Hello everyone,

Since I learned many things from this forum I wanted to share my experience with TBC bank (and other banks) in Georgia and closing of my business account.

I couldn't find much information on the subject and it varies case by case but here is what happened to me:

My business is in affiliate marketing.

In June 2019, with the help of a Lawyer, I made a company in Georgia with IT certificate, opened business bank account and personal bank account in TBC Bank.

Until September I didn't really have any activity so business account was pretty much just waiting there. Then small amounts started to arrive from all around the world (but nothing from blacklisted countries or places like Seyschelles) . Money coming was mostly from 1st world countries. France, UK, USA etc. Amounts were not so big, nothing exceeding 10k and avg. is 1-2k USD.

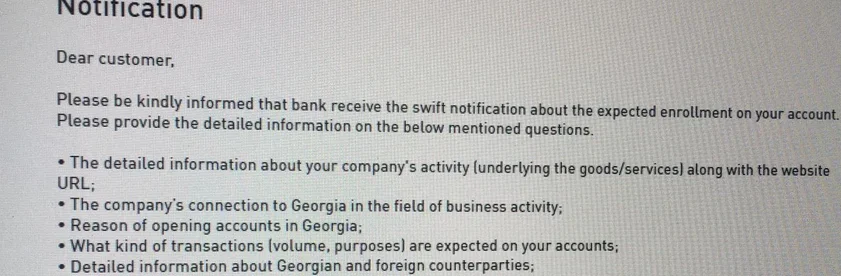

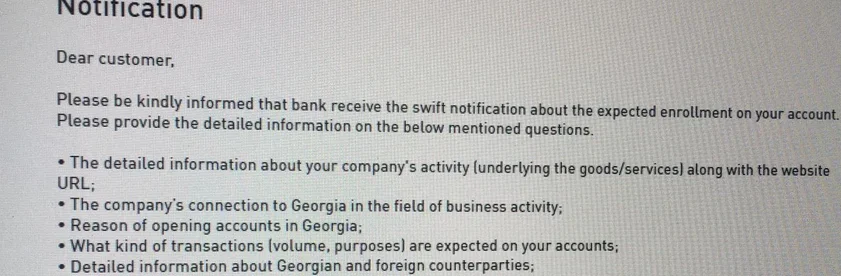

After around 15-16 bank transactions in and out, one day I recieved a message from the bank asking KYC questions. I replied them with the best of my knowledge and there were nothing risky with my business (No adult, no drugs, no illegal stuff, nothing)

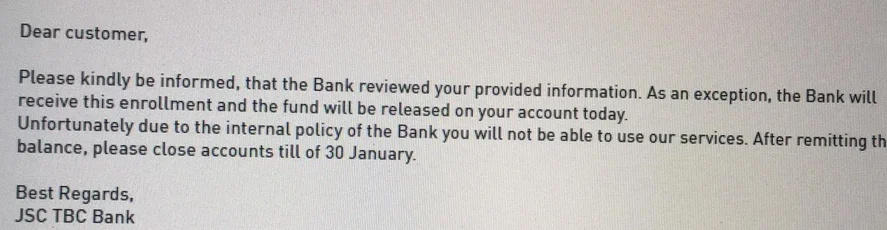

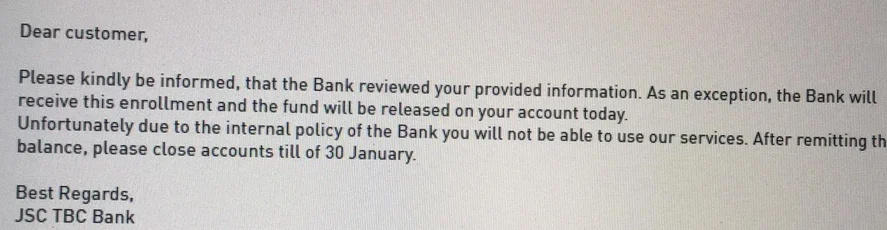

After few days of sending out my replies, bank sent me a message from the online platform and said they'll close my bank account in the next 10 days due to "internal reasons". (I'm attaching some parts of the messages)

I called them but no avail, according to the georgian law, they are allowed to do whatever they want. And looks like, money coming from abroad is kind of risky for them.

It was a killing blow for my company and I looked for some proper alternatives and I decided to go with a mix of Transferwise, Paypal and Payoneer. Now this process is crippled me but I'm still be able to recieve money from many partners.

