Do Search top Listed Company in UAE and find their Share holding pattern, Calculate the money they investedLast I checked it was Indians after UAE nationals of course owning most of UAE properties. US citizens not there in the list CaptK.

Top 10 nationalities of property investors in Dubai

- UAE. Transactions: 12,000. Value: Dhs37.4bn.

- India. Transactions: 10,628. Value: Dhs20.42bn.

- Pakistan. Transactions: 5,398. Value: Dhs7bn.

- Saudi Arabia. Transactions: 5,366. Value: Dhs12.51bn.

- UK. Transactions: 4,188. Value: Dhs9bn.

- Egypt. Transactions: 2,439. Value: Dhs4bn.

- Jordan. Transactions: 2,235. ...

- China. Transactions: 2,177.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Goodbye to Dubai and all UAE Banks friendliness?

- Thread starter Zed

- Start date

Telecoms doubt it as it is very much state owned..hospitality and commodities, very much yesIt's not what you can see that their money is in.

Think telecoms, hospitality, commodities, gold, oil and gas

Telecoms doubt it as it is very much state owned

It's not state-owned. There are only two main providers (Etisalat and Du) and both belong to the same person.

although a common misconception, it is not owned by the same person. Du is owned by 2 UAE sovereign wealth funds & Etisalat is majority state owned with the rest being publicly traded (in reality owned by one big family yes)It's not state-owned. There are only two main providers (Etisalat and Du) and both belong to the same person.

although a common misconception, it is not owned by the same person. Du is owned by 2 UAE sovereign wealth funds & Etisalat is majority state owned with the rest being publicly traded (in reality owned by one big family yes)

How do you think those are run. The equipment investment into network and fibre is as much as the investor is willing to invest. No tax means no audit which means happy days.

Funds back to the investor in a nominee structure.

Not common.What about UAE law.? If some problem arises how common is in UAE to get assets seized?

I had years ago in mind that it doesn't make sense to keep a lot of cash parked under Sharia law and talked to some private banks in DIFC but they all mentioned that they are not aware of any problems with the local banks.

They did of course understand the thoughts and mentioned diversification make always sense but only for this prupose they didn't recommend to go with them.

All mentioned that you should register a will for holding bigger amounts with local banks and this is what we recommend clients as well.

What maximum amounts you would recommend keeping at UAE bank? I mean for UHNWI residents? Let's say some customer would like to deposit 5m$ is it safe with such money in UAE?Not common.

I had years ago in mind that it doesn't make sense to keep a lot of cash parked under Sharia law and talked to some private banks in DIFC but they all mentioned that they are not aware of any problems with the local banks.

They did of course understand the thoughts and mentioned diversification make always sense but only for this prupose they didn't recommend to go with them.

All mentioned that you should register a will for holding bigger amounts with local banks and this is what we recommend clients as well.

Upto about 20M you are good but I personally think once you hit 5M move that amount to a bank in Singapore and or Switzerland.What maximum amounts you would recommend keeping at UAE bank? I mean for UHNWI residents? Let's say some customer would like to deposit 5m$ is it safe with such money in UAE?

@CaptK named it.

Technically there is no issue holding 5m+ in the local banks and it's even not uncommon.

Starting from this point you simply get banking that better serves your needs in terms of private banking and wealth management outside the UAE. UAE banks are retail banks without any really good private banking options. That's why you have the DIFC with Julius Baer, UBS and Bank of Singapore.

Technically there is no issue holding 5m+ in the local banks and it's even not uncommon.

Starting from this point you simply get banking that better serves your needs in terms of private banking and wealth management outside the UAE. UAE banks are retail banks without any really good private banking options. That's why you have the DIFC with Julius Baer, UBS and Bank of Singapore.

You have to have big balls to keep 5m$ in a Sharia law country bank account. I understand to keep maybe up to 1m.@CaptK named it.

Technically there is no issue holding 5m+ in the local banks and it's even not uncommon.

