I recently received an attractive offer for a project in Switzerland. But it would require giving up my nomad lifestyle for a few years at at least and moving there.

As I would have to rent an apartment where I would need to show proof of high income, I guess it would be difficult to save taxes. Buying an apartment would probably require more capital than I have, and even if I did have the money, I would still be a Swiss tax resident with all the negative consequences.

But maybe there are still some good setups in Switzerland? After all, Switzerland at least doesn’t have any CFC rules.

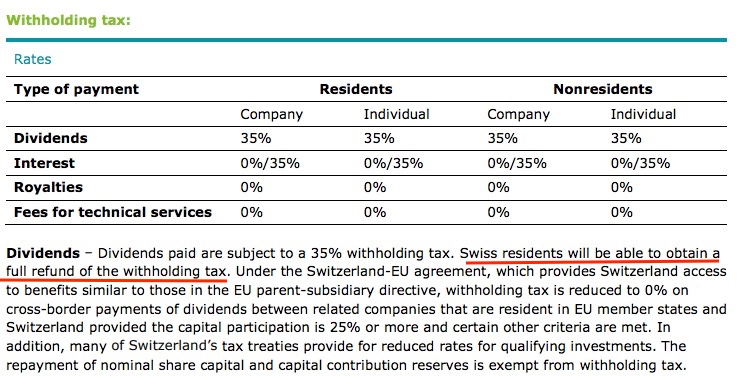

One other option I can think of would be to keep as much cash in the company as possible, paying only corporate income tax (which would be about 14% in the area if I remember correctly). And then, in a few years (when the project is finished), to move to Estonia to cash out tax free.

But I guess between the maintenance costs for a Swiss company with accountants and lawyers, housing and other expenses, I’m not sure if it would be worth it. So I’m leaning towards declining the offer. But I’d like to at least know what I’m saying no to.

So if anyone has some insight, please share it.

I think @clemens , @marzio and @Admin might have some input?

As I would have to rent an apartment where I would need to show proof of high income, I guess it would be difficult to save taxes. Buying an apartment would probably require more capital than I have, and even if I did have the money, I would still be a Swiss tax resident with all the negative consequences.

But maybe there are still some good setups in Switzerland? After all, Switzerland at least doesn’t have any CFC rules.

One other option I can think of would be to keep as much cash in the company as possible, paying only corporate income tax (which would be about 14% in the area if I remember correctly). And then, in a few years (when the project is finished), to move to Estonia to cash out tax free.

But I guess between the maintenance costs for a Swiss company with accountants and lawyers, housing and other expenses, I’m not sure if it would be worth it. So I’m leaning towards declining the offer. But I’d like to at least know what I’m saying no to.

So if anyone has some insight, please share it.

I think @clemens , @marzio and @Admin might have some input?