EU citizen looking to relocate to tax efficient country with low dividend, income, crypto tax and tax optimized company setups.

Which of these countries would be the best?

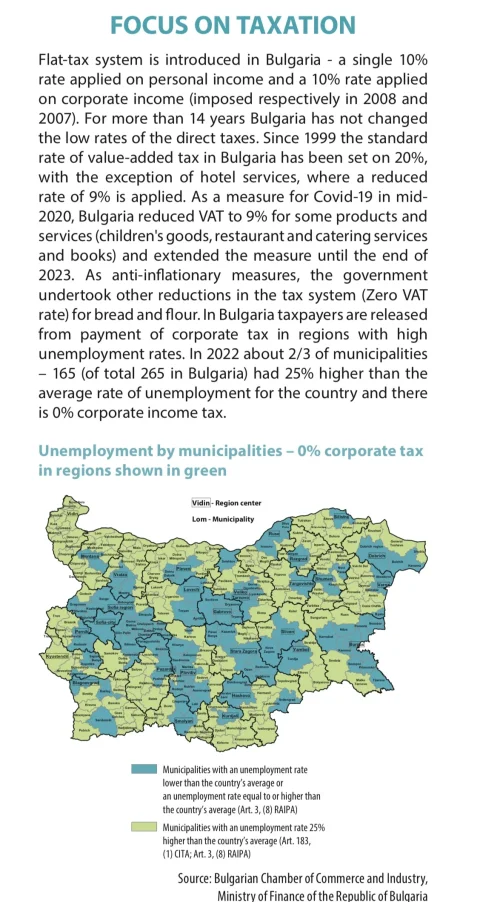

Bulgaria

Romania

Cyprus?

Maybe others you'd recommend?

Low crypto taxes is also super important.

Business activity: IT, marketing.

Which of these countries would be the best?

Bulgaria

Romania

Cyprus?

Maybe others you'd recommend?

Low crypto taxes is also super important.

Business activity: IT, marketing.