Hi guys,

I incorporated my Youtube company in Cyprus a couple months ago with the intention of residing there and claiming the benefits under the DTA with the US. Due to recent events in Europe, and the fact that Cyprus always follows along, I don't think it would be tenable for me to stay in the country for even 2 months to claim tax residency at the moment.

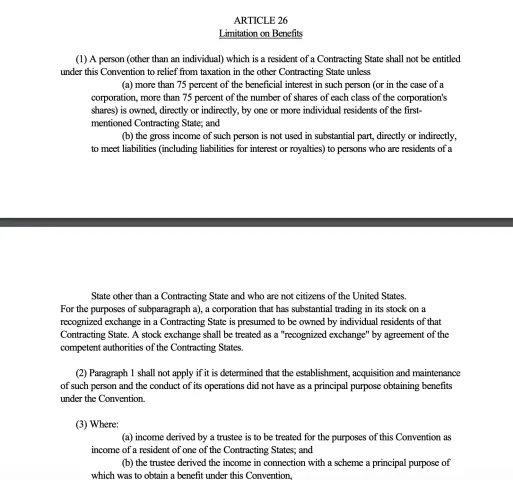

My new plan is to get residency in Dubai and live there for 6 months a year. I have visited Dubai and am a lot more confident they will not follow whatever the fk is going on in the western world (just my opinion). Regardless, with this new move, I would be technically ineligible to claim benefits of the tax treaty due to failing the company base and erosion test.

However, I would still be able to rent out a 'permanent address' in Cyprus that I could put on the W-8BEN-E form. Since those forms don't actually even go to the IRS and only go to the US payment distributor in case of an audit, how likely is it that I, someone making under 1 million USD a year at the moment, would be caught out?

I realise that this is a really gray area, but would love to hear some advice/opinions.

I incorporated my Youtube company in Cyprus a couple months ago with the intention of residing there and claiming the benefits under the DTA with the US. Due to recent events in Europe, and the fact that Cyprus always follows along, I don't think it would be tenable for me to stay in the country for even 2 months to claim tax residency at the moment.

My new plan is to get residency in Dubai and live there for 6 months a year. I have visited Dubai and am a lot more confident they will not follow whatever the fk is going on in the western world (just my opinion). Regardless, with this new move, I would be technically ineligible to claim benefits of the tax treaty due to failing the company base and erosion test.

However, I would still be able to rent out a 'permanent address' in Cyprus that I could put on the W-8BEN-E form. Since those forms don't actually even go to the IRS and only go to the US payment distributor in case of an audit, how likely is it that I, someone making under 1 million USD a year at the moment, would be caught out?

I realise that this is a really gray area, but would love to hear some advice/opinions.