I've reached a point in which I'm content with my investment income, and at the same time I'm getting tired of constant changing tax policies in all countries.

I feel that 10-15 years ago it made sense to live in 3rd world countries that lacked regulations or foreign tax policies. One could save a lot of money, run their offshore businesses freely, invest and reinvest, etc. The downside was that one didn't get anything in return (no social security for example, usually no path to PR or anything like that). It was all mostly about the money.

Nowadays, all these cool, free 3rd world countries are joining CRS, and many of them are starting to tax foreign income and increasing regulations. They're losing their appeal, getting uglier. Like a girl that was once beautiful and easy-going, but now you can tell she's going old and high-maintenance. Maybe a bit crazy too.

So, I'm changing my way of thinking. Or maybe it's the world that is changing. Maybe a bit of both. But, in any case, third world countries are becoming less attractive to me.

I'm thinking about countries such Spain to move to. I know it's a tax hell but it's not that bad for investment income (19% on dividends and capital gains on progressive rates from 19% to 26%). It's also clean, safe and generally organized.

I could also register as self-employed there to do some freelance work on the side (this can be taxed highly but the progressive tax means that it's not so bad for a few thousand euros a month of extra pocket money). This also gives me social security and a path to PR/citizenship that could be useful in the future.

However, I'm interested in the opinions of others, maybe some other possible countries I'm not considering. Mainly what I'm looking for:

* No wealth tax or low wealth tax (Spain's wealth tax is fine, and some communities of Spain don't have it, although that's likely temporary).

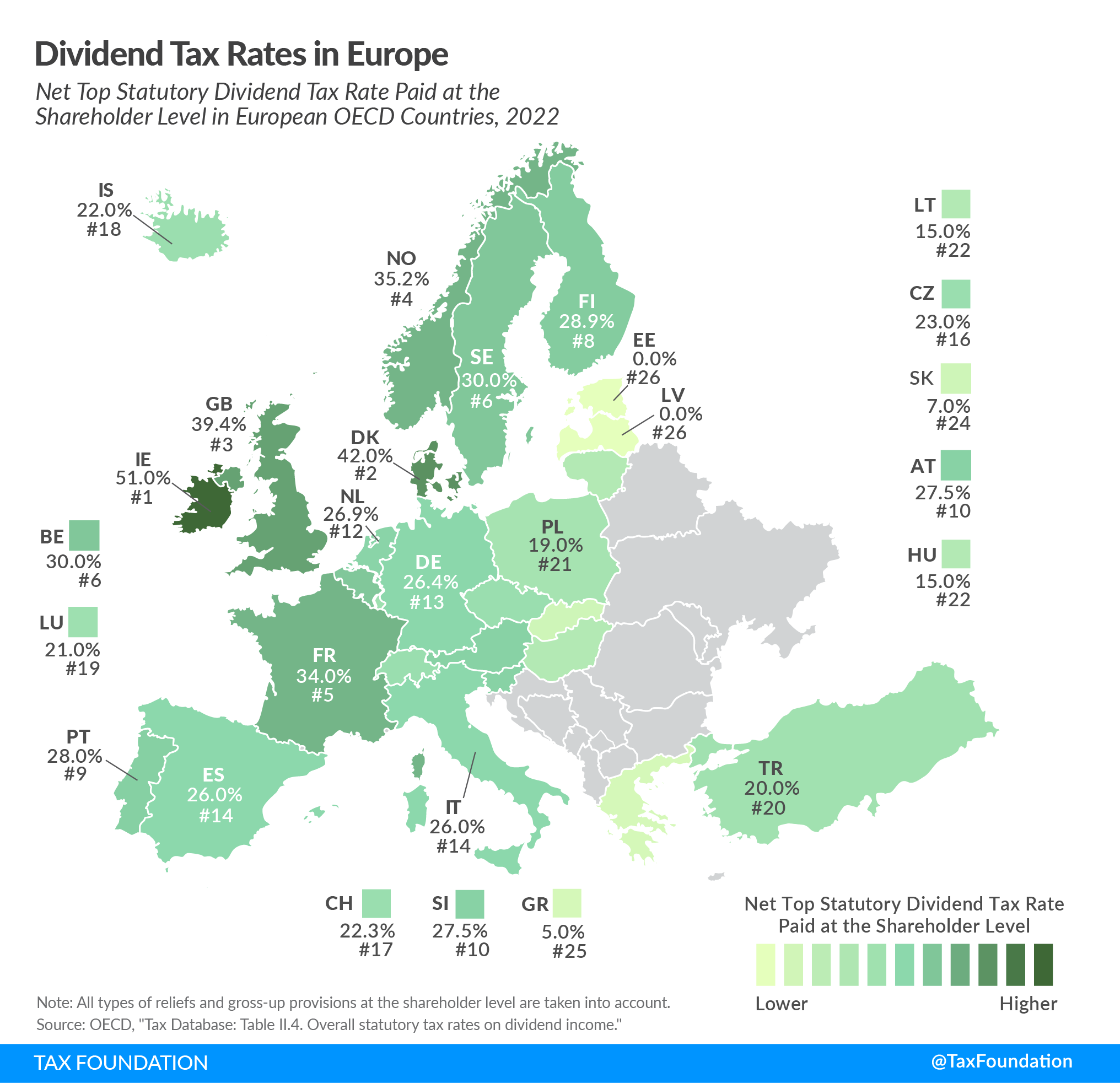

* Dividend income tax at ~20% or less.

* The possibility of easily registering as self-employed to do some work.

* Relatively good weather (i.e., UK is off limits).

* No countries with weird laws (i.e., tired of UAE or Singapore and risking going to jail for stupid sh*t ).

).

Interested in your opinions! And thanks for reading this long post!

I feel that 10-15 years ago it made sense to live in 3rd world countries that lacked regulations or foreign tax policies. One could save a lot of money, run their offshore businesses freely, invest and reinvest, etc. The downside was that one didn't get anything in return (no social security for example, usually no path to PR or anything like that). It was all mostly about the money.

Nowadays, all these cool, free 3rd world countries are joining CRS, and many of them are starting to tax foreign income and increasing regulations. They're losing their appeal, getting uglier. Like a girl that was once beautiful and easy-going, but now you can tell she's going old and high-maintenance. Maybe a bit crazy too.

So, I'm changing my way of thinking. Or maybe it's the world that is changing. Maybe a bit of both. But, in any case, third world countries are becoming less attractive to me.

I'm thinking about countries such Spain to move to. I know it's a tax hell but it's not that bad for investment income (19% on dividends and capital gains on progressive rates from 19% to 26%). It's also clean, safe and generally organized.

I could also register as self-employed there to do some freelance work on the side (this can be taxed highly but the progressive tax means that it's not so bad for a few thousand euros a month of extra pocket money). This also gives me social security and a path to PR/citizenship that could be useful in the future.

However, I'm interested in the opinions of others, maybe some other possible countries I'm not considering. Mainly what I'm looking for:

* No wealth tax or low wealth tax (Spain's wealth tax is fine, and some communities of Spain don't have it, although that's likely temporary).

* Dividend income tax at ~20% or less.

* The possibility of easily registering as self-employed to do some work.

* Relatively good weather (i.e., UK is off limits).

* No countries with weird laws (i.e., tired of UAE or Singapore and risking going to jail for stupid sh*t

Interested in your opinions! And thanks for reading this long post!