I reside in the UAE as a EU citizen and need a quick, easy and cheap solution to receive SEPA payments in EUR from 3 different businesses.

So far, I solved this with a Delaware LLC, sole owner, with a WISE account, but I made a mistake and got it permabanned.

Here are the options I'm already considering:

> Airwallex: refused my US LLC with no explanation.

> Wallex: personal account with SEPA works fine, but the corporate one is a pain in the a*s to KYC. Their verification partner keeps rejecting the documents, with vague explanations and no support.

> VertoFX: pain in the a*s KYC and, once passed, there's even more KYC if you want the EUR account. Work in progress...

> Trulyfinancial: waiting for the KYC result since more than a week.

Discarded because of high fees: Bankera, Satchel, 3S Money, Finom, Payoneer.

Airwallex and Currenxie would be a perfect solution, and I'm considering opening a Hong Kong or Belize ltd just for one of them (Currenxie in particular). Has anyone ever done so successfully? Are the documents provided by the registered agent enough to open an account? Or are they also a KYC pain in the a*s making it impossible to work?

My question: what is the cheapest and easiest solution for a sole trader, UAE resident and EU citizen to have access to SEPA? What combination of EMI+Company have you tested as good/cheap as Wise+US LLC?

Many thanks for any input!

So far, I solved this with a Delaware LLC, sole owner, with a WISE account, but I made a mistake and got it permabanned.

Here are the options I'm already considering:

> Airwallex: refused my US LLC with no explanation.

> Wallex: personal account with SEPA works fine, but the corporate one is a pain in the a*s to KYC. Their verification partner keeps rejecting the documents, with vague explanations and no support.

> VertoFX: pain in the a*s KYC and, once passed, there's even more KYC if you want the EUR account. Work in progress...

> Trulyfinancial: waiting for the KYC result since more than a week.

Discarded because of high fees: Bankera, Satchel, 3S Money, Finom, Payoneer.

Airwallex and Currenxie would be a perfect solution, and I'm considering opening a Hong Kong or Belize ltd just for one of them (Currenxie in particular). Has anyone ever done so successfully? Are the documents provided by the registered agent enough to open an account? Or are they also a KYC pain in the a*s making it impossible to work?

My question: what is the cheapest and easiest solution for a sole trader, UAE resident and EU citizen to have access to SEPA? What combination of EMI+Company have you tested as good/cheap as Wise+US LLC?

Many thanks for any input!

I get so tired of telling people this, but here we go...

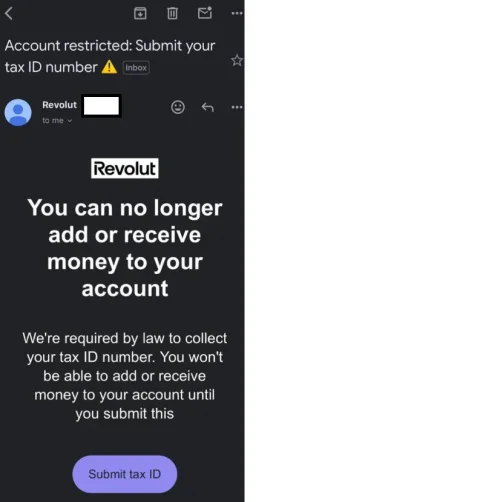

I get so tired of telling people this, but here we go... It may work for a few times...but eventually, the mask will come off.

It may work for a few times...but eventually, the mask will come off.

There's a whole forum here with years of experience for you to tap into. There's lot to choose from. Maybe upgrade to get mentoring and personal guidance.

There's a whole forum here with years of experience for you to tap into. There's lot to choose from. Maybe upgrade to get mentoring and personal guidance.