I get that and think its a fair point. However, the best than would be cash in bills or with a bank you know how they work, these 2 stables are not necessarily much safer.Yes, you are right on this point. Still, I prefer to avoid it even if it's a 1% risk. Much rather have USDC or USDP

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

There is a rumour of FTX insolvency

- Thread starter troubled soul

- Start date

these 2 stables are not necessarily much safer.

I think we need to distinguish between different types of backed assets.

I don't know much about USDC, thought smart people seem to like it. Its reputation is far beyond USDT (which I don't think is worth zero).

Paxos Trust and NYDFS seem to have a good thing going. USDP (and PAXG) look very reassuring. I am less sure that I would identify forged cash in bills. I think it would be a lot harder. Right now, I can't really say that money in my fiat bank accounts would be safer than money stored with Paxos.

Part of the reason that I dislike Gensler style regulatory monopoly, is that it diminishes the reputation of good regulators. A good regulator doesn't need to rely on state violence, a good regulator will be an asset for each member. Many people trust the Michelin ratings for restaurants, they don't need guns or jails to protect their reputation.

But, it is time for some humility. @azb1 was right to start this thread with a subject that, at the time, seemed unnecessarily alarmist to me. @azb1 I am sorry for doubting you.

I am extremely surprised about the FTX contagion. It should not have been possible. I really hope that the inevitable legal advice to say nothing doesn't stop SBF and others from coming clean and explaining how they fell into this whole fiasco. I do hope that everyone who wants to withdraw from FTX can do, promptly, and I also hope that it survives. I hope that volume picks back up and that the FTT buybacks support a decent price (whatever that is). I don't think that Alameda was funded by financially insecure over-leveraged pensioners and if it goes under that's a good lesson for future investors.

Further, I think this is a very good moment for legal systems for allow client deposits to be ringfenced. Coinbase got a a lot of criticism for highlighting this problem, but it was not their doing. It has been created at a political level. One of the reasons that the Cayman Islands are trusted with so many assets, is their protected cell structures.

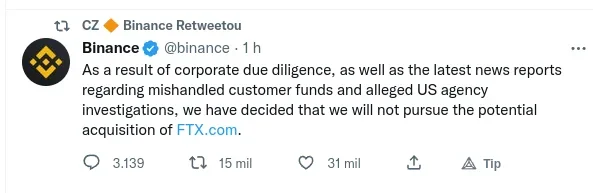

So, that's it: Binance backs out of the rescue. Kindergarten closed.

https://www.cnbc.com/2022/11/09/bin...the-crypto-exchange-on-the-brink-of-collapse.Meanwhile total capitulation of the crypto market. Will be interesting to see what happens with the big players like Microstrategy/Saylor who even placed bonds to buy more BTC at the top of the hype .... - if these big guys are forced to sell (margin call or else), BTC will look like the Lebanese Pound.

Interesting, this nonsense even affects the stock market. That might be a sign of more problems ahead and the financial markets smelling it. Saylor? Microstrategy?

Anyway, this "incident" will bring the regulator on stage and we will see extremely tough regulations that might strangulate the crypto market to death. So, FTX helped the government in a way.

https://www.cnbc.com/2022/11/09/bin...the-crypto-exchange-on-the-brink-of-collapse.Meanwhile total capitulation of the crypto market. Will be interesting to see what happens with the big players like Microstrategy/Saylor who even placed bonds to buy more BTC at the top of the hype .... - if these big guys are forced to sell (margin call or else), BTC will look like the Lebanese Pound.

Interesting, this nonsense even affects the stock market. That might be a sign of more problems ahead and the financial markets smelling it. Saylor? Microstrategy?

Anyway, this "incident" will bring the regulator on stage and we will see extremely tough regulations that might strangulate the crypto market to death. So, FTX helped the government in a way.

Last edited:

So... probably FTX is finished.... solana will face massive struggles to keep competitive (since it was Alameda Research money that was doing all the job)... maybe another buyer will show up but at this point and with investigations going on it will be hard to save anything...

Attachments

Same here, I had about $25k there used for algorithms etc.. VERY VERY bad timing..Thanks for all the details guys. Quick Q : I got 25K EURO (fiat) on FTX.. was waiting for higher discounts to buy BTC/ETH...

