You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Offshore company + self employed in EU. How to structure?

- Thread starter hfs

- Start date

The tax authority will still see such transactions as tax evasion. You have to submit reports and pay taxes.Is there a way for an owner of an offshore company to receive payments from his LLC as a self-employed in EU? LLC director is automatically an employee. Has to be self-employed.

Side question: is there a way to structure a company in a way that you don't have to report assets/turnover/profit to an EU tax office? You basically only report what you withdraw (this is not tax evasion, just simplifying reporting). I think there isn't?

In your situation, more details are needed to provide a more comprehensive consultation.

Marzio, which jurisdiction would you pick assuming the branch would be in the EU and you want the parent company not to be a US one (LLC) or a UK one (due to public PSC register)?You can form a US LLC, form a Swiss branch so that everything will be taxed in Switzerland with the added benefit that branch profits aren't subject to withholding taxes.

This means that you can keep all the after tax profits in the Swiss branch, pay yourself a salary congruent with Swiss living standard and the day you decide to move to a territorial taxation country or UAE all the branch profits will be tax exempt.

This strategy is 100% legal and doesn't require you to form a Swiss company

I was thinking Gibraltar.

If possibile i would form a UK LTD + nominee shareholder with foreign branch exemption so you would pay only branch CIT and everything remitted to the UK parent will not be taxed, dividends from UK will be tax free as well.

UK has a better reputation than Gibraltar and more banking opportunities.

UK has a better reputation than Gibraltar and more banking opportunities.

Is it really that easy/convenient tax wise? really 100% legal?You can form a US LLC, form a Swiss branch so that everything will be taxed in Switzerland with the added benefit that branch profits aren't subject to withholding taxes.

This means that you can keep all the after tax profits in the Swiss branch, pay yourself a salary congruent with Swiss living standard and the day you decide to move to a territorial taxation country or UAE all the branch profits will be tax exempt.

This strategy is 100% legal and doesn't require you to form a Swiss company

- Do you know the current state of things in regard of US-LLCs owned by a single member, living in Switzerland?

I am stuck at the Federal Court sentence of quite a few years ago linked here:

https://www.unilu.ch/fileadmin/fakultaeten/rf/opel/Opel_Taxation_LLC.pdf

and that said bad things...

in short it says that if you don't elect as corp in the US and the LLC is pass-through, then you (swiss resident) should pay taxes on the us-llc revenue as if it was personal income in switzerland...

e.g. you pay PIT plus uncapped social security contribs too on the whole lot.

In the absence of a permanent establishment in the United States, the Swiss resident partners derive income from independent services, even if they are not actively engaged in the LLC's business. This leads to a relatively high tax burden of up to 46%, depending on their residence in Switzerland. Income from independent services is also subject to social contributions of approximately 10%, which are of a parafiscal nature when above a certain limit.

It would be nice to know how things really are if there's a swiss resident/expert here.

Is it really that easy/convenient tax wise? really 100% legal?

If I remember correctly, you told once the story of your friend that had a problem with Italian revenue agency (BTW how did the story end?) so I guess you live in that area so I did a search on how many US LLC have a Swiss branch.

Now, of those i found a very interesting result.

I'm pretty sure that this is single member LLC with a CH resident managing it.

You can dig deeper into that single member LLC by buying a status report on the business records service portal.

I am stuck at the Federal Court sentence of quite a few years ago.

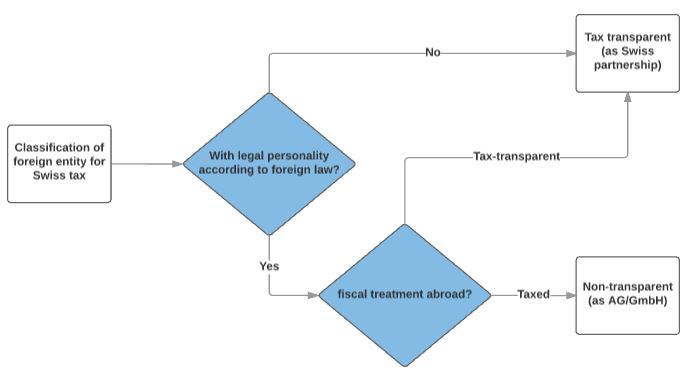

I know that document, here' a visual flow chart of how tax transparent entities are treated in Switzerland

By creating a Swiss branch you are getting everything taxed at the branch level, then you can keep profits in the branch and pay yourself a salary and / or business profits.

In your opinion, would there be any difference in case one wants to use a non-US LLC instead (e.g. a Belize or Nevis LLC)?I did a search on how many US LLC have a Swiss branch.

Now, of those i found a very interesting result.

I'm pretty sure that this is single member LLC with a CH resident managing it.

US LLCs are subject to all kinds of filing requirements and classic IBCs are a hassle to work with nowadays.

In your opinion, would there be any difference in case one wants to use a non-US LLC instead (e.g. a Belize or Nevis LLC)?

