By Matteo Bottacini

Tether: is it 1:1?

Tether has always been one major point of discussion in crypto on account of its non-transparent history. And there are still today ongoing discussions regarding the quality of its reserves.

Have a look at the Tether Assurance Consolidated Reserves Report from September 30, 2022 https://assets.ctfassets.net/vyse88cgwfbl/1Xfu4398CIoMiuKjPhvnHM/6d1608c90bb775d2d432b7b24264da28/ESO.02_Std_ISAE_3000R_Opinion_30-9-2022_RC134792022BD0548.pdf

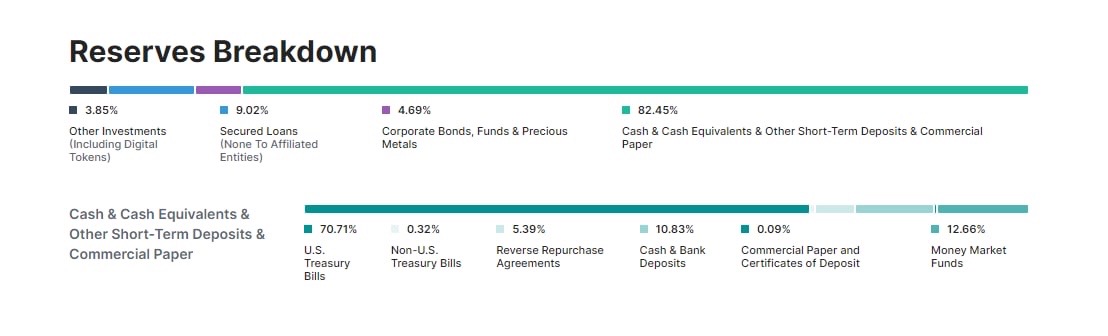

We appreciate the following:

- 82.45%: cash & cash equivalents & Other short-term Deposits & Commercial Paper (maturity <90 days)

- 4.69% Corporate bonds, Funds & Precious Metals

- 9.02% Secured Loans

- 3.85% Other investments

We can assume that cash equivalents and Corporate bonds overall generated a net positive (representing 87.19% of the reserves +/- 2%).

Then again, for secured loans we can assume that these were made to crypto companies or similar, thus a 40% probability of default might be reasonable.

For “other investments” it is likely that these are an investment in BTC/ETH/AVAX, etc., which are down 60% YTD.

We can then assume that these two are likely now worth 6.95% instead of 12.87%.

Therefore, USDT might have a current status of 0.96:1.

