You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Delaware 1 person LLC taxes

- Thread starter Elgringoblanco

- Start date

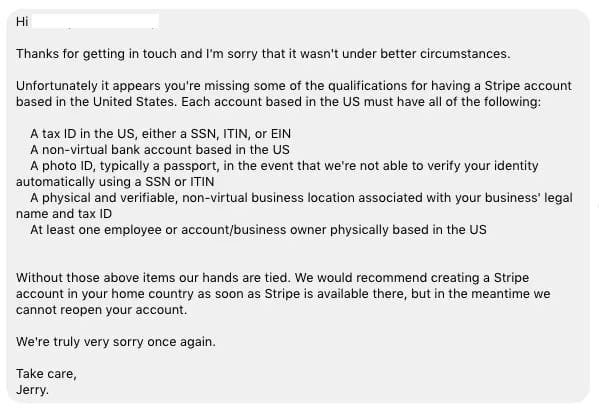

Just to report back i found a big problem with merchant processing that anybody involved with US LLC's needs to be aware.

As they say a picture is worth a 1000 words

In my case i need to start from scratch and discard US LLC's

As they say a picture is worth a 1000 words

In my case i need to start from scratch and discard US LLC's

You may find other providers of merchant processing to have different criteria .... opening any type of account seem to be very much hit and miss these days.

Cool

But form 5472 is a dangerous. Have you seen the questions? It provides more detailed information than even CRS will ever do. If it ever came to a situation where IRS shared that data with your home country your finished....

P.S I have zero dealing with U.S as many of you know but the topic is interesting. What will IRS do with that data on disregarded entities? They are part of J5 now so information is shared.

https://www.irs.gov/compliance/joint-chiefs-of-global-tax-enforcement

But form 5472 is a dangerous. Have you seen the questions? It provides more detailed information than even CRS will ever do. If it ever came to a situation where IRS shared that data with your home country your finished....

P.S I have zero dealing with U.S as many of you know but the topic is interesting. What will IRS do with that data on disregarded entities? They are part of J5 now so information is shared.

https://www.irs.gov/compliance/joint-chiefs-of-global-tax-enforcement

Indeed ... as pointed out earlier in this thread you are not home dry until the beneficial owner is resident somewhere with territorial taxation ... or where for some other reason you do not get taxed.Cool

But form 5472 is a dangerous. Have you seen the questions? It provides more detailed information than even CRS will ever do. If it ever came to a situation where IRS shared that data with your home country your finished....

P.S I have zero dealing with U.S as many of you know but the topic is interesting. What will IRS do with that data on disregarded entities? They are part of J5 now so information is shared.

https://www.irs.gov/compliance/joint-chiefs-of-global-tax-enforcement

Secondary problem is of course that any taxman might just disregard everything, including the legal niceties, just based on obtaining information on you. Anyone here that believe that they are "safe" because they are following the corresponding laws every step of the way may get a very nasty surprise some day ... it is the Taxman ... not you lawyer ... that decides what the laws mean.

Agreed, Some how my spider senses tell me the US delaying joining CRS as their house is in order to do so. I got a bad feeling IRS are compiling data as we speak on disregarded entities. Both EU and US know clients avoiding taxes are using US companies and territories (i.e Puerto Rico) to do so. It is just a matter of IRS gathering empirical data on volumes and home countries via form 5472 etc to aid there work.

Make no mistake data will be shared as everyone is onboard including US via J5 to fight tax avoidance.

Make no mistake data will be shared as everyone is onboard including US via J5 to fight tax avoidance.

Can absolutely not agree that a US company is no good choice. For me the best state is Florida, Miami really became the best offshore paradise in my opinion if you are a EU citizen with an EU company which wants to avoid tax. The problem why many don't like the US is that you can't get a bank account so easily and only with a personal visit and they blacklisted almost every Nominee the common offshore providers have. Sorry but the articles at "Tax Free Today" are rubbish... . In my opinion they just weren't able to open bank accounts in 2016 and therefore looked for bashing reasons, now in 2019 they changed from "super uncertain laws for the future" to "United States as a long-term solution" after they managed to get a bank account there. It was a long term solution in 2016 already.... . At least in 2019 they noticed that Florida is a very good offshore jurisdiction.

Keep in mind, the US is in a currency fight which will go on for the next decade, they are trying to bind as much money as possible in their country, this is why they are welcoming black money with really wide open arms. Just look at the last few years how they dried out other offshore jurisdiction for their own citizens, they are building an offshore monoply right now. No AEIO/AIA for business accounts, easy almost non existence KYC, no need for accounting in Florida and internationally well respected. If you find a good offshore provider who will open the bank account for you with a personal visit and makes all fillings then you really have an easy life with your US company.

Keep in mind, the US is in a currency fight which will go on for the next decade, they are trying to bind as much money as possible in their country, this is why they are welcoming black money with really wide open arms. Just look at the last few years how they dried out other offshore jurisdiction for their own citizens, they are building an offshore monoply right now. No AEIO/AIA for business accounts, easy almost non existence KYC, no need for accounting in Florida and internationally well respected. If you find a good offshore provider who will open the bank account for you with a personal visit and makes all fillings then you really have an easy life with your US company.

How do you see Wyoming? It has the best protection for single member LLC's, how does it compare to Florida?For me the best state is Florida

if just looked at the single member protection, then Wyoming is the better choice. Because in Florida you need multi members.

If you can get a bank account for your Wyoming company (in the USA!!) then you will have lots of fun with your Wyoming company. But since now I don't know any non-US Citizen who achieved this in Wyoming.

@fshore yes, you are right, checked with my accountant guy. You also need to file 1040NR along with some minor fillings, however there can be used estimates and it is almost impossible to be fined for having wrong estimates. They only want to see that you are not doing business in the US, that's all. They won't check an offshore company where they can't get tax from, so every audit would be a loss. The accounting laws in Florida make it easy to book almost everything without bills/invoices so normally a good offshore provider does this accounting tricks for you and you don't have to care about anything and don't need to collect invoices and bills. Sorry for my wrong text I hereby change my "no accounting" answer to "no real accounting needed, because the IRS doesn't want to see bills/invoices"

@Martin Everson form 5472 is only dangerous if no nominee is used. That always should be rule no.1 to use a nominee

If you can get a bank account for your Wyoming company (in the USA!!) then you will have lots of fun with your Wyoming company. But since now I don't know any non-US Citizen who achieved this in Wyoming.

@fshore yes, you are right, checked with my accountant guy. You also need to file 1040NR along with some minor fillings, however there can be used estimates and it is almost impossible to be fined for having wrong estimates. They only want to see that you are not doing business in the US, that's all. They won't check an offshore company where they can't get tax from, so every audit would be a loss. The accounting laws in Florida make it easy to book almost everything without bills/invoices so normally a good offshore provider does this accounting tricks for you and you don't have to care about anything and don't need to collect invoices and bills. Sorry for my wrong text I hereby change my "no accounting" answer to "no real accounting needed, because the IRS doesn't want to see bills/invoices"

@Martin Everson form 5472 is only dangerous if no nominee is used. That always should be rule no.1 to use a nominee

You don't need to file 1040nr if you don't do business in the US. Only 1120 Pro forma with 5472.if just looked at the single member protection, then Wyoming is the better choice. Because in Florida you need multi members.

If you can get a bank account for your Wyoming company (in the USA!!) then you will have lots of fun with your Wyoming company. But since now I don't know any non-US Citizen who achieved this in Wyoming.

@fshore yes, you are right, checked with my accountant guy. You also need to file 1040NR along with some minor fillings, however there can be used estimates and it is almost impossible to be fined for having wrong estimates. They only want to see that you are not doing business in the US, that's all. They won't check an offshore company where they can't get tax from, so every audit would be a loss. The accounting laws in Florida make it easy to book almost everything without bills/invoices so normally a good offshore provider does this accounting tricks for you and you don't have to care about anything and don't need to collect invoices and bills. Sorry for my wrong text I hereby change my "no accounting" answer to "no real accounting needed, because the IRS doesn't want to see bills/invoices"

@Martin Everson form 5472 is only dangerous if no nominee is used. That always should be rule no.1 to use a nominee

You don't need to file 1040nr if you don't do business in the US.

What does doing business in US means? Is selling on Amazon FBA considered doing business in US?

It generally means being in the US, or having employees working in the US.What does doing business in US means? Is selling on Amazon FBA considered doing business in US?

According to this US tax attorney a single member LLC who is non-US citizen, non US-resident and has no employees working in the US but sells on Amazon FBA in US doesn't pay taxes in US (only sales taxes).

In that case do you still only need to fill form 5472 +1120?

In that case do you still only need to fill form 5472 +1120?

Keep in mind, the US is in a currency fight which will go on for the next decade, they are trying to bind as much money as possible in their country, this is why they are welcoming black money with really wide open arms.

The US is welcoming black money with open arms? Now I heard everything

YesAccording to this US tax attorney a single member LLC who is non-US citizen, non US-resident and has no employees working in the US but sells on Amazon FBA in US doesn't pay taxes in US (only sales taxes).

In that case do you still only need to fill form 5472 +1120?

Latest Threads

-

tax resident but not allowed to be permanent resident possible?

- Started by ShillGates

- Replies: 1

-

Does Riseworks.io does also some kind of reporting ?

- Started by Piano

- Replies: 1

-

-

-

Converting USDT to Fiat, Questions on CRS

- Started by Var12

- Replies: 6