Hello, I have a rather complex situation I would like some guidance on.

I am currently living in Denmark, with no interest in relocating at the moment.

I’d like to open an investment firm/family office offshore for myself and some clients, at first just trading stocks, but potentially purchasing real estate.

At the moment, there would be quite low cashflow, but we have some major things in the pipeline and it could quickly pick up, but besides that the main benefit I’d like would be the elimination of capital gains tax, which means that I’d be able to reinvest a larger amount of equity.

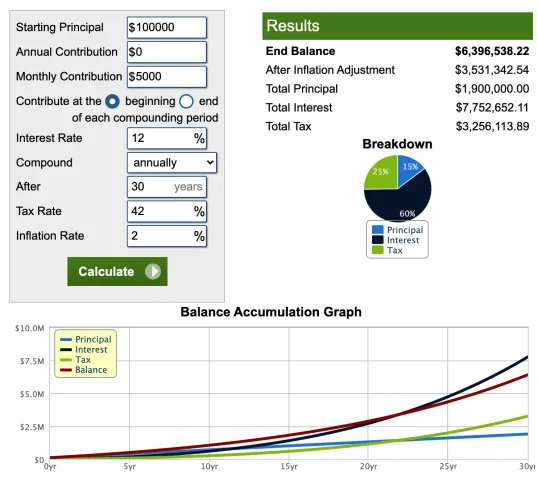

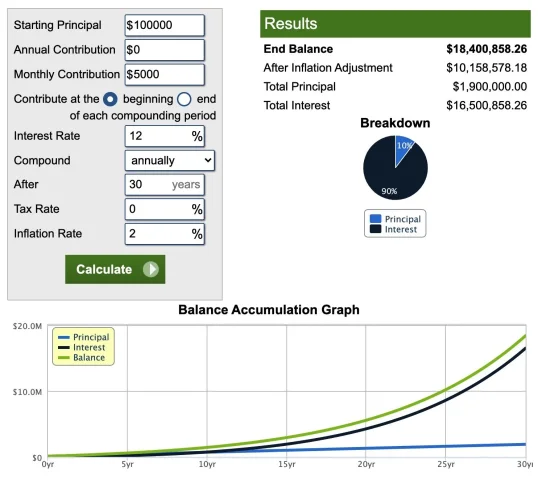

The tax rate on capital gains in Denmark is an extortionate 42%, eliminating that, hallelujah.

Compound that for a couple years, and that makes a major difference.

I do not intend to pay out the gains, just continually reinvest, and if i, or a client, would want to pay out the gains, we’d be fine paying danish taxes, or relocate to somewhere else at that point.

Anyone have an idea whether this is legally possible without relocating (possibly using a nominee director + power of attorney in a Bahamas or Cyprus company?), any ideas on structuring?

Also if anyone has a good recommendation for a firm specialising in this I’d love to hear it.

I am currently living in Denmark, with no interest in relocating at the moment.

I’d like to open an investment firm/family office offshore for myself and some clients, at first just trading stocks, but potentially purchasing real estate.

At the moment, there would be quite low cashflow, but we have some major things in the pipeline and it could quickly pick up, but besides that the main benefit I’d like would be the elimination of capital gains tax, which means that I’d be able to reinvest a larger amount of equity.

The tax rate on capital gains in Denmark is an extortionate 42%, eliminating that, hallelujah.

Compound that for a couple years, and that makes a major difference.

I do not intend to pay out the gains, just continually reinvest, and if i, or a client, would want to pay out the gains, we’d be fine paying danish taxes, or relocate to somewhere else at that point.

Anyone have an idea whether this is legally possible without relocating (possibly using a nominee director + power of attorney in a Bahamas or Cyprus company?), any ideas on structuring?

Also if anyone has a good recommendation for a firm specialising in this I’d love to hear it.