Nope, you could use any jurisdiction that best suits you and have a tax treaty with CH

I assume this would not be required if the parent company (e.g. an "offshore" LLC as mentioned above) is tax free anyway?have a tax treaty with CH

Only in case a UK LTD is used for example, where we want to shift its existing corporate tax residency to Switzerland thanks to the Swiss branch. (I actually found one such company in the branch register, it's called "Denta Consult GmbH Limited" and it's a dormant company for UK purposes, as expected.)

Correct?

Last edited:

I assume this would not be required if the parent company (e.g. an "offshore" LLC as mentioned above) is tax free anyway?

In case the parent company is tax free anyway you don't need the treaty.

Take a look at this Seychelles company with a Zug branch (Seychelles doesn't have a treaty with CH)

Last edited:

Hello! I was wondering if you have any updates on this?Greatly appreciate your input! Will have to think this through.

I am a swiss resident and I am thinking about the foreign entity with Swiss branch setup, although I cannot see clearly the picture. Would be great to have any feedback on this from someone who dig into this.

I have similar idea. I have US LLC as pass trough entity, I am Eu resident. I was planning to use it as pass trough entitiy and pay inome tax on income coming from USA LLC as divdends. Also LLC is in Wyoming and they dont exchange information with my country. Does this plan has a flaw i have not tought of ?

I was planning to use it as pass trough entitiy and pay inome tax on income coming from USA LLC as divdends

Depending on your tax residency country a US LLC could be see as transparent or opaque. If LLC is seen as opaque then income from LLC will be seen as divendends and taxed as dividend in your country, otherwise it will be taxed as personal income.

In any case by managing your LLC from EU you are making the LLC tax resident in your home country. You should be paying your country's CIT and social contributions if you want to do things by the book.

Depends on the jurisdiction.Depending on your tax residency country a US LLC could be see as transparent or opaque. If LLC is seen as opaque then income from LLC will be seen as divendends and taxed as dividend in your country, otherwise it will be taxed as personal income.

In any case by managing your LLC from EU you are making the LLC tax resident in your home country. You should be paying your country's CIT and social contributions if you want to do things by the book.

You might also be able to establish a branch office for the LLC in an EU jurisdiction.

Then, you could invoice this branch office as a sole proprietor from another jurisdiction.

I haven't verified the below, but it looks like a US LLC with a branch in Estonia + Sole proprietor in Slovenia could be a decent setup:

- The branch of US LLC in Estonia - All undistributed corporate profits are tax-exempt

- The sole proprietor in Slovenia - 4% effective tax (maximum 150k EUR per year) + to get an exemption from relatively high social taxes in Slovenia, you need an A1 certificate, which you can acquire for EUR 215,82 per month in Estonia.

Interesting setup.

You probably need to hire a director for the Estonian branch

I never heard of that certificate, can you elaborate on wht it does?

You probably need to hire a director for the Estonian branch

to get an exemption from relatively high social taxes in Slovenia, you need an A1 certificate, which you can acquire for EUR 215,82 per month in Estonia.

I never heard of that certificate, can you elaborate on wht it does?

Yes, a local director should be appointed.Interesting setup.

You probably need to hire a director for the Estonian branch

I never heard of that certificate, can you elaborate on wht it does?

Form A1 certifies that social tax is paid for the employee in the country which has issued the certificate. The certificate allows the employee to prove to their other countries of employment that no social security contributions are required there. For 2.6k/year you will be covered with social security, and you can get it from your EE operation.

It should work out as follows:

- 5.7% tax on 150k EUR income (need to hire one employee) - (income can be greater, but max 300k EUR in 2 years)

- or 9.2% on 50k EUR income.

Form A1 certifies that social tax is paid for the employee

So you will be sole proprietor in Slovenia and at the same time an employee of the Estonian branch? You'll pay PIT in Slovenia and social contributions in Estonia?

That's the idea, yes. Pay absolute minimum you can for the certificate. You can technically avoid paying a salary and just pay the minimum social tax.So you will be sole proprietor in Slovenia and at the same time an employee of the Estonian branch? You'll pay PIT in Slovenia and social contributions in Estonia?

Otherwise, you need to pay social tax in Slovenia, which is relatively high.

In the EU if you have social insurance in one country, you are anyway covered across the whole EU.

It's improbable that for such a small-scale structure, they would start cross-border tax investigations, which is expensive.hmm wouldn't this fall under GAAR? I mean, beside tax savings, what other reasons could you present that justify having a structure like that one?

It's important to note that an additional benefit of operating as a branch office is that your identity will not be reported as UBO in this jurisdiction (or EU UBO register) since branch offices are exempt from UBO reporting, so consequently information about them shouldn't be reported between authorities as smoothly compared to companies.

Latest Threads

-

-

Litigation Finance - My 26M Euros portfolio (BONUS: Free resources)

- Started by James Orwell

- Replies: 0

-

Mentor Group Gold - AD Thread! kemycard.com | Crypto Virtual Cards | Reloadable Without KYC | BIN USA

- Started by ththugues4

- Replies: 1

-

banking (fiat to crypto to fiat) for unconventional businesses (gambling, adult, and more)

- Started by Gediminas

- Replies: 2

-

Wise to move primary listing to the U.S. in blow to London stock exchange

- Started by Martin Everson

- Replies: 1