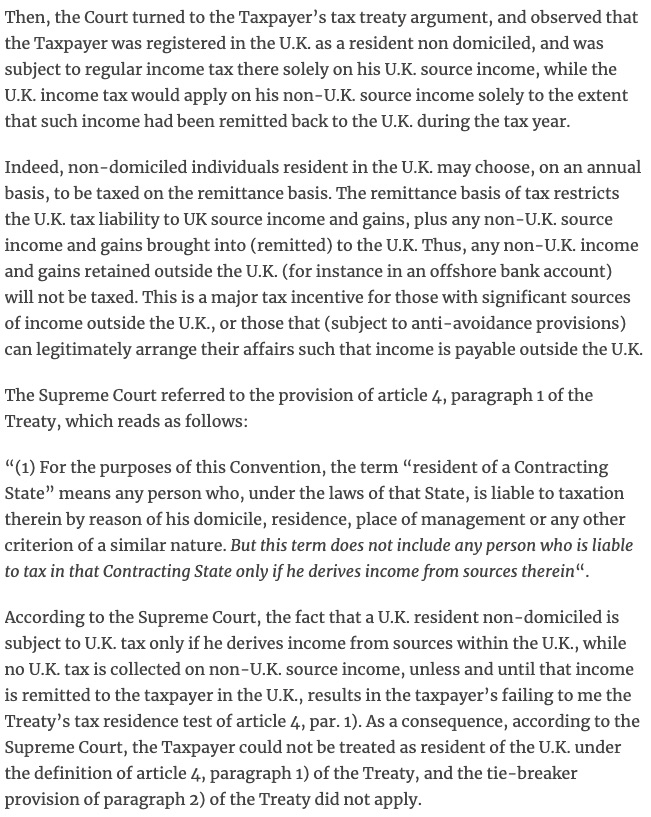

Hmmm.. The case you are quoting is indeed rather parallel to the case at hand and it is good that you bring this into light.Do you really think his case is different than this one?

https://www.euitalianinternationalt...x-treaty-benefits-italian-supreme-court-says/

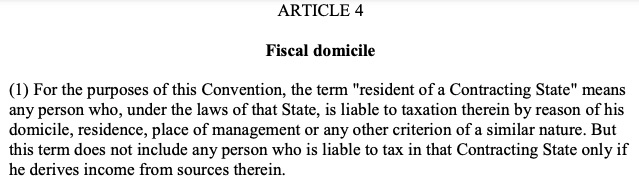

Ok we are talking about Italy and not US but the article 4 between UK and IT is exactly the same.

Here's what i'm talking about

Having said that, I am still not sure I agree with the court's decision as to the fact that because the foreing sourced income only becomes taxable upon remittance that such person may not be deemed a tax resident of UK for the purposes of the treaty. The treaty applies to tax residents of a particular country ; the fact that the type of tax residency provides some special conditions does not make the person a non tax resident. It would have been an acceptablr argument if no taxation wqs applied at all to the non dom but since taxability was effective when income was remmitted then I do not see how the person may not be regarded as tax resident. The remmittance basis of taxation is based on the premise that one becomes resident in the country and by virtue of such residency he is able to claim the particular benefits of non dom. I believe that the Italian court was affected by the particular circumstances of the individual and how his position was interpeted under Italian domestic law and this may have prompted it to reach a slightly outstretched conclusion with respect to Treaty interpetation. I may be wrong. Also particular circumstances are of vital importance it appears. Irrespective of my counter argument, this case is very important and instrumental as to the potential treatment for such cases by domestic courts. Thank you for sharing.