Hi,

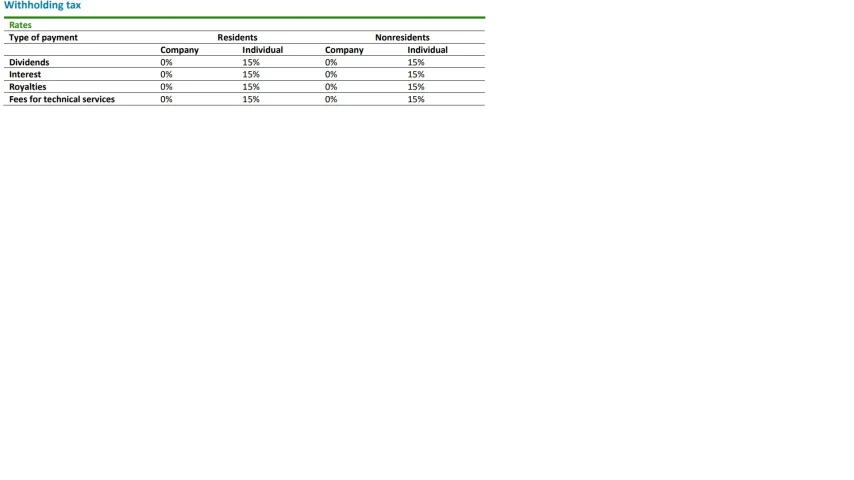

To be able to do business with European companies (IT domain), I think to let my Lebanese company creates a company in Hungaria. I know taxes are just 9% on the benefits, however I am not sure regarding dividends. I found the table below on Deloitte webtire:

View attachment 4579

Seems following this table that after the hungarian company pays 9% on its benefits, the rest can be paid to my Lebanese company as dividends with 0% taxes. Of course the Lebanese company will have to pay taxes in Lebanon.

Questions:

- Anyone can confirm the table above?

- Is my understanding regarding dividends explained above correct?

- Will the hungarian company will be able to open a bank account in Hungary without any manager in this country?

Many thanks for your help in advance.

Reagrds

With the table:

To be able to do business with European companies (IT domain), I think to let my Lebanese company creates a company in Hungaria. I know taxes are just 9% on the benefits, however I am not sure regarding dividends. I found the table below on Deloitte webtire:

View attachment 4579

Seems following this table that after the hungarian company pays 9% on its benefits, the rest can be paid to my Lebanese company as dividends with 0% taxes. Of course the Lebanese company will have to pay taxes in Lebanon.

Questions:

- Anyone can confirm the table above?

- Is my understanding regarding dividends explained above correct?

- Will the hungarian company will be able to open a bank account in Hungary without any manager in this country?

Many thanks for your help in advance.

Reagrds

With the table: