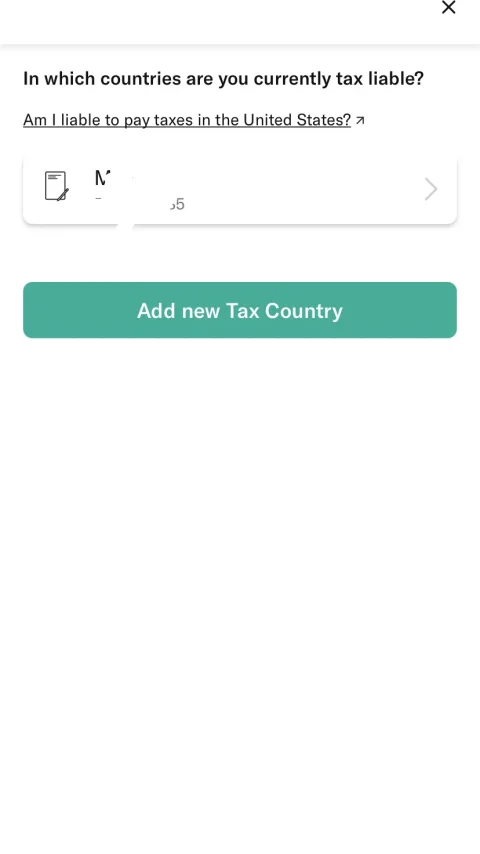

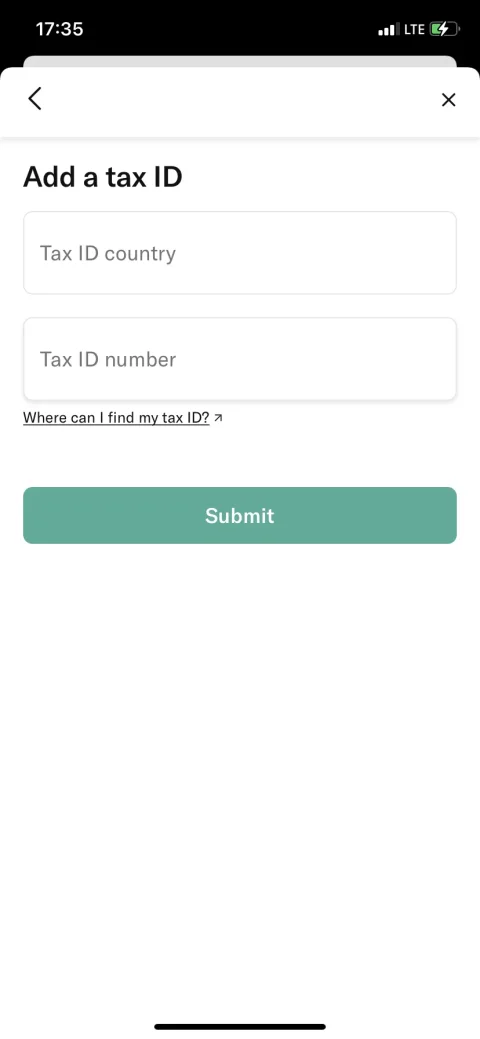

Hey offshore community, this is by no mean an advice but I noticed something very interesting with N26, they let you change your TAX resdiency country and TIN (Tax identification number) so they ask these infos to every customer and they clearly specify it's for CRS reporting reasons ( Why we need to report tax information to the EU - N26 Support Center)

I obviously changed those to a completely different country than my real EU residency country (African country ) with a dummy TIN. Now the reporting get redirected to elsewhere, you can put any country in the world, even non-CRS participating ones, it's been like this for a few months and had 0 problems whatsoever. (There's even many CRS reporting countries that chose"V voluntary secrecy" meaning they'll report infos to other countries but they don't accep reported data from anyone, as they don't tax non-resident anyway, you can look it up online). If you ever get caught (probably 0 chances of happening) you can just say you had a residency permit and visa elsewhere and now you moved back to *your EU country* and you can give them your real TIN and Tax residency.

) with a dummy TIN. Now the reporting get redirected to elsewhere, you can put any country in the world, even non-CRS participating ones, it's been like this for a few months and had 0 problems whatsoever. (There's even many CRS reporting countries that chose"V voluntary secrecy" meaning they'll report infos to other countries but they don't accep reported data from anyone, as they don't tax non-resident anyway, you can look it up online). If you ever get caught (probably 0 chances of happening) you can just say you had a residency permit and visa elsewhere and now you moved back to *your EU country* and you can give them your real TIN and Tax residency.

Bunq doesn't allow to change these tax infos. Transferwise and Revolut do not report to CRS yet but I think it'll be possible to do the same trick once they start asking for those infos.

Anyway, again this is by no mean an advice, I am just sharing my toughts and what I did...

Non-gov related Blog that partially talked about the issue a few years ago: Faking residency: OECD’s Common Reporting Standard leaves the door wide open for fraud

I obviously changed those to a completely different country than my real EU residency country (African country

Bunq doesn't allow to change these tax infos. Transferwise and Revolut do not report to CRS yet but I think it'll be possible to do the same trick once they start asking for those infos.

Anyway, again this is by no mean an advice, I am just sharing my toughts and what I did...

Non-gov related Blog that partially talked about the issue a few years ago: Faking residency: OECD’s Common Reporting Standard leaves the door wide open for fraud