Dividend tax is very high though. How do people take money out of the company?yes, local company.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Relocate to Switzerland, how to?

- Thread starter EliasIT

- Start date

How do people take money out of the company?

Here's the best answer you'll ever get on the subject from Credit Suisse

https://www.credit-suisse.com/media...nden/finanzplanung/lohn-oder-dividende-en.pdf

awesome.Here's the best answer you'll ever get on the subject from Credit Suisse

https://www.credit-suisse.com/media...nden/finanzplanung/lohn-oder-dividende-en.pdf

I'm researching the links suggested in this thread and also read the entire article from Credit Suisse which details it all in nice points.

According to the maps and the article you can cook it down to the following cantons of interest if you only look at taxes and fix costs.

Schwyz, Zug & Steinberg - Lugano is still interesting if you also consider the the climate and if you like the Italian living.

The report and map is based on an income for singles of 80,000 CHF and for a married family with 2 children of 110,000 CHF. It is a good starting point. But what if you earn e.g. 200,000 CHF per year then it can all change and the order is different. So how do you find out?

But what if you earn e.g. 200,000 CHF per year then it can all change and the order is different. So how do you find out?

You download tax monitor 2022

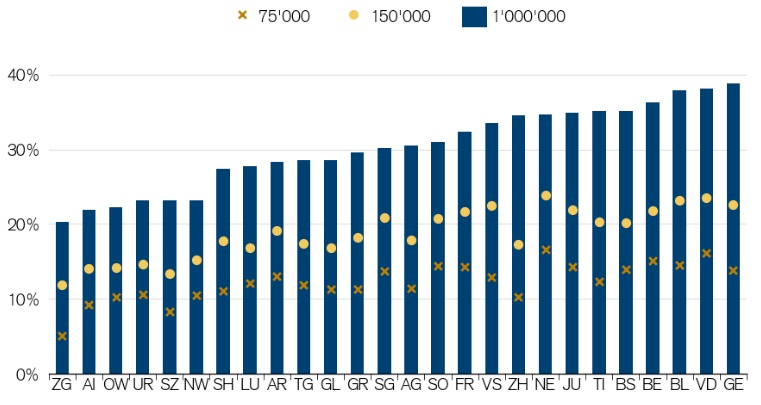

Income tax rate (federal government/canton/municipality) for a net income of CHF 75,000, CHF 150,000 and CHF 1 million, taking into account standard deductions, single persons, cantonal capitals, 2022

Do you know if you have a full-blown company in Zug - i.e. AG with real office, utility and director of the company if the company will be taxed for instant in Lugano (should that be my choice) or if it still will be taxed in Zug ?

Zug. It is also not that far to justify commuting. So you can justify that case should the riders of Mordor be out for your blood, which I doubt.Do you know if you have a full-blown company in Zug - i.e. AG with real office, utility and director of the company if the company will be taxed for instant in Lugano (should that be my choice) or if it still will be taxed in Zug ?

However, you have real substance so these rules apply internationally as well.

No, you cannot. Italiano is a must and it better be almost native-like fluent level, not just some broken ciao ciao.Can you live well in Lugano with English? It would be my first choice if I had to move to Switzerland.

However, you can get by of course and order food in restaurants, that is no problem, but you will stay forever the tourist and people will let you feel that way very very clearly.

I cannot see any foreigner wanting to live anywhere outside Zurich, Zug, Geneva and maybe Basel. The other places are just very tough to integrate and isolating without any strong knowledge of local language.

Last edited:

It is also not that far to justify commuting

What do you mean?

Could someone trade in Zug as self employed and what would be the tax in that case? Also what happens with assets that someone has before relocating to Zug? How would these crypto assets get taxed?

A german friend survived for 7 years in Bern, than moved back to germany and is now happy againI cannot see any foreigner wanting to live anywhere outside Zurich, Zug, Geneva and maybe Basel. The other places are just very tough to integrate and isolating without any strong knowledge of local language.

You go there for work, 3 days a week by commuting e.g. by train.What do you mean?

Anyone?Could someone trade in Zug as self employed and what would be the tax in that case? Also what happens with assets that someone has before relocating to Zug? How would these crypto assets get taxed?

It is basically like in any other western country.Anyone?

you are a pro trader and then all cap gains will be taxed with your income tax bracket percentage plus you pay all socials (15% on top).

you will want a company to have a company as this can save on the socials.

That is your starting price from which cap gains will be calculated.

Plus you need to declare every crypto wallet you own to tax man for them to calculate your wealth tax.

So we are talking about at least 30% in tax in Zug since you are taxed both in company and personal level. That's terribleIt is basically like in any other western country.

you are a pro trader and then all cap gains will be taxed with your income tax bracket percentage plus you pay all socials (15% on top).

you will want a company to have a company as this can save on the socials.

That is your starting price from which cap gains will be calculated.

Plus you need to declare every crypto wallet you own to tax man for them to calculate your wealth tax.

The key is to not have much personal income.So we are talking about at least 30% in tax in Zug since you are taxed both in company and personal level. That's terrible

So you park all your money in the company?The key is to not have much personal income.

Ya. Your working capital.So you park all your money in the company?

Hm but what about capital that is not needed. Then how you tax optimize in a place like Zug, where dividend tax is enormous.Ya. Your working capital.

Latest Threads

-

Crypto friendly banks that don’t ask for the impossible

- Started by jeffbean

- Replies: 1

-

-

10k stablecoin topup to revolut gets it insta frozen - wow so crypto friendly

- Started by OKboomer

- Replies: 5

-