You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

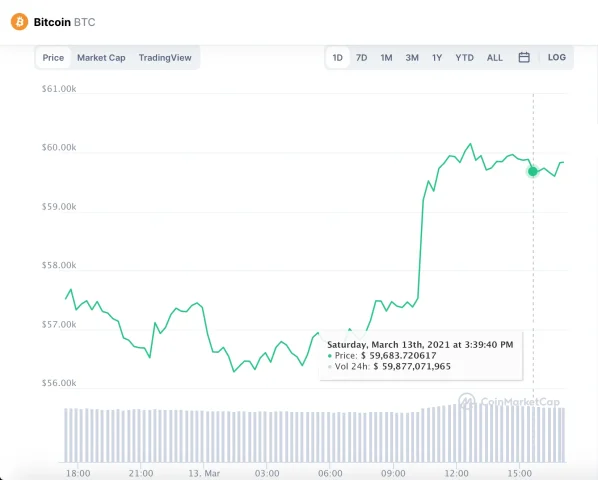

Bitcoin New $60k high, where does it go now?

- Thread starter Chappers147

- Start date

-

- Tags

- bitcoin

I do not know. But we should call ms lagarde and ask her how many euros she wants to print. someone also should call the fed and ask them. Then we get an idea.With Bitcoin hitting new highs today, where do you see this ending up?

$100k for sure, that doesn't mean it's a good investment though

My guess will be 80K and a dip then 100K by end of year.

$100k for sure, that doesn't mean it's a good investment though

huh ?

the underlying technology (aka fundamentals) is completely useless, price is completely based on hype and people who buy because of FOMO.huh ?

I'm not saying you can't make money off of it but one day it will drop hard and won't recover.

the underlying technology (aka fundamentals) is completely useless, price is completely based on hype and people who buy because of FOMO.

I'm not saying you can't make money off of it but one day it will drop hard and won't recover.

Ok got you ..

Because my definition of good investment is something you can make money out of

That's true yes.Ok got you ..

Because my definition of good investment is something you can make money out of) You go in and out of crypto you can definitely make a lot from it, and minimize the risk of holding the bag at the end ..

the underlying technology (aka fundamentals) is completely useless, price is completely based on hype and people who buy because of FOMO.

I'm not saying you can't make money off of it but one day it will drop hard and won't recover.

People love BTC for that very reason; it is nothing. Money, gold, stocks, real estate, etc. can all be taken from you at a whim. Bitcoin pretty much exists only in your head and the keys are stored there. One of the few places you can park money outside of the sphere of government control.

Couple that with the fact that we're moving towards 100% internet money anyways very soon, BTC could become the new alternative to physical cash, except you earn interest on it because there is a limited amount. If people decide it so, this thing will be around in 50 years.

I would agree with this as well. It is probably the most unstable but stable coin on the market. Bitcoin will always we around, but the volatility will still continue (point proven over the last few days).Ok got you ..

Because my definition of good investment is something you can make money out of) You go in and out of crypto you can definitely make a lot from it, and minimize the risk of holding the bag at the end ..

Reaching 100K USD looks probable this year. I am not planning to sell there. Unlike the previous bubbles, this one could extend well into the next year because of institutional investor participation. Only a severe regulatory impact could kill this bull market, and the FED does not have an appetite for a fight right now.

During stock market booms, smaller and smaller companies rally as the boom progresses. Crypto market may have a similar tendency. As the boom heats up, small traders start grasping for altcoins. I don't see anything like that yet. For example, ETH/BTC ratio is about half of what it was in 2017/18 bull market climax.

During stock market booms, smaller and smaller companies rally as the boom progresses. Crypto market may have a similar tendency. As the boom heats up, small traders start grasping for altcoins. I don't see anything like that yet. For example, ETH/BTC ratio is about half of what it was in 2017/18 bull market climax.

I would guess the Fed actually like this as it serves as an inflation sink (aka a place to store the excess liquidity).Reaching 100K USD looks probable this year. I am not planning to sell there. Unlike the previous bubbles, this one could extend well into the next year because of institutional investor participation. Only a severe regulatory impact could kill this bull market, and the FED does not have an appetite for a fight right now.

During stock market booms, smaller and smaller companies rally as the boom progresses. Crypto market may have a similar tendency. As the boom heats up, small traders start grasping for altcoins. I don't see anything like that yet. For example, ETH/BTC ratio is about half of what it was in 2017/18 bull market climax.

An inflation sink comes handy at this point. It would also help if the central banks took their foot off the throttle pedal (I suspect this is no longer an option). Even if the Fed, ECB were to leave cryptos alone, they still might want to molest stablecoins.I would guess the Fed actually like this as it serves as an inflation sink (aka a place to store the excess liquidity).

For 10 years it can sound like for two years or for eight yearsIt will reach new high's over the next 10 years after that it will break.

Its funny how people thought after some institutions joined the market Bitcoin can't drop more than 20%. Institutions are in for the money and nothing else, they will sell for profit and don't care about Bitcoin.

Bitcoin is a highly volatility asset and if you can't deal with that it's better to watch from the side. You can enjoy hating on it and laugh at the people when the price drops, and always tell people you were right all along.

I am still very confident in Bitcoin and think we are seeing a new ATH soon. Maybe I am wrong and we will leave the "Bull market". Time will show.

The market dominance of Bitcoin will rise again. ETH will not flip Bitcoin anytime soon, if ever.

Bitcoin price now against 2013 and 2017.

Bitcoin can easily go way higher.

Said it already at the crash this year.

Inflation does not seem to go away.

Exciting times ahead.

Similar threads

- Replies

- 51

- Views

- 4,557

- Replies

- 3

- Views

- 719

- Replies

- 23

- Views

- 2,060

- Replies

- 18

- Views

- 1,287

Latest Threads

-

-

Offshore Crypto without license (Where to move from SVG?)

- Started by off42

- Replies: 3

-

Saudi Arabia permits GCC residents to invest in its main stock market Tawadul - thoughts?

- Started by OKboomer

- Replies: 4

-

-

Incorporating, Payment Processing, and General Privacy and Advice for College Cheating Software Company

- Started by westudytools

- Replies: 0