Starting from this point you simply get banking that better serves your needs in terms of private banking and wealth management outside the UAE. UAE banks are retail banks without any really good private banking options. That's why you have the DIFC with Julius Baer, UBS and Bank of Singapore.

If they decide to freeze funds in UAE, I don't think you can win any legal battle, because there is no such legal system there as we understand in western europe

Am I really curious if I buy stock/mutual fund using bank service , is it ok ?

Or you have to open account in Switzerland or Singapore??

Sorry for my ignorance in advance

Or you have to open account in Switzerland or Singapore??

Sorry for my ignorance in advance

UAE banks are safe(high CET1 ratios, high credit ratings etc...) still it doesn't make sense to keep a high(7 figures) amount in UAE banks because of the service standards. Every bank in UAE has a "Wealth Management" or "Private Bank" segment but their service standard is low, I mean very low.

If you open a private bank account in Switzerland they will assign you 10 years of wealth management experienced relationship manager who knows investing better and understand your needs + exclusive bank services. If you open a private bank account in UAE you will deal with amateur relationship managers(2-year retail banking experienced "Wealth Specialist") and low service standards.

If you open a private bank account in Switzerland they will assign you 10 years of wealth management experienced relationship manager who knows investing better and understand your needs + exclusive bank services. If you open a private bank account in UAE you will deal with amateur relationship managers(2-year retail banking experienced "Wealth Specialist") and low service standards.

Last edited:

I thought this back in the days as well but as already mentioned no private banker in the DIFC ever noticed such a case like random asset freezing.You have to have big balls to keep 5m$ in a Sharia law country bank account. I understand to keep maybe up to 1m.

If they decide to freeze funds in UAE, I don't think you can win any legal battle, because there is no such legal system there as we understand in western europe

All funds that were really seized in the past had some illegal source.

Like @rowena mentioned it simply makes no sense to keep high balances with them not because they are not safe but you can get much better wealth management / private banking solutions in the DIFC.

Can someone add to this? Any experience as of lately?This, literally THIS.

You can walk in Chase and open account as non-resident if you are dressed well. In UAE banks they ask so many questions lately that people often give up because they can not be bothered anymore. In the past few weeks I heard several people got their account closed in UAE for no specific reason. I imagine bank policies are getting more and more strict and they tend to close accounts that had any "high risk" transaction.

Can't agree with this.Can someone add to this? Any experience as of lately?

We have daily experience with the local banks and especially the bank account opening needs to be planned well. Bank policies changing frequently in terms of the onboarding conditions so what was working with one bank one year ago might not work nowadays.

When it comes to account closure we are not aware of any big waves of account closures lately by any bank and we still see many clients mention us that they are impressed how transactional the UAE banks are even if they do some type of transactions that doesn't make any sense for the business trade license they have in file with the bank and then still again we never seen a bank that closed the bank account from one day to another only because the transaction profile doesn't fit the company trade license. They are always asking for adding or changing the business activity within a timeframe before finally close the account.

In the past we have only seen two big waves of account closures - one was for all the offshore non-resident companies and the other for physical Gold trading business.

Beside of that there are two high risk activities we don't incorporate for our clients:

General Trading and Management Consultancy.

There is no official black listing like with the non resident offshore companies and physical Gold trading activity but to get any bank account open you need to bring several millions with you and even small banks without any prober mobile banking asking for 1m$ initial deposit.

@Fred Can you shed light on how friendly the banks in Dubai are towards direct crypto transactions.

Specifically, what I mean is, suppose you set up a personal bank account for the sole purpose of crypto trading. And let's say you were moving in large sums of money direct to your personal bank account from a local crypto exchange.

Would this raise any red flags and possibly lead to account closure or suspension?

I understand that the service you offer is a more layered approach, but suppose one wanted to take more of a direct approach--would that create any problems vis-a-vis the bank?