I read that withdrawals are paused.. Which option from the below is "safer" and quicker :

EUR ==> USDT ==> Tranfer to Binance

or

EUR ==> EUR bank account

We should all gather for courts.. This will take at least 1-2 years :-(

2.6 millis locked at FTX here

I wanna puke

This was exepected. Binance just wrote a LOI (letter of intent) which has nil value but was just an agreement to calm down the sell off.So, that's it: Binance backs out of the rescue. Kindergarten closed.

https://www.cnbc.com/2022/11/09/bin...the-crypto-exchange-on-the-brink-of-collapse.Meanwhile total capitulation of the crypto market. Will be interesting to see what happens with the big players like Microstrategy/Saylor who even placed bonds to buy more BTC at the top of the hype .... - if these big guys are forced to sell (margin call or else), BTC will look like the Lebanese Pound.

Interesting, this nonsense even affects the stock market. That might be a sign of more problems ahead and the financial markets smelling it. Saylor? Microstrategy?

Anyway, this "incident" will bring the regulator on stage and we will see extremely tough regulations that might strangulate the crypto market to death. So, FTX helped the government in a way.

For sure Binance would step out of this as they would find any reason (false equity statement, false valuation,..).

BTC will survive this, it's the oldest and most 'stable' crypto and still has some use (mostly illegit) . The other cryptos beside ETH are all just ponzi schemes with no use beside speculation and where the early backers could grab the profits before the scheme collapses.

Last edited:

He really did it.....

https://markets.businessinsider.com...lameda-cryptocurrency-markets-economy-2022-11Inside the ruthless moves Binance's CEO made to bring Sam Bankman-Fried's FTX to its knees

Last edited:

No biggie, FTX was anyway a childrens playground exchange in size. (Can be seen with amounts of BTC deposited there on glassnode). It was a big factor smaller than binance and is about the same size (not size) as Poloniex.

But their marketing ploy was a factor of maybe all exchanges combined times 10.

Water will calm down after the hype passes.

But their marketing ploy was a factor of maybe all exchanges combined times 10.

Water will calm down after the hype passes.

Do you know what % of bitcoin transactions are 'illegit'?BTC will survive this, it's the oldest and most 'stable' crypto and still has some use (mostly illegit)

80% i would guessDo you know what % of bitcoin transactions are 'illegit'?

False narrative. Needs upgrade to 2022Do you know what % of bitcoin transactions are 'illegit'?

https://www.forbes.com/sites/hailey...ins-role-in-illicit-activity/?sh=1c710b2e3432

FTX: Cryptocurrency giant Binance walks away from bailout

https://www.bbc.com/news/business-63577783

---- quote start

Binance said that after due diligence, it would not pursue the deal.

It said reports of "mishandled customer funds and alleged US agency investigations" had swayed its decision.

FTX had been struggling with a surge in withdrawals that caused a "liquidity crunch".

Concerns about FTX's financial health reportedly triggered $6bn (£5.2bn) of withdrawals in just three days.

The Reuters news agency reported on Wednesday that the US Securities and Exchange Commission (SEC) was investigating FTX's handling of customer funds and its crypto-lending activities.

The markets regulator was examining whether the platform had followed securities laws about keeping customer assets separate and whether it had traded against customers.

---- quote end

FTT @ $2.61'ish. Nuff said. All bad news. As I always say at any wiff of danger take your money and run and ask questions later. Same applies to USDT btw. Never ever take a wait and see approach with crypto. It is a snake pit of white collar criminals who wouldn't be out of place working for Credit Suisse.

Yah, good they let this fail. Why would Binance buy it. Does not serve their purpose nor would they really want to have such a toxic and burned name now.FTX: Cryptocurrency giant Binance walks away from bailout

https://www.bbc.com/news/business-63577783

---- quote start

Binance said that after due diligence, it would not pursue the deal.

It said reports of "mishandled customer funds and alleged US agency investigations" had swayed its decision.

FTX had been struggling with a surge in withdrawals that caused a "liquidity crunch".

Concerns about FTX's financial health reportedly triggered $6bn (£5.2bn) of withdrawals in just three days.

The Reuters news agency reported on Wednesday that the US Securities and Exchange Commission (SEC) was investigating FTX's handling of customer funds and its crypto-lending activities.

The markets regulator was examining whether the platform had followed securities laws about keeping customer assets separate and whether it had traded against customers.

---- quote end

FTT @ $2.61'ish. Nuff said. All bad news. As I always say at any wiff of danger take your money and run an ask questions later. Same applies to USDT btw. Never ever take a wait and see approach with crypto. It is a snake pit of white collar criminals who wouldn't be out of place working for Credit Suisse.

