I still don't see why they should do a KYC on a client? The LLC is not receiving any money. But for some reason, even if they'll start requesting additional informations the only thing that they will discover is that the LLC's owner is the foundation and the foundation doesn't have any UBO.I still don´t see how it will be possible to do when the Danish company makes KYC on the foundation and the freelancer.

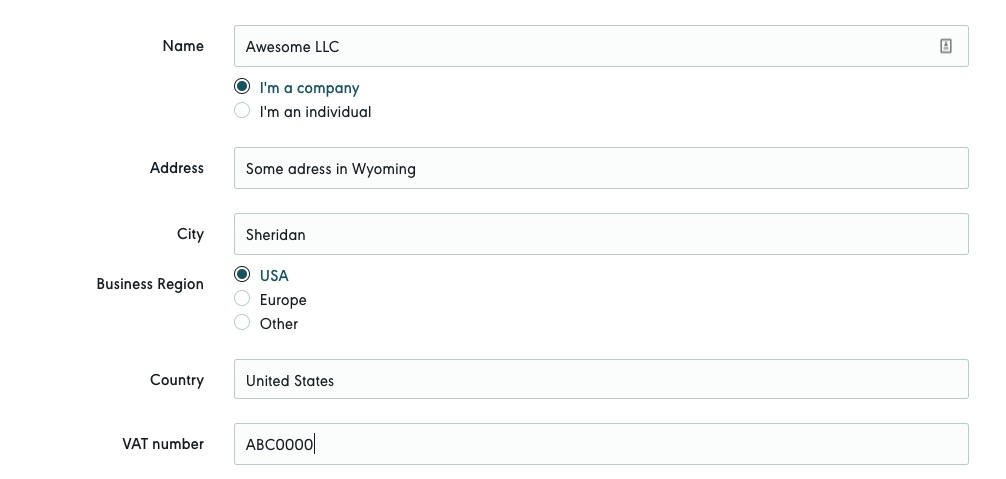

Those are all the information that Codeable is requesting.

I'm registered with them since 2018 and nobody ever started any KYC on me.