This Spitznagel guy claims all assets are correlated and no diversification will work.

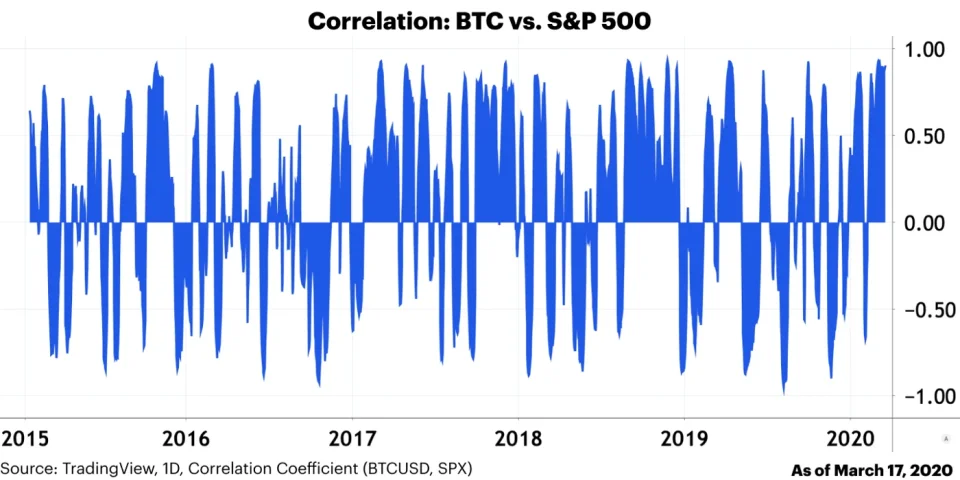

During a market panic, they are. Investors sell every asset they can, not necessarily every asset they want to sell. After that, the prices start to decouple. We've seen that now in gold, which is making new highs as we speak. Gold's long-time correlation coefficient with the stock market is slightly negative, bitcoin's slightly positive.

Discussion about hedging, safe havens etc. is a bit muddied, with many concepts confused. For specificially

hedging a stock portfolio, gold/bitcoin are not good options. They may be good option for long-term survival of capital, especially in (rare) situations where banks, custodians etc. might go under.

And he expects an even bigger crash to come..

Yes, as do basically everyone forming their opinions via Austrian Economics. If by some miracle the Fed managed (again) to kick the can down the road, the next crisis would be even bigger. At some point the market (incl. interest rates) will return to a level that reflets real capital formation, not central bank manipulation.

I also did not expect everything will crash in tandem.

Not many did, I didn't either. I had less than 0.4% of my wealth in stocks. But I have a very large position in bitcoin, which behaved like a stock, so

. I've been in bitcoin rollercoaster more or less continuously since 2013, so I am not worried at all, and almost don't care. If bitcoin goes to zero, I hope gold will pull me through.

...but then I also think about service workers with very little savings, pension funds that got hit badly and they still expect to earn 10%+ pa forever in the future with their stocks/bonds strategy.

IMO, most countries, most people will be truly fucked in 2-3 years time. The little guy in any country does not have any savings. Governments were caught pants down again, so not much help from there, either. If there's even a short recovery, that would be a good time to build proper buffers.

What is a Bitcoin Fat Lady by the way?

Fat Lady singing refers to

Wagner's opera Nibelungen. When the fat valkyrie Brünnhilde sings, that's the time for a final tally of the situation - not before. "Bitcoin Fat Lady" was just my way of telling I expect bitcoin to eventually reach bubble prices, like it did in 2013 & 2017. Maybe not 30X like last time, but way, way higher. My expectations for this year are not high, they weren't high even before the crash.