Well to come back to our forever beloved topic and discussion, we wait for 5years+ for the tether fud to finally materialize

It made the rounds again very strongly yesterday and as Im checking right now, is just 1$. So another market test passed with A added to its chest. Passing the UST debacle in June can be marked as A+.

But that being said, better safe than sorry and apply not your keys not your coins. It is an important message.

Compared to banking and other legacy systems, the fraud is just being discovered quickly and violently purged whereas in all legacy systems, it is being tampered over and bailed out. From that perspective, crypto is a vastly superior.

USDT has been steadily dropping against BUSD past few days.FTX: Cryptocurrency giant Binance walks away from bailout

https://www.bbc.com/news/business-63577783

---- quote start

Binance said that after due diligence, it would not pursue the deal.

It said reports of "mishandled customer funds and alleged US agency investigations" had swayed its decision.

FTX had been struggling with a surge in withdrawals that caused a "liquidity crunch".

Concerns about FTX's financial health reportedly triggered $6bn (£5.2bn) of withdrawals in just three days.

The Reuters news agency reported on Wednesday that the US Securities and Exchange Commission (SEC) was investigating FTX's handling of customer funds and its crypto-lending activities.

The markets regulator was examining whether the platform had followed securities laws about keeping customer assets separate and whether it had traded against customers.

---- quote end

FTT @ $2.61'ish. Nuff said. All bad news. As I always say at any wiff of danger take your money and run and ask questions later. Same applies to USDT btw. Never ever take a wait and see approach with crypto. It is a snake pit of white collar criminals who wouldn't be out of place working for Credit Suisse.

What do you mean by quickly? Any comparisons?Yah, good they let this fail. Why would Binance buy it. Does not serve their purpose nor would they really want to have such a toxic and burned name now.

Well to come back to our forever beloved topic and discussion, we wait for 5years+ for the tether fud to finally materialize.

It made the rounds again very strongly yesterday and as Im checking right now, is just 1$. So another market test passed with A added to its chest.

But that being said, better safe than sorry and apply not your keys not your coins. It is an important message.

Compared to banking and other legacy systems, the fraud is just being discovered quickly and violently purged whereas in all legacy systems, it is being tampered over and bailed out. From that perspective, crypto is a vastly superior.

SBF is still trying:

He sounds delusional, but we don't know how much the shortfall is in the short term, or what value remains for the longer term if he finds someone with the cash.

Even if FTX + FTX.us could give enough value for someone to come to the rescue and honour withdrawals, he has a problem. Existing investors will have duties to their investors. For example, the Ontario Teachers' Pension Plan invested in ftx.us so he presumably can't just give it away. Plus the regulatory and reputational risks.

FTX loaned $4 billion to Alameda, part backed by FTT tokens. Step one, make some coins. Step two, give them to your own fund. Step three, lend yourself $billions against the token you made.

https://www.coindesk.com/business/2...f-of-reserves-as-ftx-contagion-grips-markets/

I say that Paxos, Kraken and Gate deserve credit for doing this already (also Bitmex occasionally). I remember looking up my deposits on the now defunct BX in 2017 and wondering why they don't all do it. I guess the answer is just that we didn't demand it.

He sounds delusional, but we don't know how much the shortfall is in the short term, or what value remains for the longer term if he finds someone with the cash.

Even if FTX + FTX.us could give enough value for someone to come to the rescue and honour withdrawals, he has a problem. Existing investors will have duties to their investors. For example, the Ontario Teachers' Pension Plan invested in ftx.us so he presumably can't just give it away. Plus the regulatory and reputational risks.

FTX loaned $4 billion to Alameda, part backed by FTT tokens. Step one, make some coins. Step two, give them to your own fund. Step three, lend yourself $billions against the token you made.

https://www.coindesk.com/business/2...f-of-reserves-as-ftx-contagion-grips-markets/

I say that Paxos, Kraken and Gate deserve credit for doing this already (also Bitmex occasionally). I remember looking up my deposits on the now defunct BX in 2017 and wondering why they don't all do it. I guess the answer is just that we didn't demand it.

Yeah, most people are guessing, but the reality is most transactions using BTC aren't "illegit"80% i would guess

Similar threads

- Replies

- 6

- Views

- 515

- Article

- Replies

- 23

- Views

- 5,419

- Replies

- 9

- Views

- 2,670

- Replies

- 15

- Views

- 2,281

Share: