https://news.bitcoin.com/crypto-exc...ns-on-its-books-ceo-cites-recent-revelations/It's a bitter lesson. There is no smoke without fire in Crypto. Stay safe.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

There is a rumour of FTX insolvency

- Thread starter troubled soul

- Start date

FTT token is under pressure but the market cap is pretty small and I think they could just buy it all if they want to support the price. SBF said in June that they have a few billion on hand to support projects.

Alameda Research is reported to have $billions of FTT already, which is also raising eyebrows. If they only have $7 billion of debt, then I guess they're still in an OK position.

I don't hear people questioning FTX exchange's solvency. I would be surprised if they do not have a ton of cash and assets.

If FTT price does drop a lot before FTX/Alameda support it, then it would be a good time to stock up for trading discounts. I really wish I hadn't sold my BNB in 2017...

Alameda Research is reported to have $billions of FTT already, which is also raising eyebrows. If they only have $7 billion of debt, then I guess they're still in an OK position.

I don't hear people questioning FTX exchange's solvency. I would be surprised if they do not have a ton of cash and assets.

If FTT price does drop a lot before FTX/Alameda support it, then it would be a good time to stock up for trading discounts. I really wish I hadn't sold my BNB in 2017...

I still remember when someone tried to warn people about the impending bankruptcy of Celsius and the all people ridiculed him for it. A week later and Celsius halted withdrawals. I truly hope this will be different. In any case, be careful out there

I'm not saying that FTT price will not fall, just that it's important to understand how FTT, FTX and Alameda relate to each other.

33% of FTX trading fees go to buying FTT back. I wonder what volume that represents. There should be some price at which it's a bargain.

33% of FTX trading fees go to buying FTT back. I wonder what volume that represents. There should be some price at which it's a bargain.

isn't this a actually the major sign to stay away?FTT token is under pressure but the market cap is pretty small and I think they could just buy it all if they want to support the price. SBF said in June that they have a few billion on hand to support projects.

isn't this a actually the major sign to stay away?

The market thinks so and rightly so. Run and then ask questions later.

Investors Withdraw Millions From FTX as Binance Begins Liquidating FTT Token

https://decrypt.co/113723/investors...from-ftx-binance-begins-liquidating-ftt-token

Nah, it's a narrative we are pushing to crush SBF...https://news.bitcoin.com/crypto-exc...ns-on-its-books-ceo-cites-recent-revelations/It's a bitter lesson. There is no smoke without fire in Crypto. Stay safe.

Technically they are ok, but then again its a house of cards propped up by FTT... so its risk level is higher than standard....

But nuts and bolts its an agenda to punish him for trying to buy politicians and get state protection for FTX at the cost of competition (Centralised and Decentralised).

But nuts and bolts its an agenda to punish him for trying to buy politicians and get state protection for FTX at the cost of competition (Centralised and Decentralised).

Is that all the 'recent revelations' talked about is? Or is something far worse?

FTX is not Alameda, Alameda is not FTX. Some documents leaked show that Alameda has big positions on FTT, what those documents don't show is that they hold +$10B of other assets which are not shown in the report. FTX is fine, Alameda is the one that may not be fine, but remember, it's all rumors.

Have you read this? Might be of interest.I'm not saying that FTT price will not fall, just that it's important to understand how FTT, FTX and Alameda relate to each other.

33% of FTX trading fees go to buying FTT back. I wonder what volume that represents. There should be some price at which it's a bargain.

isn't this a actually the major sign to stay away?

FTT securitises 33% of FTX fees (among other things), so a small market cap would be a positive sign because (income / market cap) increases. More on that at the end.

Technically they are ok, but then again its a house of cards propped up by FTT... so its risk level is higher than standard....

FTT is propped up by Alamada (who bought lots) and FTX (who buy it weekly and burn it). I don't see how FTT props up FTX; the token provides holders with discounts.

I do agree that people want to punish SBF for trying to buy politicians and get state protection for FTX. I believe that he is sincere in wanting the US to provide a better legal framework, but this will inevitably include a level of regulation that many crypto enthusiasts will hate.

FTX is not Alameda, Alameda is not FTX. Some documents leaked show that Alameda has big positions on FTT, what those documents don't show is that they hold +$10B of other assets which are not shown in the report. FTX is fine, Alameda is the one that may not be fine, but remember, it's all rumors.

If we discount FTT to zero (which I wouldn't at this time) then Alameda's assets would still be more than liabilities. However, they are exposed to SOL and other crypto.

Have you read this? Might be of interest.

Yes it's the coindesk article with some added commentary but also a link to this FTX page on FTT which helps explain the model.

At the start of this month, FTT was trading at $26.10. With a $2.8 million buy back and burn per week, that represent 4.2% annual yield on circulating supply.

As I write this, FTT is trading at $15.78. With a $2.8 million buy back and burn per week, that would represent 6.9% annual yield.

The fundamental value (FTX burning about $2.8 million per week) remains, but you can get 65% more of it for your $100 than you could a week ago.

This is where Alameda's holding raises eyebrows, what if their total assets drop below $8 billion (i.e. SOL and other crypto drop as well as FTT)? There would be no benefit in forcing Alameda to sell on the open market, because the biggest market (FTT-USDT on Binance) has less than $4million in liquidity above $10. There is a large buy order for FTT on FTX, which could be a related party.

I am not saying that now is the right time to buy or that $15.78 is the right price (it could be a bargain, or not), but FTX is committed to buying a few million dollars of FTT per week so at some market cap it makes sense, if you believe that FTX will remain in business and generating exchange market fees.

"FTX stops processing client withdrawals after deposit run - report"

https://www.investing.com/news/cryp...withdrawals-after-deposit-run--report-2936341

https://www.investing.com/news/cryp...withdrawals-after-deposit-run--report-2936341

It's always the same: First denial, than disaster."FTX stops processing client withdrawals after deposit run - report"

https://www.investing.com/news/cryp...withdrawals-after-deposit-run--report-2936341

Like Celsius - the signs were written on the billboard long ago. This industry is a scam.

Now the entire crypto market tanks.

almost every country in the world is issuing and pushing it's own scam security (it's called currency) and people get robbed by design - why would anyone voluntarily do the same with security issued by a private company?

yes, it's great if you're a trader/speculator and want to make money, but then it should be part of your risk model and there is no space for complaints

yes, it's great if you're a trader/speculator and want to make money, but then it should be part of your risk model and there is no space for complaints

I am not saying that now is the right time to buy or that $15.78 is the right price (it could be a bargain, or not),

Should have bought!

Against this - we confirm that a USD withdraw request was processed and received today."FTX stops processing client withdrawals after deposit run - report"

https://www.investing.com/news/cryp...withdrawals-after-deposit-run--report-2936341

Honestly if you guys wouldn't have talked here about it just from user experience point of view we wouldn't have noticed anything.

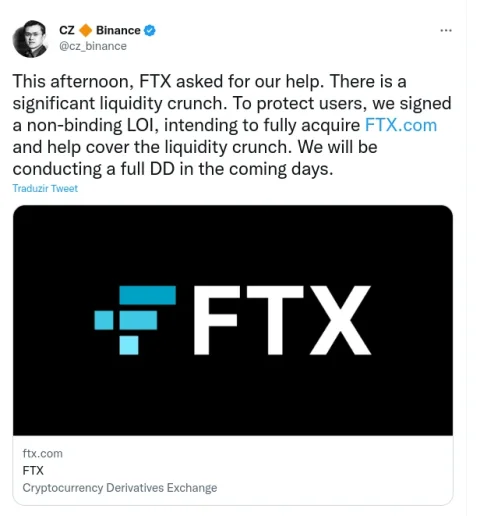

This whole Binance/FTX saga is suspiciously murky  . CZ went from dumping FTT to considering buying the company. Is this just a ploy to stall for time to liquidate his FTT or is this genuine.

. CZ went from dumping FTT to considering buying the company. Is this just a ploy to stall for time to liquidate his FTT or is this genuine.

P.S Sorry I trust no company in crypto world.

. CZ went from dumping FTT to considering buying the company. Is this just a ploy to stall for time to liquidate his FTT or is this genuine.

. CZ went from dumping FTT to considering buying the company. Is this just a ploy to stall for time to liquidate his FTT or is this genuine.P.S Sorry I trust no company in crypto world.

Market does not seem to be convinced. Too much damage. BTC now below 19k means people are rightfully scared.problem solved! Binance will acquire FTX

Similar threads

- Replies

- 6

- Views

- 535

- Article

- Replies

- 23

- Views

- 5,808

- Replies

- 9

- Views

- 2,708

- Replies

- 15

- Views

- 2,342

Share:

Latest Threads

-

Destination Thailand Visa – Guide to the Official Digital Nomad Visa in Thailand

- Started by Kim-OTC

- Replies: 2

-

Crypto exchange platform without Licensing

- Started by Ann1892

- Replies: 5

-

Cheap OFFshore, no taxes, no audit what country for a 5k income freelancer?

- Started by Lex00

- Replies: 6

-

-

Moving to Cyprus – Is the HK offshore structure still viable? What are the real risks?

- Started by jiejq

- Replies: 3