Thanks

Specifically, what I mean is, suppose you set up a personal bank account for the sole purpose of crypto trading. And let's say you were moving in large sums of money direct to your personal bank account from a local crypto exchange.

Would this raise any red flags and possibly lead to account closure or suspension?

I understand that the service you offer is a more layered approach, but suppose one wanted to take more of a direct approach--would that create any problems vis-a-vis the bank?

Thanks

I doubt that you want to use local provider BitOasis that charges all in all around 10% fees.@Fred Can you shed light on how friendly the banks in Dubai are towards direct crypto transactions.

Specifically, what I mean is, suppose you set up a personal bank account for the sole purpose of crypto trading. And let's say you were moving in large sums of money direct to your personal bank account from a local crypto exchange.

Would this raise any red flags and possibly lead to account closure or suspension?

I understand that the service you offer is a more layered approach, but suppose one wanted to take more of a direct approach--would that create any problems vis-a-vis the bank?

Thanks

However beside of Mashreq and Arab Bank no bank is official claiming to be crypto unfriendly.

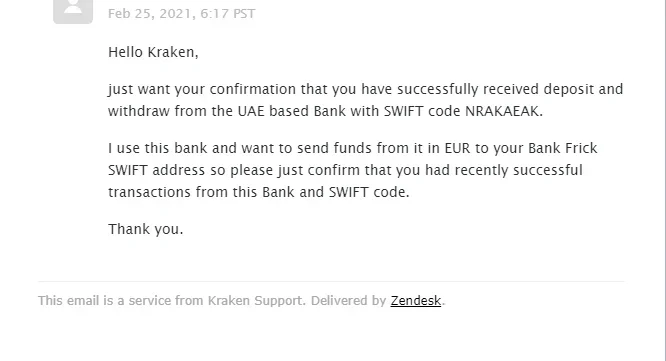

See attached the confirmation of Kraken as well.

First of all we and many clients have good experience when it comes to using the personal account organic that means you pay yourself a salary from the Business Bank Account of your own company and invest this money in Cryptocurrency via Kraken and withdraw this funds at a later stage from Kraken to the same Personal Bank Account.

In your thinking is a mistake - you need a reason to open the personal bank account in the UAE as well. You need to show either your own company or a salary certificate or you need 7 figures and want to invest in UAE in lets say real estate. Only mentioning you want to open the Personal Bank Account for unspecified investments won't satisfy the bank to open the Personal Account for you as well as for Crypto Trading only. This is like with all major high street bank - go and mention Crypto Trading only to HSBC, Barclays or Standart Chartered and they even open the account because they know they need to close it down sooner then later.

That's why we say use our innovative methods to go the route over the business earnings to have a Fiat On/Off ramp to avoid any problems at all.

Attachments

https://support.kraken.com/hc/en-us...that-don-t-work-with-cryptocurrency-exchanges

Official statement by Kraken.

Official statement by Kraken.

Ironically, most of the issues we've seen with funding have been with online-only "cloud" banks. In contrast, traditional banks with physical branches have generally worked fine with our clients.

Wait, you can buy property in Dubai for crypto???Very true , Top real state broker accept money in Cash, Crypto, Card any form of payment . If they make things difficult , Nobody is going to buy their property . Biggest reason for Dubai property boom is "Hub for Money laundering ". If they do too much KYC/AML drama , 1% leave the country and It completely finish their economy . It is an open secret for Dubai. Spend your money on car and bebe and enjoy life . They do not have any problem. Do not do any crime in Dubai . That's the only one rule apply in dubai .

Share:

Latest Threads

-

-

Help Needed: SVG LLC & DR Bank Setup – Discreet GBP Payments & Tax-Efficient Flow (UK Resident)

- Started by quantora

- Replies: 4

-

-

"Britannia Card" - £250,000 landing fee for zero taxes on foreign earnings

- Started by cherry

- Replies: 4

-

Crypto immigration (I guess I"m the first Asian here)

- Started by Nomadguk

- Replies: 2