Hello everyone!

I’m currently self-employed with Hungarian citizenship offering remote consulting service. Working long term with a US based partner for ~100k USD per year and also dealing with about 70k USD/yr of crypto that I get paid from an EU partner.

These are not large amounts so I probably can't do magic here, but if you could give me some tips for tax optimization would be amazing.

Currently paying ~42.3% tax on my total income, I think that's pretty ridiculous.

I guess the first step is to be a resident in a country that doesn’t tax foreign income. Then find a tax haven for my business and bank account.

Can you recommend any setups that are worthwhile with this income range?

I'm willing to move, to travel, anything as long as I don't have to pay so much tax.

I'm in a similar situation and have researched a lot this year and will start to implement next year, maybe I can give some directions but you must absolutely look these up yourself.

As an EU citizen I searched more in the EU because of quite a lot of reasons and only looked up legal ways so anonimity was less important.

In almost every case you need to move permanently and beside the personal taxation you should check your new residency's CFC rules.

- My top choice now is US LLC with Cyprus residency, you can find a lot of info on this forum about both even in combination.

On the level of personal taxation Cyprus has more than one attractive options but a company in Cyprus is costly and I mean UAE level costs, plus it's complicated and you also pay 12.5% tax on it, therefore I would try a US LLC instead.

I must mention the rumored/planned modification of CFC rules in the near future, which would be a huge blow for this setup if it will be enforced but currently it's all good.

- Plan B might be Portugal residency, it's tricky and I don't know if it could be good in your or even in my case, I mean in a legal way, their CFC rules spell trouble.

I've just started to think about it because of the rumored changes in Cyprus CFC rules and because Portugal has some advantage in everyday life plus 0 tax on foreign dividends.

- Outside of EU you might want to check UAE company too, it's quite costly but Hungary has a pretty unique DTT with UAE, that's the reason I mention this option.

There are other options in Asia, Latin America, etc, some of them are for another level of wealth, some of them are not developed enough or the legal system is not acceptable so I can not recommend or give you details about them.

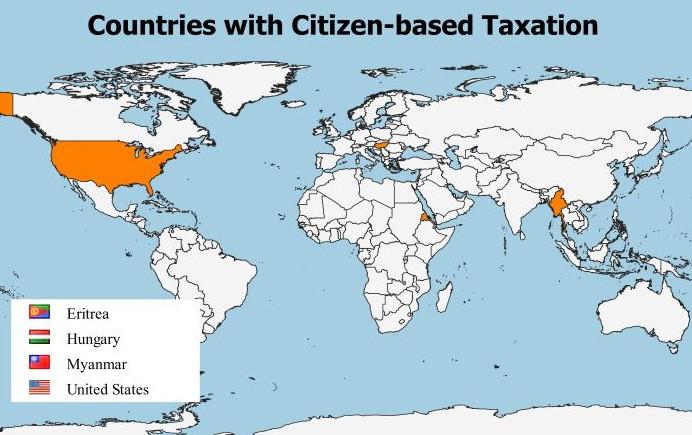

Unfortunately for you Hungary follows a citizenship based taxation

You do not need new citizenship to lower your corporate tax burden. But you would need to renounce your Hungarian citizenship if you want to lower your personal tax burden.

True but only if no DTT and no EU/international law applies to you, it's a last resort fallback when you don't have substance in any other country and Hungary has a lot of DTTs too.

Even if it comes to that fallback you can still cut ties and wish good luck for the hungarian taxman to reach you in a country which doesn't even have a DTT with Hungary.

Sure, it's recommended to give up your residency but you can keep your citizenship, as an EU citizen this is important.

Why don’t you open a KFT instead of being self-employed?

Hungary has the lowest CIT in EU at 9%

You’ll pay yourself a small salary + dividends which as far as i know aren’t subject to social contributions.

The company pays 9% CIT and 2% local business tax on profit, and if you are a hungarian tax resident you pay 15% PIT and 13% social contribution on dividends and there is accounting and audit.

On top of that you pay 15% PIT + 18.5% social insurance of that minimum salary - withold and paid by the company - plus the company pays an additional 13% social contribution on the whole amount, with an example 665€ salary costs 1130€.

That 'only 9%' sounds good for someone not from Hungary but it's mainly marketing, on company level alone it's 9+2% then comes the dividend part. If you are a foreign tax resident shareholder and take dividends out of the country then it is tax free, otherwise the hungarian taxation is a total rip off.