Hello guys. I would be glad if someone helps me in choosing a jurisdiction.

1) The main purpose is to avoid capital gain tax and being able to trade crypto/stocks without worrying about accounting.

2) I am based in Brazil. I am not liable to taxes from the profits generated by the Offshore Company, I would only pay tax if I pay myself dividends.

3) I don't need to cash out for the next few years. I plan to first accumulate wealth using this structure and in the future moving to a country that don't tax foreign dividends (such as Uruguay)

4) Being able to create an account in FTX is very important, and they don't allow US jurisdictions. Having a IBKR account is nice but not a necessity.

5) I don't need anonymity. The source of the funds is legit.

6) I would like to pay no more than $2.5k yearly in maintenance costs.

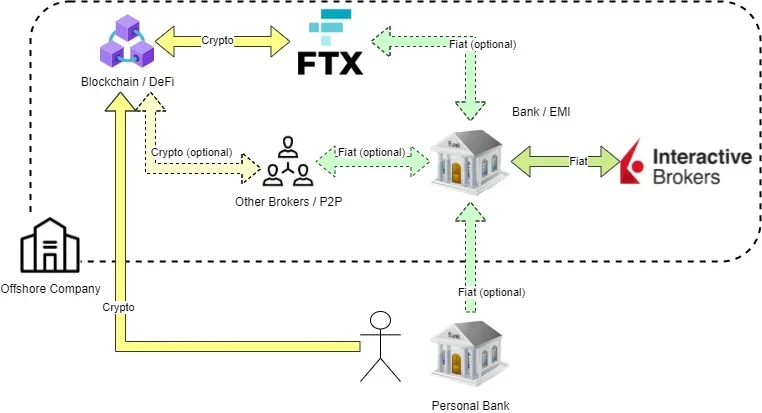

7) Although it would be very nice to have a Crypto->Fiat path, this is not required as long as I have a Crypto->FTX and Fiat(personal)->Fiat(corporate) path.

8) I plan from time to time (like once or twice a year) move crypto/fiat to my offshore company in order to invest.

A setup that seems to fit these requirements is a BVI company + EMI as it seems to work with both FTX and IBKR. I have read recently in this forum however that someone with BVI was rejected in IBKR.

It also seems that I can also use a UK LLP, as I would not need accounting or pay taxes due to being a foreigner and it being a small company (less than $10M worth)

I was also considering a Delaware LLC. It is cheap and I would not face problems with EMIs and Brokers. I would not be able to trade on FTX legally though. But I could create an account with KYC level 1, no proof of identification needed, and the 9000 USD daily withdraw limit is enough for me. But if they ask for proof of identity in the future I may have my funds blocked.

I would be glad to hear other suggestions.

1) The main purpose is to avoid capital gain tax and being able to trade crypto/stocks without worrying about accounting.

2) I am based in Brazil. I am not liable to taxes from the profits generated by the Offshore Company, I would only pay tax if I pay myself dividends.

3) I don't need to cash out for the next few years. I plan to first accumulate wealth using this structure and in the future moving to a country that don't tax foreign dividends (such as Uruguay)

4) Being able to create an account in FTX is very important, and they don't allow US jurisdictions. Having a IBKR account is nice but not a necessity.

5) I don't need anonymity. The source of the funds is legit.

6) I would like to pay no more than $2.5k yearly in maintenance costs.

7) Although it would be very nice to have a Crypto->Fiat path, this is not required as long as I have a Crypto->FTX and Fiat(personal)->Fiat(corporate) path.

8) I plan from time to time (like once or twice a year) move crypto/fiat to my offshore company in order to invest.

A setup that seems to fit these requirements is a BVI company + EMI as it seems to work with both FTX and IBKR. I have read recently in this forum however that someone with BVI was rejected in IBKR.

It also seems that I can also use a UK LLP, as I would not need accounting or pay taxes due to being a foreigner and it being a small company (less than $10M worth)

I was also considering a Delaware LLC. It is cheap and I would not face problems with EMIs and Brokers. I would not be able to trade on FTX legally though. But I could create an account with KYC level 1, no proof of identification needed, and the 9000 USD daily withdraw limit is enough for me. But if they ask for proof of identity in the future I may have my funds blocked.

I would be glad to hear other suggestions.