I currently have a big problem, namely that my company takes in several million per year in profit. However, we only keep the money in crypto and do not pay it out to banks, how could we even, banks in the UAE are very strict when it comes to crypto. So we are forced to leave the money in crypto. We are currently preparing for corporate tax and have already established that we have revenues of over 2M.

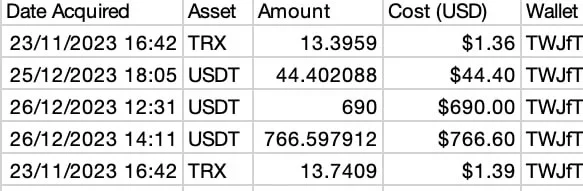

Our books look as follows: Amount in USD, date, to which address received. Just as seen in the screenshot. In the screenshot, you do not see who the person is that has paid. Is something like this important for accounting? Do we need 1:1 evidence of who has paid? The evidence is available, however only in WhatsApp chats since we give out the address separately. The invoice is in the blockchain, we do not make separate invoices for customers.

What do you think of this? There are two main problems, no direct invoices and secondly no money in the bank to pay the taxes since 99% of our money is in crypto.

Our books look as follows: Amount in USD, date, to which address received. Just as seen in the screenshot. In the screenshot, you do not see who the person is that has paid. Is something like this important for accounting? Do we need 1:1 evidence of who has paid? The evidence is available, however only in WhatsApp chats since we give out the address separately. The invoice is in the blockchain, we do not make separate invoices for customers.

What do you think of this? There are two main problems, no direct invoices and secondly no money in the bank to pay the taxes since 99% of our money is in crypto.