Transferwise can accept Swift USD payments from many first world countries and so far it worked good for me. I kinda want to have a real bank account but looks like, to open a business bank account in Georgia, you need to reside there or you need some good connections - transactions inside the Georgia. If you are not doing any business in Georgia, they just block you. At least this is what bank clerks and my accountant told me. The lawyer who helped me to form the company is ghosted on me, he is not returning my messages and my calls.

Other solutions I could find like using a mediator to open a real offshore account (in the islands) were too risky or wouldn't worth it.

Few months after these events, I went to Georgia to take care of some business. I went to TBC bank and wanted to ask about the reason and try to re-open my accounts. Clerks were helpful, after 30-40 mins on the telephone with some people, they told me the same "due to internal reasons your bank account is closed".

Then I went to Bank of Georgia and applied for an account there. However after 1-2 days they sent a KYC questioneer. I filled it but they also declined to open a bank account for my business there. (Again, nothing risky, nothing illegal, just international affiliate marketing)

In the end I spent extra money, lost some clients and time to solve this problem and it's not 100% solved. Some people told me to open an account in Armenia or other nearby countries but it's really too much effort and outcome is not known since I might have the same thing someday in those countries.

Currently I'm going with the EMIs i mentioned above, paying hefty transactions money on some of them. They are not really offshore but since all is under company name, I guess that's okay.

So if you have any similar experience, or know what would be the best solution please reply the thread and let me know.

Maybe some of the people here will laugh at me and tell me that there are other solutions out there but I don't really believe it anymore

Since I learned many things from this forum I wanted to share my experience with TBC bank (and other banks) in Georgia and closing of my business account.

I couldn't find much information on the subject and it varies case by case but here is what happened to me:

My business is in affiliate marketing.

In June 2019, with the help of a Lawyer, I made a company in Georgia with IT certificate, opened business bank account and personal bank account in TBC Bank.

Until September I didn't really have any activity so business account was pretty much just waiting there. Then small amounts started to arrive from all around the world (but nothing from blacklisted countries or places like Seyschelles) . Money coming was mostly from 1st world countries. France, UK, USA etc. Amounts were not so big, nothing exceeding 10k and avg. is 1-2k USD.

After around 15-16 bank transactions in and out, one day I recieved a message from the bank asking KYC questions. I replied them with the best of my knowledge and there were nothing risky with my business (No adult, no drugs, no illegal stuff, nothing)

After few days of sending out my replies, bank sent me a message from the online platform and said they'll close my bank account in the next 10 days due to "internal reasons". (I'm attaching some parts of the messages)

I called them but no avail, according to the georgian law, they are allowed to do whatever they want. And looks like, money coming from abroad is kind of risky for them.

It was a killing blow for my company and I looked for some proper alternatives and I decided to go with a mix of Transferwise, Paypal and Payoneer. Now this process is crippled me but I'm still be able to recieve money from many partners.

Transferwise can accept Swift USD payments from many first world countries and so far it worked good for me. I kinda want to have a real bank account but looks like, to open a business bank account in Georgia, you need to reside there or you need some good connections - transactions inside the Georgia. If you are not doing any business in Georgia, they just block you. At least this is what bank clerks and my accountant told me. The lawyer who helped me to form the company is ghosted on me, he is not returning my messages and my calls.

Other solutions I could find like using a mediator to open a real offshore account (in the islands) were too risky or wouldn't worth it.

Few months after these events, I went to Georgia to take care of some business. I went to TBC bank and wanted to ask about the reason and try to re-open my accounts. Clerks were helpful, after 30-40 mins on the telephone with some people, they told me the same "due to internal reasons your bank account is closed".

Then I went to Bank of Georgia and applied for an account there. However after 1-2 days they sent a KYC questioneer. I filled it but they also declined to open a bank account for my business there. (Again, nothing risky, nothing illegal, just international affiliate marketing)

In the end I spent extra money, lost some clients and time to solve this problem and it's not 100% solved. Some people told me to open an account in Armenia or other nearby countries but it's really too much effort and outcome is not known since I might have the same thing someday in those countries.

Currently I'm going with the EMIs i mentioned above, paying hefty transactions money on some of them. They are not really offshore but since all is under company name, I guess that's okay.

So if you have any similar experience, or know what would be the best solution please reply the thread and let me know.

Maybe some of the people here will laugh at me and tell me that there are other solutions out there but I don't really believe it anymore