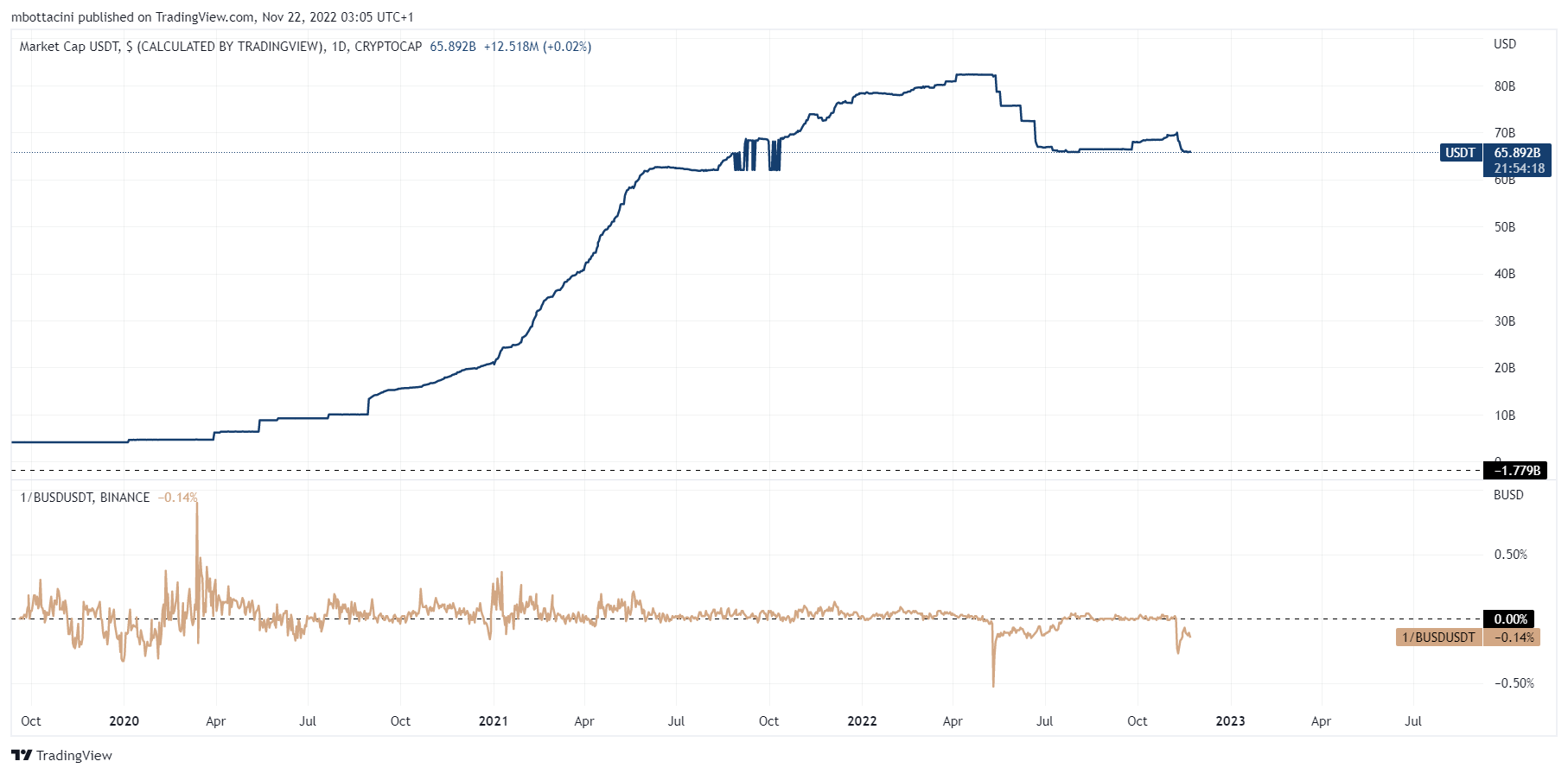

USDT market cap is currently $65B, and it is by far the most popular stablecoin used for trading spot and crypto derivatives (especially Delta One products).

On Coinbase, USDT is trading against USD at 0.9986 and similarly on Binance against BUSD.

What are the consequences if a new scandal hits Tether?

Due to the Tether process of minting/redemption, and the fact that not 100% of the reserves are held in bank deposits as cash equivalents, Tether will be unable to process an excessive redemption demand. If there is a hole in the balance sheet again, it is very likely that Tether will simply say that they are able to process $N billion per week, and that everything is fine.

In terms of price: we will see not only USDT/USD start de-pegging, but it will create a great deal of turmoil in both the DeFi pools and in the derivatives space as many Perpetuals and Term-Futures are margined in USDT (i.e. USDT down, Futures up).

It is very likely that Binance - the big brother - will impede some buy/sell orders to avoid the de-pegging (the same way it did with Terra/Luna).

Also, now that FTX is no longer active, it is going to be harder for derivatives/margin traders to hedge the USDT exposure, which means that we might see an increase in volatility as a result of liquidations /an unwinding.

Tether: is it 1:1?

Tether has always been one major point of discussion in crypto on account of its non-transparent history. And there are still today ongoing discussions regarding the quality of its reserves.

Have a look at the Tether Assurance Consolidated Reserves Report from September 30, 2022 https://assets.ctfassets.net/vyse88cgwfbl/1Xfu4398CIoMiuKjPhvnHM/6d1608c90bb775d2d432b7b24264da28/ESO.02_Std_ISAE_3000R_Opinion_30-9-2022_RC134792022BD0548.pdf

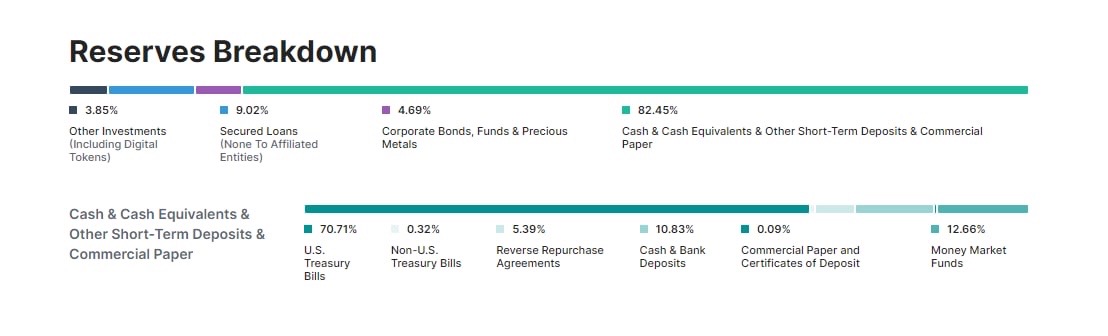

We appreciate the following:

- 82.45%: cash & cash equivalents & Other short-term Deposits & Commercial Paper (maturity <90 days)

- 4.69% Corporate bonds, Funds & Precious Metals

- 9.02% Secured Loans

- 3.85% Other investments

We can assume that cash equivalents and Corporate bonds overall generated a net positive (representing 87.19% of the reserves +/- 2%).

Then again, for secured loans we can assume that these were made to crypto companies or similar, thus a 40% probability of default might be reasonable.

For “other investments” it is likely that these are an investment in BTC/ETH/AVAX, etc., which are down 60% YTD.

We can then assume that these two are likely now worth 6.95% instead of 12.87%.

Therefore, USDT might have a current status of 0.96:1.

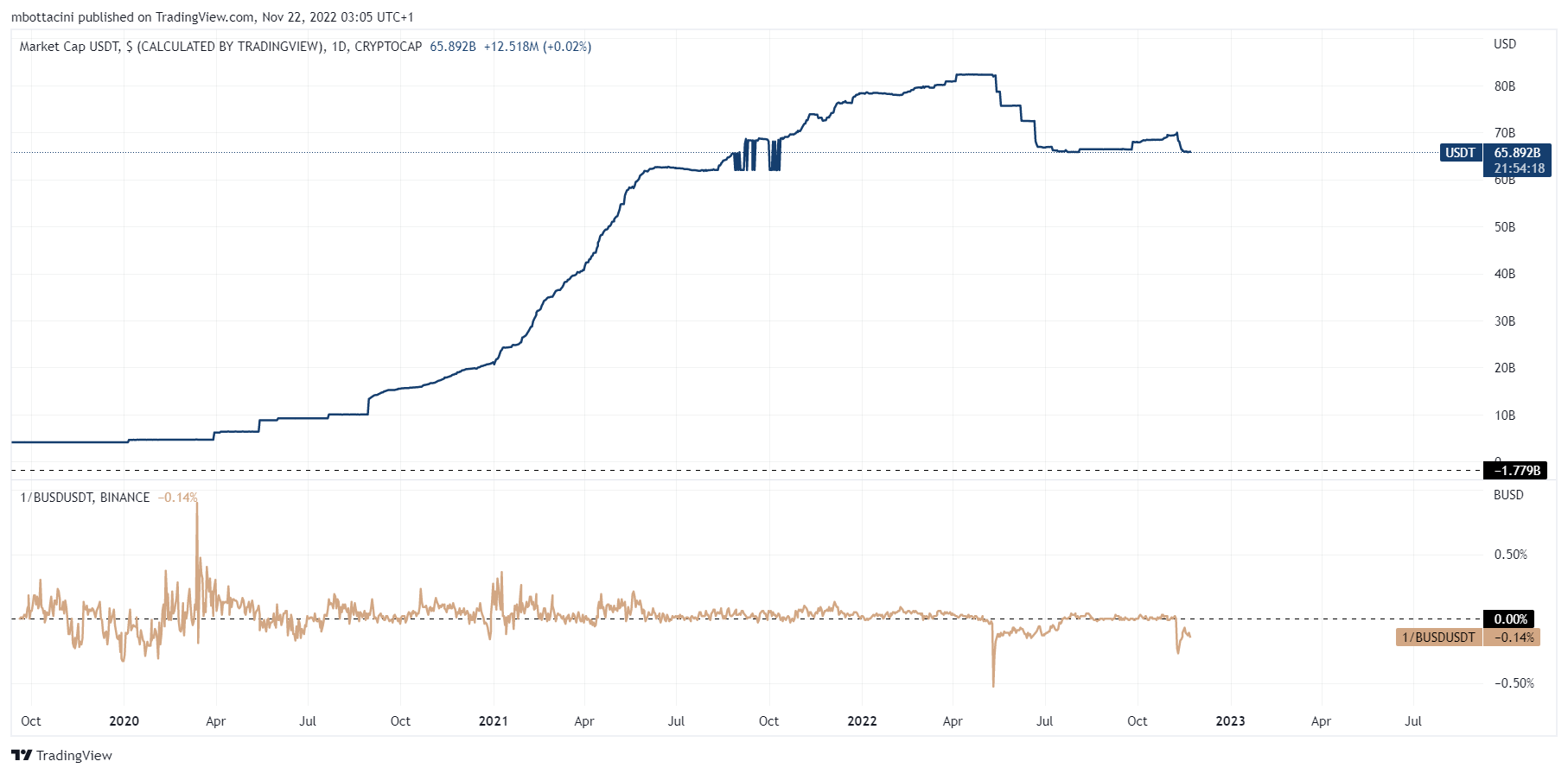

USDT market cap is currently $65B, and it is by far the most popular stablecoin used for trading spot and crypto derivatives (especially Delta One products).

On Coinbase, USDT is trading against USD at 0.9986 and similarly on Binance against BUSD.

What are the consequences if a new scandal hits Tether?

Due to the Tether process of minting/redemption, and the fact that not 100% of the reserves are held in bank deposits as cash equivalents, Tether will be unable to process an excessive redemption demand. If there is a hole in the balance sheet again, it is very likely that Tether will simply say that they are able to process $N billion per week, and that everything is fine.

In terms of price: we will see not only USDT/USD start de-pegging, but it will create a great deal of turmoil in both the DeFi pools and in the derivatives space as many Perpetuals and Term-Futures are margined in USDT (i.e. USDT down, Futures up).

It is very likely that Binance - the big brother - will impede some buy/sell orders to avoid the de-pegging (the same way it did with Terra/Luna).

Also, now that FTX is no longer active, it is going to be harder for derivatives/margin traders to hedge the USDT exposure, which means that we might see an increase in volatility as a result of liquidations /an unwinding.

.

.