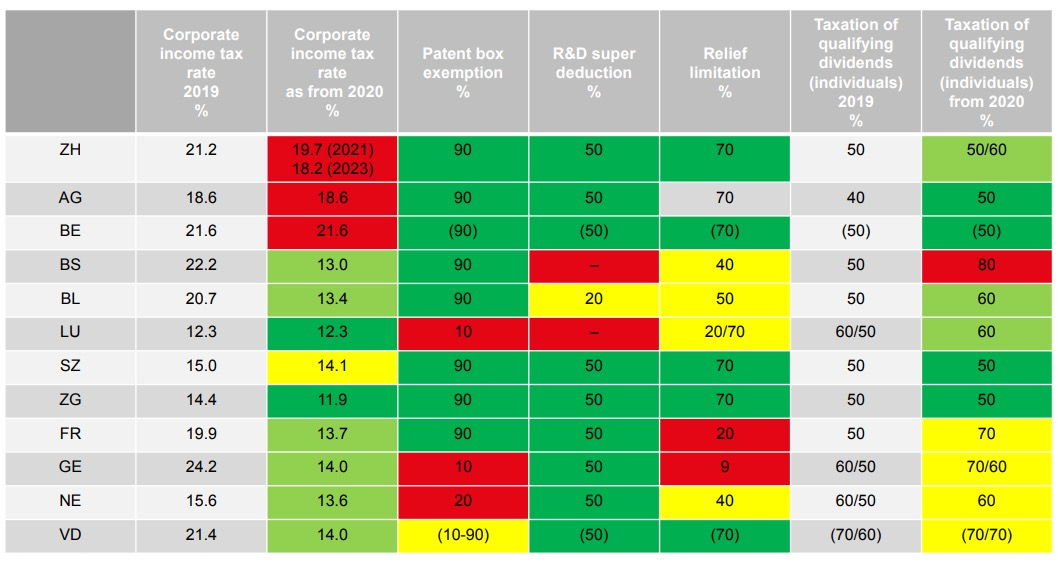

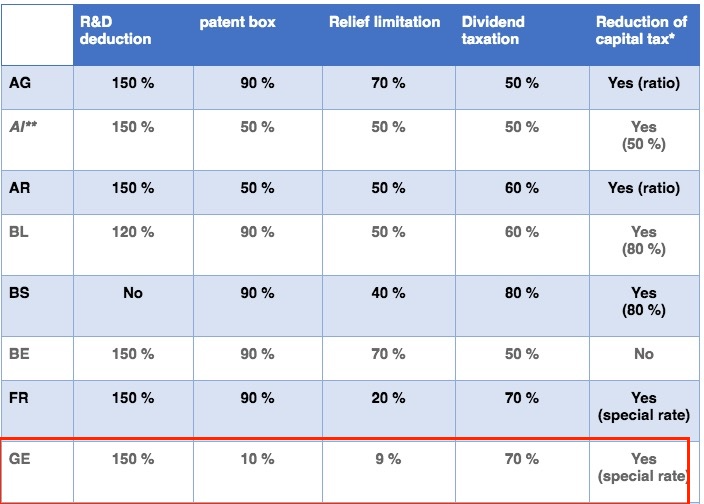

Do you know if in the "patent box" are included licensing / franchising deals?Since 2020 there is "patent box" in place where profits from patents and comparable rights are taxed at a lower rate. The discount may not exceed 90% and each canton may put a lower discount in place. For example canton Lucerne plans only 10% discount. Non-patented inventions and copyrighted software do not qualify for the patent box.

Also, does anybody know how to interpretate this table?

Patent box 10% means that for profits from patents you have 10% discount on the current corporate tax rate in Geneva (which is 13.99%), is that correct?

I don't know how to interpretate relief limitation and dividend taxation.

I guess dividend taxation means that you are taxed only on 30% of dividends that you distribute?

@ffbkdavid, @antrock333 can you help out decoding this table?

The way I understand it, the dividend taxation column tells you how much of the dividends paid out you pay taxes on. You pay out 100k - if it says 50% there, you only pay tax on 50k. That’s because you’ve already paid corporate income tax, so they say it’s unfair that you pay full personal income tax on top of it, for the same money. But that’s only the canton level tax - there is also federal tax.

Ok this answers the "relief limitation" columnIn Lucerne the tax relief due to the patent box and the additional deductions for R&D may not exceed 70 percent of the taxable profit.

This is how i understand it as wellthe dividend taxation column tells you how much of the dividends paid out you pay taxes on. You pay out 100k - if it says 50% there, you only pay tax on 50k

Share:

Latest Threads

-

-

-

Where to get a free USA TEXTING/CALL NUMBER ?

- Started by JAKINSMITH

- Replies: 3

-