If these are profits then it's not what i was talking about, i was talking about leaving the money in the company to grow the company AKA reinvesting.

Keeping 1Mln in the company is not reinvesting.

You said leave the rest in the company. It is fairly simple.

If it is profits, the company gets taxed on the profits and the owner pays wealth tax on the company value (15 x profit).

If you grow the company, it will work for as long as you stay in Switzerland. If you leave, you will pay tax on the goodwill of the company value.

In any case, you will have to pay for your success.

But if you don't make such high profits at all and still want to live in Switzerland because of other reasons not discussed much here, it may be worth it.

If the company makes 250K EUR in Profits each year and you only take out 6000 EUR / month you may stay under the radar and don't pay much taxes nor alot of other stuff, or what do you think ?

Ok, I took the time to read all the stuff written here.

1. I think you could have mentioned at the beginning that you are from Denmark and do not expect expat lifestyle. Switzerland has many Germans coming and the figuring out that the Swiss rarely eat in restaurants as it it expensive. All the other that complain about the meat price etc. Many of them leave after a while. If you are used to do all stuff on your own, you probably will like it. If you need people doing the work for you, there are places where you get more.

2. Your furniture issue. I recommend you storing it in Germany, it is much cheaper and you do not have to deal with customs. Why nobody mentioned this? Because you have not mentioned that you are in Denmark. Apart from that there are occasionally some basement bunker units for sale, I think with 10k you could be able to buy one. The annual costs will then probably be around 300. Otherwise, you can rent for about 100. Just check comparis.

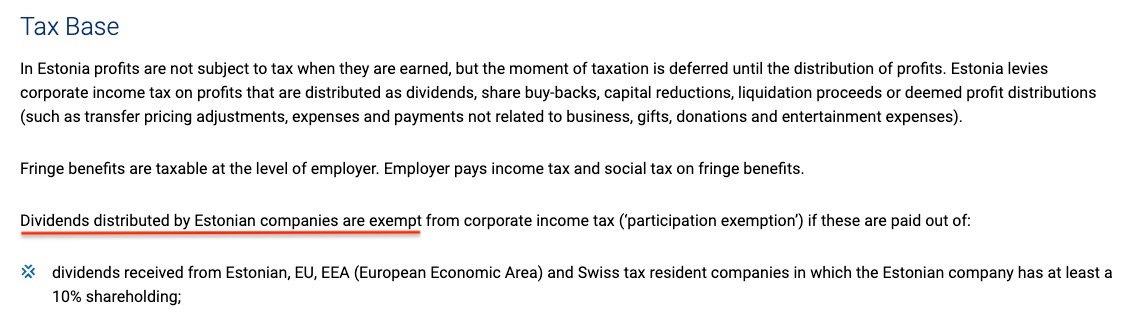

3. Your tax question. Yes, it does work for the time you are in Switzerland. But the what with all the profits? You eventually have to get them out and pay for it. Also, you will be subject to exit tax on the company goodwill when you leave the country. I personally would not recommend your setup. It sounds good to save 90k per year today. Tomorrow, you will be back here trying to save another 150k per year by moving out of Switzerland because whatever reason. Honestly, unless you are sure you want to stay in Switzerland for the rest of your life, you are better off incorporating in a low-tax country and hiring a guy there. You can register as self employed and write quarterly invoices to your company. (You will need about 3 customers to register but after that, there are no more questions.) There are many jurisdictions which offer 15% tax or less and do not tax dividends, you are better off like that as you can then disburse your dividends in the future without having to pay another 25% on top of it. Feel free to PM me.