Hey,

I don't think you will find a friendly bank, because you are planning to run your sale without KYC. None of the properly managed banks will accept this case (at least in reputable jurisdictions).

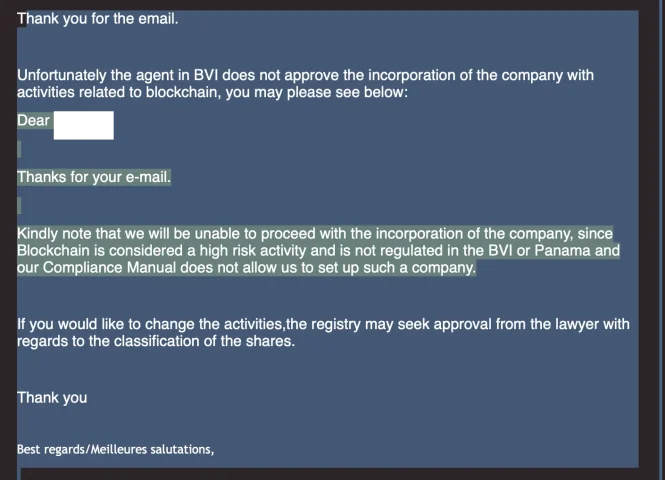

As regards the jurisdiction of the company, I would probably choose BVI.

BVI does not allow Crypto or Blockchain companies and they can cease your company...

If they find out you are involved in Blockchain or Cryptocurrency "unbanking" will look like a walk in a park when you are "unincorporated" and liable for everything personally as they remove any commercial shields.

I would like to create a decentralised private sale of my token where you will be able to buy it without

kyc using metamask/walletconnect.

Check out the SEC, DOJ, CFTC activities, it only takes one yank to get in for your life to be turned inside out, increased enforcement is going to happen, and even if its just 'questions' you will spend millions in lawyers and advisories, and training for depositions etc, paper work etc...

What if i would do the KYC? What are my options than?

You'd be best to do KYC/AML checks otherwise any dodgy money (and there will be some) you'd be liable for, and if you push any of that through a US Based or US listed or US Wire, you'd be liable for wire-fraud and money laundering (check out the counts and prison terms and fines for each), the DOJ is going for low hanging fruit...

None. Unless its legally registered in somewhere like Switzerland and you have a compliance team (and i don't mean just some random guy, but professionals) onboarding and of-boarding has taken the limelight within the industry.

Remember. Dirty money once in the system is easily moved around and mingled, making it harder to stop, gate keeprs therefore are under heavy Scrutiny.

Also doing a stablecoin... when the SEC, CFTC, DOJ, FCA, etc are clamping down on is absolutely crazy, especially when the governments are looking at their own currency on chain anyway.