Hi, I am a non US citizen and this is my first post

We are a business specializing in providing Digital Goods which are Mobile Gaming Accounts with various different titles: Epic Seven, Exos Heroes & More. We partnered with various technology companies and they supplied us with digital products and we did the sale. We also have our own production within our country but only for some titles since production costs are extremely high.

Our annual sales are about 500.000 usd

I am living in Vietnam, and allow me to explain our situation atm

About 2 days from now we are going to register a LLC in Singapore (Because I heard that is the requirement if I want to create a merchant account so I can accept Visa/master card directly on our website. Or Do I need to Switch to Delaware LLC, and create a US bank account with Payoneer, for example. etc...). Please guide me on this part since you are real expert here.

I need a merchant account that can proceed credit cards on my website.

Up to now, we were using paypal for payment methods. But we heard that when your sales get too high (like over 1 million), our account might get shut down, that's why I need to put eggs on many basket/

Our volume each day is around 70- 80 transactions.

Average cart value is around $50.

Our chargeback rate of all time atm is around 0.6%.

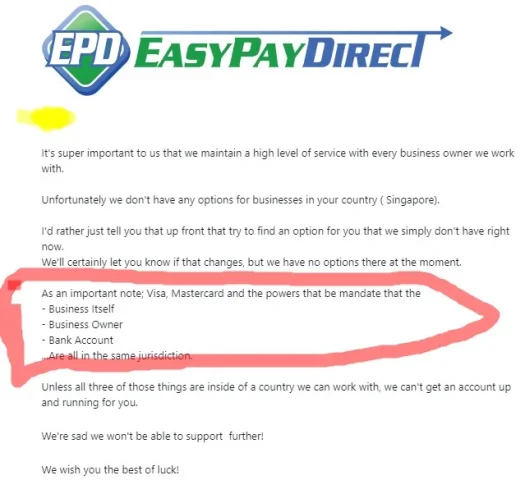

Atm, we need a trustable payment processor so that within a year or two, we can push our sales to over 1 million annually. We tried Easypaydirect a day ago and they told us that we need to register the company in the US (this, it is not hard) but the next part, the owners of the business need to live in the US as well (this part is hard because we are living in vietnam). I dont know if its is true or not, I thought i only need to register an LLC in the US, open a business bank account, get EIN, etc... and I am good to go.

I also tried to ask a few different high risk payment processors but no contract from them yet.

So my real question is, is it even possible for me to get a merchant account to process visa/credit card directly on my website beside Paypal or not?

I want to ask what are the requirements I need (like LLC in singapore, US, etc...) in order to have a trust worthy merchant account up so that I can focus on the making money part, not wasting time running in circles like this

It would be nice if someone can point me to a direction.

Hope someone to reply to this post, fee is not the problem here.

We are a business specializing in providing Digital Goods which are Mobile Gaming Accounts with various different titles: Epic Seven, Exos Heroes & More. We partnered with various technology companies and they supplied us with digital products and we did the sale. We also have our own production within our country but only for some titles since production costs are extremely high.

Our annual sales are about 500.000 usd

I am living in Vietnam, and allow me to explain our situation atm

About 2 days from now we are going to register a LLC in Singapore (Because I heard that is the requirement if I want to create a merchant account so I can accept Visa/master card directly on our website. Or Do I need to Switch to Delaware LLC, and create a US bank account with Payoneer, for example. etc...). Please guide me on this part since you are real expert here.

I need a merchant account that can proceed credit cards on my website.

Up to now, we were using paypal for payment methods. But we heard that when your sales get too high (like over 1 million), our account might get shut down, that's why I need to put eggs on many basket/

Our volume each day is around 70- 80 transactions.

Average cart value is around $50.

Our chargeback rate of all time atm is around 0.6%.

Atm, we need a trustable payment processor so that within a year or two, we can push our sales to over 1 million annually. We tried Easypaydirect a day ago and they told us that we need to register the company in the US (this, it is not hard) but the next part, the owners of the business need to live in the US as well (this part is hard because we are living in vietnam). I dont know if its is true or not, I thought i only need to register an LLC in the US, open a business bank account, get EIN, etc... and I am good to go.

I also tried to ask a few different high risk payment processors but no contract from them yet.

So my real question is, is it even possible for me to get a merchant account to process visa/credit card directly on my website beside Paypal or not?

I want to ask what are the requirements I need (like LLC in singapore, US, etc...) in order to have a trust worthy merchant account up so that I can focus on the making money part, not wasting time running in circles like this

It would be nice if someone can point me to a direction.

Hope someone to reply to this post, fee is not the problem here.