Our valued sponsor

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How to incorporate offshore company in Nevis?

- Thread starter wosniak

- Start date

Well it depends on where you are located, you will need to check all the TIEA's they have signed, for instant they signed one with the below countries, but google this to make sure.

Portugal, St Kitts And Nevis Sign TIEA

The Portuguese government has announced the signing of a Tax Information Exchange Agreement (TIEA) with the Caribbean territory of Saint Kitts and Nevis.

The agreement joins other agreements signed by Portugal, with Saint Lucia, the Isle of Man, Jersey, Guernsey, Bermuda, the Cayman Islands, Andorra and Gibraltar, bringing the country’s total of such reciprocal pacts to nine.

Each agreement is based on the Organisation for Economic Cooperation and Development’s model agreement on transparency and tax information exchange. When the respective agreements enter into force, they will allow Portugal and the signatory country to obtain information on request in civil and criminal tax disputes. The Portuguese government noted that the latest TIEA with St. Kitts and Nevis would help in efforts to mitigate tax fraud and evasion.

Portugal hopes to have its signed agreements ratified so that they can enter into force by 2011.

I find Nevis not to be so good anymore now I look to register Seychelles company if not good to I will try with Belize company.

If you mean St. Kitts and Nevis island then it can be of great benefit to incorporate your company there. I put a map below just to be sure we are on the same page.

A Nevis offshore company formation takes place the same way as any other company setup in an offshore jurisdiction. What you may consider is a Nevis company does not pay any corporate tax, they have a well developed financial center and infrastructure. and they don't maintain any beneficial owner information aswell as the Seychelles don't do. For som information in details you may want to visit the public website about St. Kitts & Nevis http://www.stkittsnevisuk.com/index.php/doing-business-in-st-kitts-and-nevis you can find some general information there.Also for this offshore jurisdciton the same apply you will get the following documents when you form an offshore company there:

/monthly_2015_05/nevis-st-kitts-company-formation.gif.480516dec505af959732202dbc438cf4.gif

A Nevis offshore company formation takes place the same way as any other company setup in an offshore jurisdiction. What you may consider is a Nevis company does not pay any corporate tax, they have a well developed financial center and infrastructure. and they don't maintain any beneficial owner information aswell as the Seychelles don't do. For som information in details you may want to visit the public website about St. Kitts & Nevis http://www.stkittsnevisuk.com/index.php/doing-business-in-st-kitts-and-nevis you can find some general information there.Also for this offshore jurisdciton the same apply you will get the following documents when you form an offshore company there:

- company certificate

- memorandum & articles

- shareholder certificate

- incorporation documents with apostille

- and registered office address

/monthly_2015_05/nevis-st-kitts-company-formation.gif.480516dec505af959732202dbc438cf4.gif

There is alot of information including a list of Nevis company formation service providers at this link, http://www.worldoffshorebanks.com/nevis-international-offshore-company-formation.php

/monthly_2015_05/574741c9a28fa_nevisoffshorecompanyformation.jpg.b79988046116e7fe9c40e9d425db3475.jpg

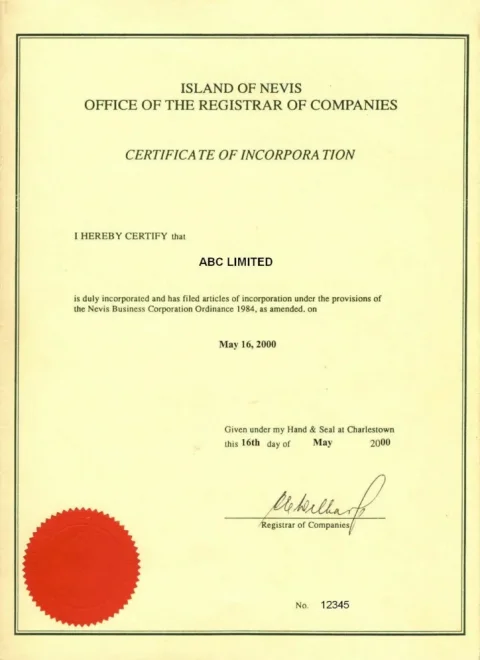

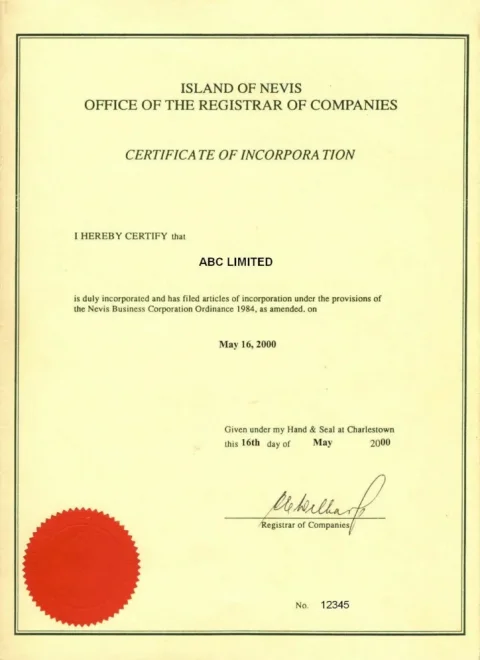

Also there is a trustable offshore nevis company formation agent here, http://www.htlnevis.com/This is what a certificate for a St. Kitts & Nevis company looks like.Structure1. The corporation?s principal office, company records, and meetings may be held or maintained outside of Nevis.2. Shares may be registered or bearer.3. The identity of beneficial owners and shareholders are not required to be filed in any public record or, except in the case of licensed companies, and government offices. 4. All shareholders and directors may act by unanimous consent, without a meeting and are allowed to issue proxies in writing.5. No annual reports are required to be filed in the public records of Nevis.Shares and Capital RequirementsThere is no minimum or maximum number of shares issued.Bearer shares must be held by a licensed custodian in Nevis.Shares can be issued with or without par value;IBC TaxationUnder the Nevis IBC legislation, all offshore companies are exempt from all taxes and stamp duties.

/monthly_2015_05/574741c9a28fa_nevisoffshorecompanyformation.jpg.b79988046116e7fe9c40e9d425db3475.jpg

Have you checked the link they are referring to.. they are out of business lol so I assume they didn't made it with their $1000 Nevis company formation!!

Similar threads

- Replies

- 6

- Views

- 606

- Replies

- 9

- Views

- 629

- Replies

- 0

- Views

- 171

- Replies

- 53

- Views

- 2,671

- Replies

- 28

- Views

- 1,917

Latest Threads

-

-

Reducing taxes by cashing out every couple of years

- Started by JustAnotherNomad

- Replies: 3

-

Mentor Group Gold - AD Thread! Binany: Trading Platform For Swift Success

- Started by Binany

- Replies: 1

-

Cyprus Ltd - director is corporate body nominee

- Started by D0naldDuck

- Replies: 4

-

Question Atlos.io - crypto payment gateway?

- Started by redeye

- Replies: 5